In brief

- Insurance underwriting analytics uses data analysis tools and techniques to evaluate risk, identify potential claims, and set appropriate premiums to ensure long term profitability and sustainability.

- Predictive modeling, machine learning algorithms and artificial intelligence can help insurers find patterns and trends in customer behavior and claims history.

- This can be used to create new market opportunities and develop more tailored insurance products that meet the specific needs of individual customers.

With every day that passes, news services report yet another extreme local or global weather event. Just look out of your window. The increasing incidence of storms, floods, heatwaves, severe cold, droughts and wildfires is unnerving, to say the least.

The Intergovernmental Panel on Climate Change (IPCC) says that without immediate and deep emissions reductions across all sectors and regions, it will be impossible to keep warming below 2015’s UN Paris agreement level of 1.5°C (above the preindustrial 1850-1899 baseline) unless underlying factors are resolved now. Which is a pretty bleak picture.

So, with the prospect of unprecedented insurance risks, claims and payouts, the critical question for underwriters is not “what’s happening?” but “what’s going to happen?”

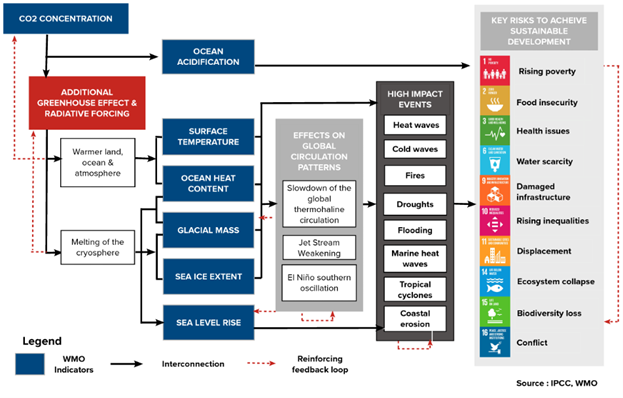

Insurable risk and climate impact on sustainable development

The World Meteorological Organization (WMO) cites seven issues (indicators) that contribute to climate change and charts their global threat as follows:

The latest IPCC report predicts that we’ll cross the 1.5°C frontier in roughly 10 years. Around 4.2 billion people live in urban regions, and if the authorities could warn individuals and communities that hazardous weather was imminent, it could reduce the effects... and insurance company exposure.

Some proactive insurers are trying creative technological approaches in preparation for the size of climate-based claims. And that’s where the most progress will be made; finding the sweet spot, the perfect combination of insurance and data analytics.

Digital development relies on the use of artificial intelligence in insurance underwriting. Which means, in the end, personal and insurance industry survival could come down to data and underwriting analytics.

Data, the heart of modern underwriting

The ability to interpret data is the beating heart of underwriting — all insurance functions, in fact. It always has been, well, right back to 1688 and the embryonic Lloyds of London, certainly. Sailors needed to know whether it was safer to cross the Atlantic in the spring or autumn, avoiding storms. In more modern times, the wealth of available data sources means we depend on underwriters being able to interpret the data rather than using personal knowledge built up over decades (or a hybrid of the two) because that knowledge is already in the data.

Data and machine learning underwriting tools provide additional insights, enabling better-informed underwriting decisions. That said, nobody is underestimating the value of personal experience or looking to take decisions out of underwriters’ hands. But by bringing new factors to the table, we’re encouraging fellow professionals to expand their skills and become as valuable as possible. To paraphrase a well-worn quotation, “Predictive analytics is not going to take your job. Another person using predictive analytics is going to take your job.”

Take household underwriting, for example

Over the years, underwriters catalog the things likely to impact a house, like theft, the frequency of storms or the chance of fires breaking out. However, things change over time, and changes must also be considered, as in the case of underwriters and innate knowledge. Suddenly, a raft of fresh data becomes available, and the traditional advantage of relying on natural wisdom is less obvious.

One of the latest household challenges is the escape of water in bathrooms caused by people installing new ensuites in old houses. These properties are not designed to have unpredictable pipework trailing around walls and under floorboards. The fly in the ointment here is not new bathrooms; it's added bathrooms. From an underwriting perspective, you can review a particular house sale from a decade ago and see a two-bedroom, two-bathroom property. Compare that to a later resale, and you find that the previous owner added three bathrooms, making it a considerably worse risk than five bathrooms in a new build. The point is you can only get that data externally.

Other home truths

A major complaint from people applying for home insurance is about the pages and pages of information they have to fill in. This problem goes away with a bit of extra thought and a solid application of data analytics for insurance. One insurer cut their online application to just five questions. They were able to shorten it by that much because they realized they could work out everything else about prospective customers from the vast amount of data available via the internet, social media and publicly available property information. No need for applicants to tell the company the square meterage or that the property’s on a floodplain; they can figure that out. In the same way that by checking a satellite image, underwriters can see if there's a tree nearby.

And that’s key because to compete in the market, you must provide an exceptional customer experience — no more paper, much faster turnarounds and improved accuracy. If the data comes in digitized and remains digitized, underwriters can get improved pricing models and more information more easily.

What about un-insurability?

At one point, flood insurance reached a point where people could not insure their homes because the issue presented an unclear or unreasonable risk of economic loss for insurers. As a last resort, the UK government was forced to set up Flood Re as an interim solution to support homeowners who couldn't get affordable flood insurance.

From an insurance perspective, companies that spotted flood risk early got out of the market quickly. Those insurers knew a house would flood before the subsequent owners had even bought it. Insurance analytics gives companies a clear advantage and keeps them ahead of the game. Clearly, if any organization doesn’t use the data-driven underwriting, they’re putting themselves at risk.

Three main data drivers for underwriters

The first preoccupation is getting their hands on as much data as possible. They draw from all the traditional data sources — insurers share data, bodies like the Association of British Insurers (ABI) provide data around standard incidents and so on — but data is also starting to arrive from new areas. Online shopping, for instance. People who buy clothes, try them on (even wear them to an event) and then return them. These manipulative digital customers represent greater insurance risk characteristics than those who choose to keep the clothes they buy.

Second, more insurance companies are beginning to fish new streams for data to power the underwriting rate. Of course, the question then becomes, “I’ve got all this data; how do I manage it?” Motor insurance comparison websites probably run off 20 or 30 common rating factors. So, how do insurers get their super-niche rate if everyone's using the same rating factors? And if you think you've got a differentiator based on information taken from a great source but can't display it on Go Compare.com, you've lost your competitive advantage.

Third is the ability to interpret conflicting data. The data scientist’s question is, “how can I start understanding how those two factors relate?”

One vision, multiple viewpoints

One of the most important qualities Zoreza Global brings to the table is the ability to provide an external viewpoint rather than a narrow insurance perspective. Because we work with different insurers and several other industries, we develop a multifaceted mindset. Consequently, we bring all those varied online and analytics experiences to the insurance sector. That’s where genuine breakthroughs in the financial services industry are made, by thinking outside the box and learning in place.

There will always be a human element in underwriting AI one way or the other. People will increasingly focus on strategy because although you may have seen a million policies in your lifetime, AI underwriting has seen a zillion. So, the required skills and tasks underwriters undertake will likely shift and become more interesting.

Let’s talk

If you’d like to learn more about how underwriting analytics could improve the immediate business value of your underwriting function and the future viability of your organization, visit luxoft.com/industries/insurance or contact us.