In brief

- How are other insurers challenging the meerkats for control of consumer choice and diverting the stream of new and renewing customers away from Compare the Market?

- New entrants into the insurance sector aren't insurance companies; they’re intermediaries, general managing agents, or organizations that own the customer but don’t want to take on the risk.

- Insurers must work more closely with car makers because manufacturers have all the data required to price risk and even become insurance companies themselves. Could that ever happen?

In the insurance industry, whoever controls the customer at renewal is king (or queen, obviously).

With that in mind, comparethemarket.com has gone to great multimedia lengths to build a brand affinity with an extended family of small anthropomorphic mongooses, acquiring an “excellent” Trustpilot approval rating of 4.8 out of 5 in the process.

Although meerkats usually live in African rock crevices, these dapper, urbanized and intelligent TV stars appear to be in complete control of customer choice, bringing new and renewing customers flocking back to Compare the Market in their droves (whether they get a cut of the commission is unclear.) To stop those customers reverting to confuse.com or wherever next year, the meerkats have to be rejuvenated on a regular basis (currently, a continent-hopping wombat is causing mayhem.)

But how do insurers challenge Compare the Market? Whip up their own furry brand loyalty campaign and compete head to head?

A single point of contact

It’s the same in banking. For argument’s sake, let’s say that Ms. Jones has a digital current account with one bank and a savings account with another. She dislikes checking statements and paying bills via the first bank’s app because she finds it too clunky. On the other hand, the competitor’s app is really slick. So, how does the first bank prevent Angela and others like her from moving their current accounts to competitors?

Naturally, the first bank will have to transform or update its app because market success is all about ownership of the customer. But the simplest and most convenient solution is open banking. Open banking enables customers to keep all their banking records in one app, regardless of who owns it. So, Angela could still access her current account via the smooth, slick savings app without moving anything.

Digital transformation is changing the banking world in so many ways, and to maintain business continuity, progress has to be prioritized according to function:

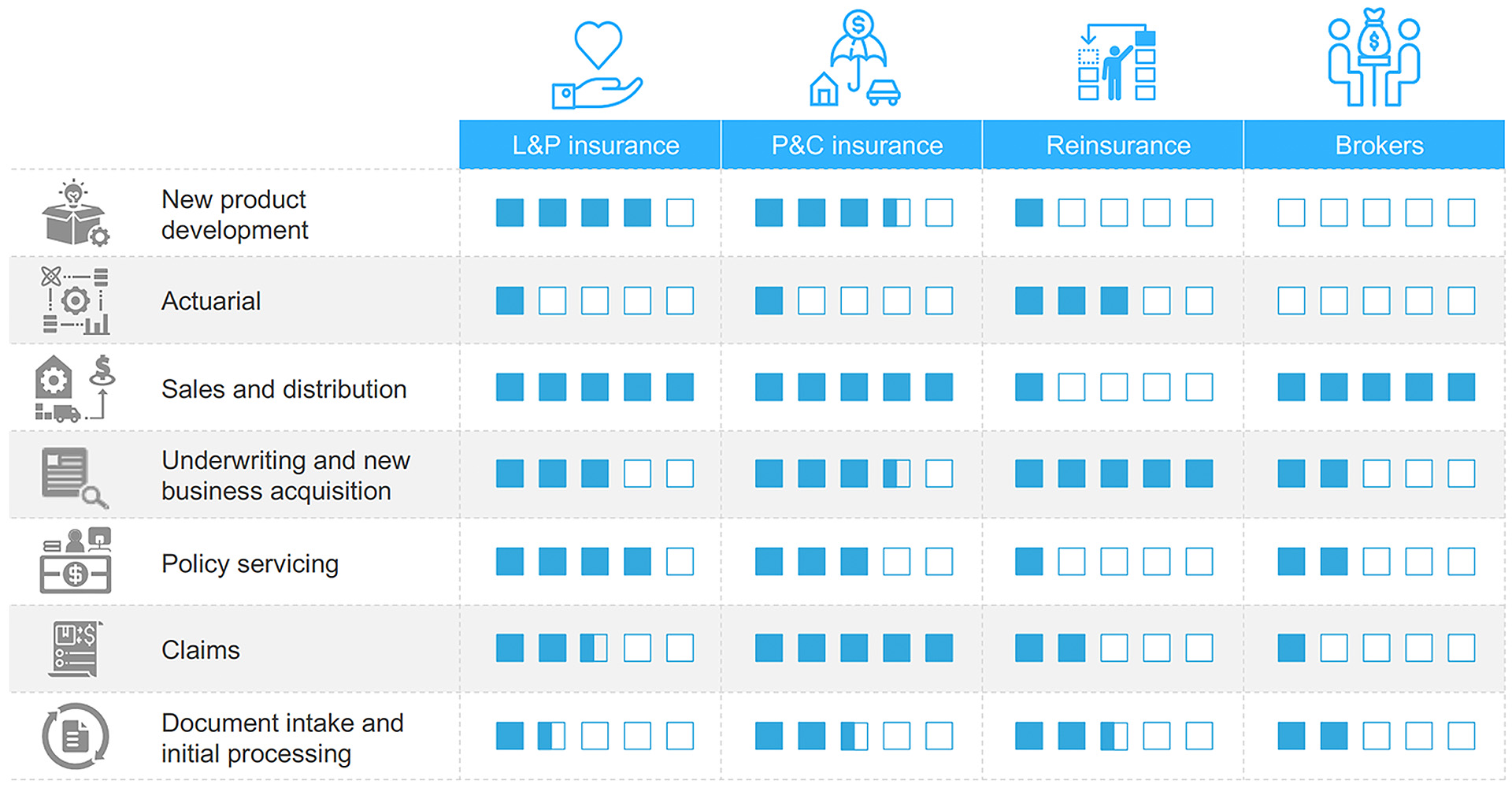

Priority listing of insurance functions for digital transformation across industry segments

What are insurers investing in?

Change is inevitable across all sectors, and organizations must react accordingly. Look at automation in insurance companies or the pensions industry, for example.

Pensions

People have been moving to self-funded pensions for some time. Now, those investors might have three or four different pensions, which they should be reviewing once a year to make sure the fund allocation still reflects a level of risk they feel comfortable with. But writing to four different pension companies saying, “I want to switch my pension fund from adventurous to cautious because I'm heading toward retirement,” takes time and effort.

Taking a leaf out of banking’s handbook, the pensions industry is trying to create an app capable of simplifying tasks and providing enhanced investment opportunities. If a pensions provider owns the customer and can say, “Here's the relative performance of your four pensions. While Scottish Widows were up 3%, Standard Chartered went up 20%, so why not use the app to move your money from Scottish Widows to Standard Chartered?”, they’re home and dry.

Powerful stuff.

A clean sweep

So, we’re back to the Compare the Market-type approach, and considerable sums of money are at stake — pension pots worth hundreds of thousands of dollars each. It's starting to happen in the insurance sector too.

“MyAviva" advertising shows people reviewing all their Aviva insurance products (life, car, home) on one app, with a discount for keeping everything together. Ultimately, Aviva wants to own each customer’s full roster of insurance relationships (themselves, through subsidiaries, etc.), and a great app is the key to success.

Chips with everything

Another excellent example of this approach is the installation of embedded chips in all brown and white goods. Now, your smart fridge can tell you things like when you’re running out of milk, or that there's been a power cut and frozen food is beginning to defrost. The downside is that Samsung, Miele and Siemens, etc., have all produced apps. So, customers will to have to juggle six or seven different apps in their connected homes.

Domestic & General, the biggest warranty provider for brown and white goods, is looking to introduce an app that interfaces all the other apps for conducting warranty business with customers. And that will put them at the very heart of the customer relationship.

In which case, customers will be able to use their D&G app to check what their fridge is doing, whether the dishwasher is programmed to start at 6 a.m., or if their tumble dryer is due to break down in 10 days’ time. With everything controlled through their app, D&G will own that customer and secure their renewals.

And it doesn’t stop there

Home insurance. Now you're thinking; my house has a remote alarm, remote lights and a central heating system I control via my cell phone. What if they all get linked to an insurance company app? And say I go away on holiday and forget to set the burglar alarm. The insurance company is insuring me on condition the alarm is activated, and their app knows I can control it from my mobile. So, as the alarm’s off even though I could have primed it remotely, the insurer will adjust my cover accordingly.

Car insurance. Effectively, modern cars are massive cell phones on wheels with in-built SIMs and updatable Sat Navs. They know how fast you're going, how efficiently you’re braking and your rate of acceleration. They know what road you're driving on and even how far away from home you park. If you claim that your car is always garaged, yet it’s always parked a quarter of a mile away from your house, clearly, either the garage is full of trash, or you haven't even got a garage. From a theft perspective, that’s a bit of a giveaway.

Car insurance is a risky business

Insurance companies need to start working more closely with car makers because car companies have all the data required to price risk and become insurance companies themselves. Whoever has access to that critical data has a clear indicator of price and premium. In the case of Volkswagen insurance, Allianz has an edge, so they’re always cheaper. Suddenly, other insurers can't get Volkswagens underwritten because they need access to the app.

As I’m sure you’re aware, insurers work on small margins, and nobody makes any real money out of insurance. So, new entrants into the insurance sector aren't insurance companies at all. They’re intermediaries, general managing agents, or organizations that own the customer but want to avoid the risk.

The devil’s in the retail

For example, a commercial titan like Amazon could think, “We can make a 30% return on broking a risk, and let’s say the insurance fee is £100. If I'm getting 30% commission and it costs me £20 to earn my £30, I'm making a 33% margin. The insurance company’s probably only making £1 profit on the other £70. Why should we take the risk on the £70 to make £1 profit when we’re already making a safe £10 profit on £30?”

Similarly, why would Volkswagen (as in our previous example) want also to become an insurance company anyway? It makes more sense to find an insurance company that will underwrite the risk at the most competitive level and just make money on the introductory fee.

So, £70 covers the chance of that car having an accident and the insurer losing £1,000. However, if the insurance company finds a way to increase its overall accuracy, it might discover that instead of costing the company £1,000, the potential payout is only £180. Then it can reduce the risk premium from £70 to £65 or whatever and become more competitive in the market.

Many happy returns

The smart car / Amazon-type company will say, “Well, I've already pocketed the commission on selling the product in the first place, and my data shows that this is a better insurance risk. So Mr. XYZ Insurance, instead of reducing your £70 premium to £65, drop it by £3 and give me the other £2.” This will drive underwriting margins down further still, enabling introducers to earn even more.

Rather than relying on the Amazons of this world to give them data, insurance companies need to get on the front foot, develop a more innovative understanding of the data and take them on. Their partnership with Volkswagen means Allianz gets all the car data it needs. But could other insurers outmaneuver Allianz and develop a vital competitive edge by understanding Volkswagen vehicles in a way that Allianz can't?

Keeping one step ahead

This kind of thinking outside the insurance box is not restricted to the automotive industry. Massive improvements in technology and data management have created a raft of great opportunities.

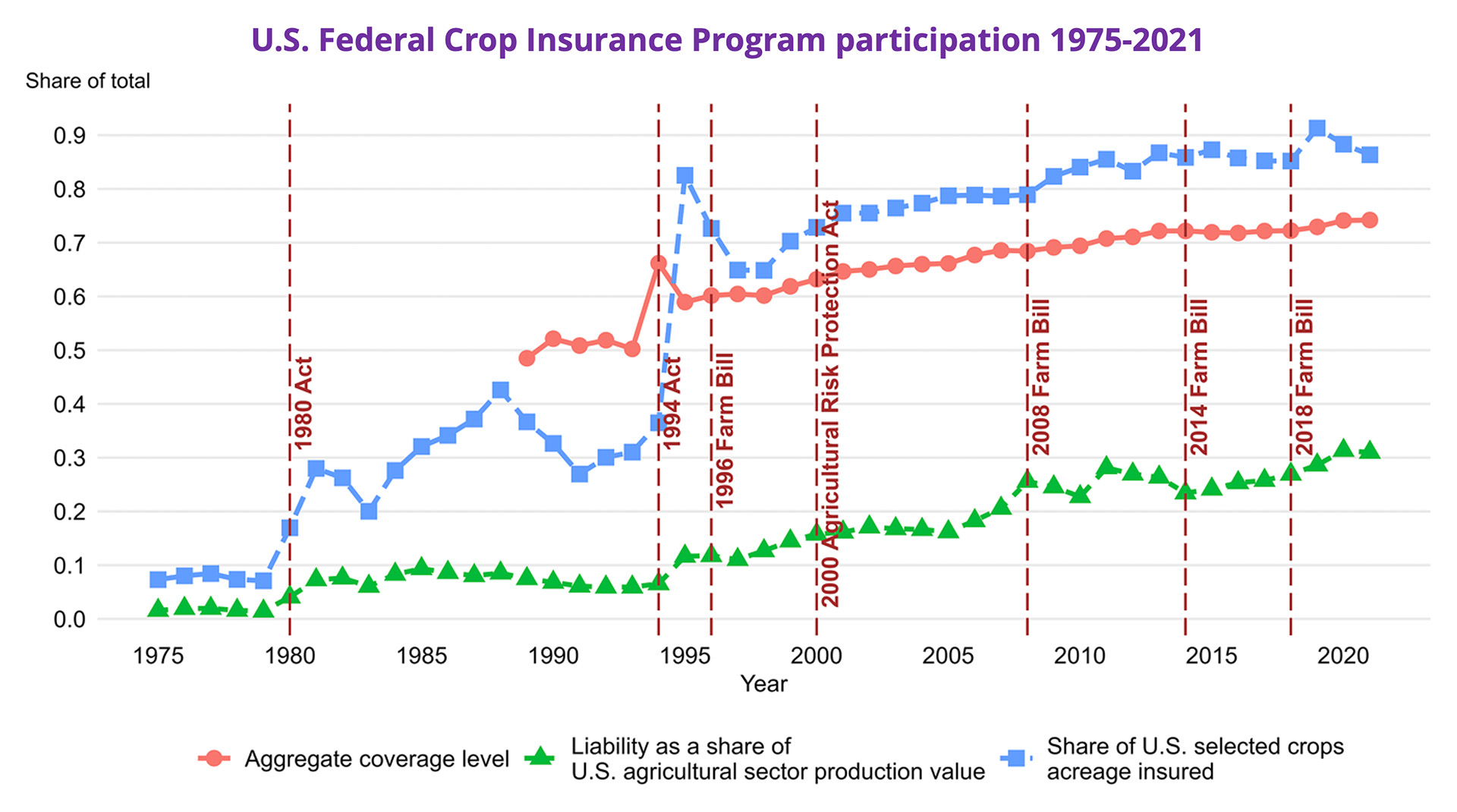

Take U.S. crop insurance, for instance. Farmer Clark insures a cornfield measuring five miles by five miles for half a million dollars. Then a hurricane rips through the field, trashing the corn, and Clark loses his shirt.

In the past, he would have had to spend ages gathering weather records, taking photographs in the field and so on, to present a claim. Nowadays, the weather records are so good the insurance company almost knows the hurricane is going to strip the Clark cornfield before it happens. Which means it can pay the claim much faster.

By anticipating the farmer's needs, the insurer elevates its customer experience. The farmer thinks, “Okay, I’ve lost this crop, but with half a million dollars in my bank account, I can start plowing first thing tomorrow, and I might be able to plant another corn crop in time.”

If you were in Farmer Clark’s shoes, which insurer would you renew with next year?

Are you sure you own your customers?

If you’d like to discuss how digital transformation can help your organization improve its customer experience and win the battle for new business and renewals, contact us.