In brief

- Robotic process automation (RPA) in insurance has been a game changer for improving operational efficiency, achieving cost optimization, enhancing the customer experience and boosting performance

- By eliminating data entry and reducing human error, RPA combined with ML provides greater efficiency in insurance processes such as financial claims, accounting and policy management

- Insurers can use the transformative power of Industry-leading RPA tools like UiPath, Automation Anywhere, Blue Prism and more to automate processes, improve decision-making and strengthen information security

Insurance companies have become accustomed to the economic reality of low growth and rising costs. With increasing complexity and competition from new entrants like Insurtech, e-commerce giants, super apps like Grab, etc., insurance is no longer in the domain of traditional insurers. Complex and labor-intensive business operations are rapidly being transformed by the integration of new technologies.

So, companies need to adapt urgently, reducing operational costs, bringing new products to market faster and increasing customer satisfaction. Daily activities like personal and business insurance, promotions, insurance policies and claims focus on key activities that affect the performance of the entire organization, influencing customer satisfaction, business transformation and profitability.

Robotic process automation (RPA) in insurance has been a game changer for improving operational efficiency, achieving cost optimization and boosting performance across the organization. This article explores how RPA in insurance combined with artificial intelligence (AI), machine learning (ML), natural language processing (NLP), large language models (LLM) and robust cybersecurity measures can address both current and future challenges.

RPA: Automating mundane and repetitive tasks works well. Insurance RPA automates many repetitive tasks in the insurance business such as data entry, claims processing data, policy review, underwriting and reporting. Robotic process automation in insurance reduces manual processes and human error, freeing employees to focus on more valuable tasks. We will discuss this in detail and see how RPA has helped in these areas.

AI and ML: Artificial intelligence and ML algorithms have become the key to insurance operations, enabling companies to access more customer and product information and improve decision-making. By integrating AI and ML with RPA, insurance companies can perform complex decision-making processes such as risk assessment, fraud detection and claims assessment. This technology analyzes historical data, identifies patterns and predicts future outcomes, allowing insurers to improve financial reporting and highlight questionable and personalized customer service.

Extracting and managing internal/external data to maximum effect (including irregular and paper-based processes) demands strategic thinking and automated techniques. Zoreza Global is making significant progress in determining, developing and delivering new capabilities across the insurance industry value chain to realize new opportunities and create a more profitable future state for all. One increasingly popular capability is RPA in insurance.

NLP: Improving customer engagement and performance

Natural language processing technology enables computers to understand, interpret and respond to human speech. In the insurance industry, NLP-powered software bots and virtual assistants can interact with customers, answer questions, provide policy information and guide them through the claims process. Using NLP, insurance companies can personalize customer experiences, automate routine inquiries and increase customer satisfaction while reducing the burden on call centers.

Generative AI: Accelerating product development and risk modeling

Generative AI is a part of artificial intelligence that involves creating new data or concepts based on examples and patterns from existing customer information. Productive RPA and AI in insurance can help companies generate synthetic data for risk modeling, simulate scenarios and generate large amounts of data to train learning models. By leveraging productive AI, insurers increase productivity, improve risk assessment and better understand their business dynamics.

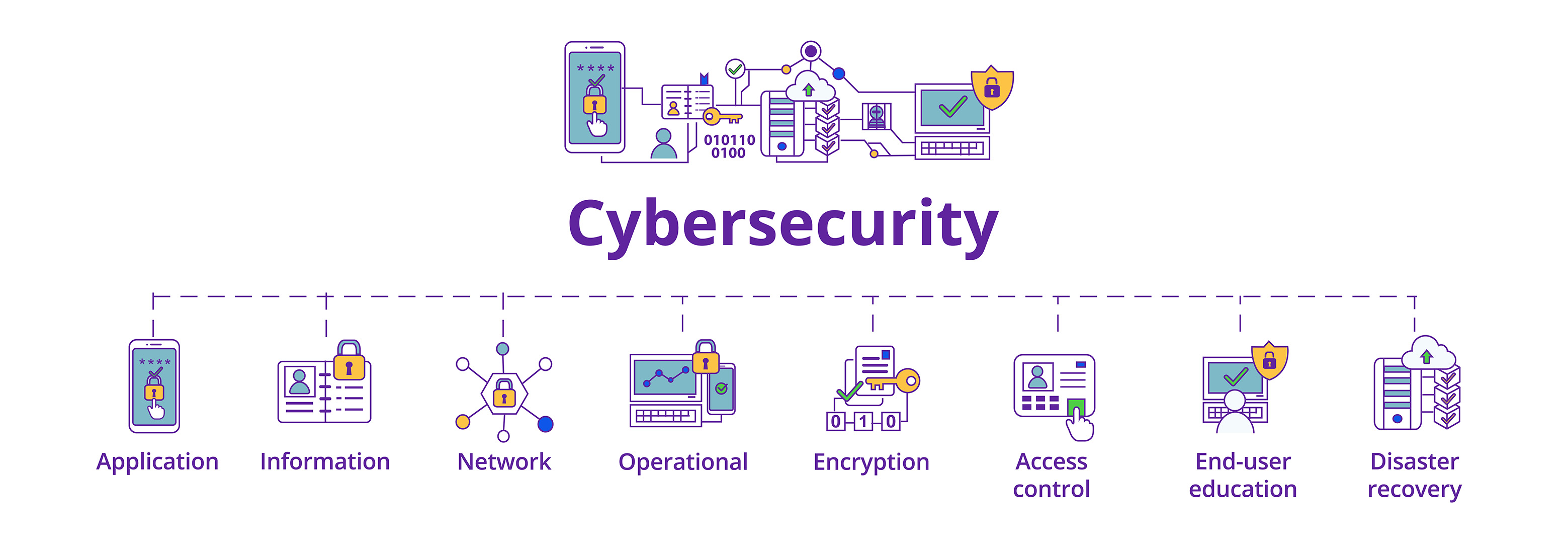

Cybersecurity: Protecting important data and business processes

Cybersecurity is critical as insurance companies digitize their business operations and process large volumes of customer data. Robotic process automation in insurance, AI and ML can also play important roles in strengthening cybersecurity measures in the industry. Intelligent automation improves threat detection, identifies vulnerabilities in real time and responds quickly to potential breaches. In addition, AI-powered algorithms can ensure customer security and privacy by analyzing patterns to identify fraudulent activities and prevent data breaches.

Low code/no code workflow: To map the entire process end-to-end and use the full range of insurance technology solutions as and when necessary to provide end-to-end automation and digitally transform the company.

The benefits of using these tools in insurance

RPA for insurance reduces the need for human intervention by automating manual and repetitive tasks. This increases productivity and allows employees to focus on more efficient and productive work.

Getting it right: By eliminating data entry and reducing human error, RPA insurance combined with ML provides greater operational efficiency in areas like financial claims, accounting and policy management. This improves data quality, reduces inconsistencies and increases customer satisfaction.

- Cost savings: Robotic process automation for the insurance industry helps firms reduce costs by minimizing effort and optimizing processes. By decreasing manual processes and improving operational efficiency, organizations can reduce costs while maintaining quality of service

- Improved customer experience: By integrating NLP, chatbots and virtual assistants, insurers can provide personalized and interactive support. Customers receive instant answers to their questions, easy access to policy information and timely assistance throughout the application process. This leads to customer satisfaction and enhanced loyalty

- Faster claim processing: RPA claims processing combined with a workflow tool accelerates claims resolution. ML algorithms help identify suspicious information, allowing insurance companies to process genuine claims quickly while minimizing fraud loss. This reduces processing time and improves poor customer experiences

- Accurate risk assessment: ML algorithms combined with RPA risk assessment allow insurance companies to analyze big data and gauge risk. Using historical data, market trends and customer profiles, insurers can optimize underlying processes, make informed decisions and improve risk assessment

- Advanced analytics and insights: AI and ML technologies provide insurance companies with advanced analytics capabilities. By analyzing patterns and trends, insurers better understand customers, markets and emerging risks. This allows them to develop business plans, adjust products and reduce costs

- Faster time to market: By combining robotic process automation in insurance with productive AI, insurers can accelerate product development and bring new products to market much faster. Generative AI helps create synthetic data that allows insurers to simulate situations, refine models and hasten product design and testing

- Increasing data security: Cybersecurity measures play an important role in protecting sensitive customer data and guarding against cyberthreats. RPA in insurance industry, AI and ML technologies can improve threat detection, identify vulnerabilities and quickly respond to potential breaches. This ensures the confidentiality, integrity and availability of existing customer information

- Regulatory compliance: RPA in insurance sector helps companies perform regulatory compliance and ensures compliance with legal requirements. By reducing human error and automating data communication and reporting, insurers can reduce the risk of breaches, penalties and damages in the system

- RPA in the insurance industry enables companies to upscale quickly to handle new markets and process higher volumes. It’s much easier to create more software bots and infrastructure compared to hiring in new geographies

RPA in insurance use cases

- Claims handling: RPA can automate the end-to-end claims handling workflow, from information extraction to approval and settlement, lessening handling time and progressing exactness. AI and ML can help recognize designs of false claims, speeding up the discovery process

- Claims settlement: Robotic process automation for insurance claims uses data extraction, validation and computation to improve the claims process. ML algorithms evaluate data requests, historical data and policy details to accelerate decision-making. By integrating insurance RPA and ML, companies accelerate claims resolution, reduce processing times and increase customer satisfaction

- Underwriting: By integrating RPA in insurance underwriting and AI, insurers can streamline external data gathering, risk assessment and policy development, enabling faster and more accurate decisions. ML algorithms analyze historical data and provide insights to improve risk assessment

- Customer service: NLP-powered chatbots and virtual assistants manage customer inquiries, provide proprietary information and assist policy selection. These AI chat agents can understand customer needs, provide personalized recommendations and guide customers through the purchasing process, increasing customer satisfaction and reducing response times

- Fraud detection: The benefits of RPA insurance are clear. Robotic process automation in insurance combined with ML can improve the ability to detect fraud. ML algorithms can analyze large amounts of data, including historical data, customer profiles and transaction data to identify suspicious patterns or anomalies that point to fraud. RPA can update the search process, identify possible states for further analysis and improve the search process

- Risk assessment: Insurance companies can use RPA risk assessment and ML to streamline the process. RPA gathers data from a variety of sources such as customer usage, external data and social media, and ML algorithms analyze this data to assess risks and provide fair prices. This integration not only simplifies the billing process, but also improves the accuracy and consistency of risk assessment

- Policy management: Robotic process automation in insurance updates policy management functions such as data access, data processing and new policy enforcement. RPA eliminates human intervention, reducing management errors, improving data accuracy and increasing efficiency. ML algorithms can also analyze policy history to identify patterns and make predictions, helping insurance companies optimize policy pricing, coverage and statement

- Compliance: The insurance industry is subject to many laws and regulations. RPA in insurance can work as a follow-up task such as the data collection process, data generation and data integration. By using RPA, insurers can act accurately and timely, reduce the risk of fines and maintain regulatory compliance

- Predictive analytics: AI and ML techniques perform predictive analytics in the insurance field. By analyzing historical data, market trends and customer behavior, insurers develop models to predict customer churn, identify sales opportunities and improve pricing strategies. This allows insurers to customize their products and services, retain customers and increase revenue

- Insurance premiums: ML and Robotic process automation in the insurance industry can improve the determination of premiums using data extraction, validation and computation and analyzing the history of calamities and effectively predicting the next occurrence which helps companies determine the risk and increase premiums accordingly

- Client onboarding: Use chatbots to recommend the right product to customers based on profile categorization. RPA insurance improves onboarding by enabling faster document extraction and updating legacy systems

Conclusion

Insurers can use the transformative power of industry-leading RPA tools like UiPath, Automation Anywhere, Blue Prism and more, plus AI, ML, NLP and cybersecurity to automate processes, improve decision-making, delight customers and strengthen information security. By integrating these technologies, insurance companies can simplify operations, diminish risk, reduce costs and provide superior products and services.

Leaders are investing heavily in these tools and taking over the industry. It’s just a matter of time before companies who fail to invest in modern technologies run out of steam with predictable consequences. However, organizations that leverage the capabilities of RPA for insurance and advanced technology will gain a competitive advantage by identifying new business models and redefining how insurance is delivered.

Zoreza Global helps clients transform processes by providing premier end-to-end technical, advisory and implementation services.

Talk to an expert

If you’d like to learn more about how Zoreza Global can help you get the most out of insurance automation tools like UiPath, Blue Prism and Automation Anywhere and RPA for insurance in general, visit our website.