In brief

- Leveraging digital technologies such as advanced analytics and intelligent automation can help insurance companies enhance their products and services, improve customer experiences, and boost business growth.

- However, many insurers face roadblocks in their digital transformation journey, including legacy systems, complex regulations, and a siloed organizational structure.

- A collaborative approach, involving various stakeholders across the organization, can help to identify and overcome these challenges and drive transformation.

Could managers concerned about the overall enterprise strategy be blocking transformation? Doubtful. What about the IT squad?

Unlikely. It's a misconception that the IT team doesn't really want to do anything new. The virtual water-cooler buzz is, “well, they've got it all worked out, haven’t they?” Supposedly, they’ve done their bit, aligning standard technology to management’s operational model and their current operational business needs.

But, in reality, IT professionals lead from the front. They need to be as close to a perfect tech fit as possible for the next step on their insurance career path. If they’ve been laboring on an ancient platform with a skill set that hasn’t budged in the past 5-10 years, their chances of being welcomed with open arms by a contemporary player are less than awesome. So, charged with getting more business value from the insurance data deluge, devs and data engineers are really keen to bring in new software and applications. It’s not their money, after all.

No, resistance is more likely to be found poking around old mainframes; the slow, inflexible unscalable building blocks on old tech stacks; the operations function. And to randomly take one set of resisters, the artists who sprinkle their magic over the trickiest cases. The underwriters.

Unlock the secrets in their head

In the London market, systems are siloed. Each underwriter has their own formula for calculating the best price for the client and writing as much business as possible with the lowest risk.

This holistic knowledge — held in superior intellects and the odd encrypted laptop file — is not widely shared because underwriters regard it as their bread and butter. These trade secrets pass for salary and career currency. There's no unified platform, no universal view. Everyone has specific databases and specific sources for specific things. Share the information, and someone else can write as much, if not more, business.

More to the point, this specialized and experienced task force is older than most. Underwriting is a well-paid job and features many more 50-year-olds than under 30s. Consequently, aging practitioners can afford to retire when they feel like it. Give it 10 years or so, and they’ll have left the company, taking their unique bank of intelligence their employer paid them to accumulate with them.

Rewrite the rules of attraction

In addition to IP and the high cost of maintaining old mainframes and systems, there’s the problem of being unable to fish in the prime specialist recruitment pool. If the legacy situation hasn’t resolved itself with the changing of the guard, the company will struggle to attract new blood in any case. Young people don’t want to learn a mass of old legacy systems only used by one insurer.

Digital transformation attracts new talent

On the other hand, if you upgrade everything right now, won’t all your extremely valuable underwriters leave anyway? It's a high-wire balancing act and one of the biggest challenges facing the C-suite — developing a general strategy incorporating both new hires and existing specialists.

So, decision-makers must also modernize the operations team to offset a growing list of expenses and the loss of income while strengthening accountability. The manually managed software approach, which entrusts vital information to slips of paper sent from place to place, is prone to mistakes. Similarly, people play with data as if it were a comparison engine, entering different values to discover the best business outcome without recording their actions, leaving their latest findings as if they were the initial results.

Should it go or should it stay?

Of course, if certain things (e.g., long-term products) need to stay on-prem, you’ll be looking at a mainframe hybrid cloud transformation. But how do you decide which data stays on mainframe or gets uploaded to private/public clouds?

First, determine your end-game strategy — creating a stable core system, for instance. Whether it’s legacy or modernized doesn't really matter. The critical element is that it should be stable and flexible, and you only use it to record policies and financials. In other words, as the accountability part of the equation. Everything you use operationally (e.g., pricing calculations) can sit separately from the core, using the front end — not the customer-facing digital front end, but the one that makes all the decisions.

With your simple, stable core and highly functional, multi-platform, multi-software, front-end approach, you have the flexibility to buy the most up-to-date solutions and connect them to your highly flexible, customizable front end. This allows you to plug and play as you progress. So, keep any modern systems that work for you while they still do a job. When they hit end-of-life, the cost of leaving them is much lower because instead of doing a complete digital transformation, you just migrate the data and eliminate excess code.

Scary monsters

There is another popular option (I got the tip from a reputable source at a conference earlier this year). The market wants to build monsters. Insurers are so accustomed to and blinded by monolithic architectures (one module built on top of another) they don't see that repeating the pattern will lead to more problems, not fewer.

Five cons of monolithic architecture

- Becomes unwieldy and hard to manage

- Start-up and implementation slow down over time

- Monolithic logic can be hard to understand for new recruits

- New technology or even one small change will impact the whole application

- Only takes one bug in a single module to derail everything

Digital transformation is a must.

Unfortunately for insurers, but fortunately for vendors, that’s the most logical route forward because the architecture is designed to suit how the pricing of software, connectors and so on, is done. Everything is built as one massive beast integrated with a ton of customized code. And that works because vendors have yet to modify their understanding of what an insurer should look like. Currently, with vendors being more reactive, data analytics and software companies are topping the proactive leaderboard.

With a little help from your friends

It's an executive decision. Leaders must realize that “maybe I won’t be able to do it in my tenure, but it will be done in the next executive term.”

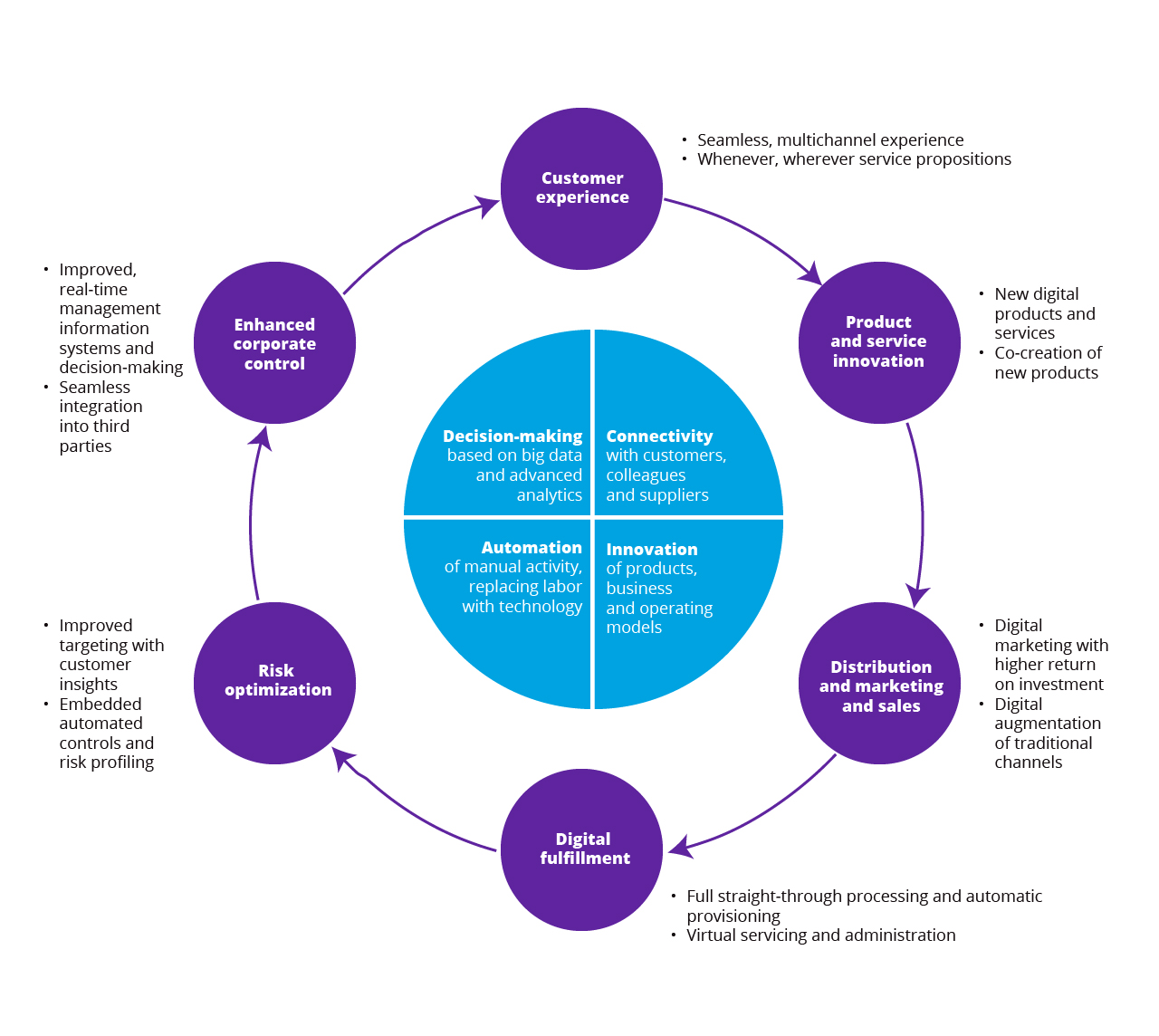

Digital transformation can reshape every aspect of the modern enterprise

Transformation is not the techie version of a Build-A-Bear workshop, i.e., gathering all the software vendors together to pick and then assemble the best features of each product. It's about nailing down the company goal and fleshing out a strategy to match it, then using consultancies to align the software and business strategy to that goal. Transformation generates the interchangeability that allows the business to make strategic decisions about moving forward rather than maintaining its current reactive approach.

Keep on moving

Digital transformation can seem daunting at first, but most organizations get around this by taking it step-by-step with a vendor that offers a specialist skill set, like Zoreza Global. With our consultancy team’s help, no challenge is beyond resolution.

The first step is where the company and consultant work out their strategy. Once they have the strategy, the consultant configures the end-goal scenario, selecting automated insurance solutions that would suit the company’s finite goal (perhaps types of software or the theoretical architecture between them). Then, together they build a road map to their destination. There’s no need to buy and build everything at the outset.

So, if you’re still in an on-prem company, buy cloud with a pricing model that spans the period you intend to ramp up production. Then divide your project, one step at a time, across a 10-year timeline, so you only pay for each step as you reach it. Also, instead of buying everything right now and then trying to figure out how it works, buy cloud-native software like Snowflake, which is market-leading and will grow with you rather than being outgrown.

One vision (multiple viewpoints)

One of the most important qualities Zoreza Global brings to the table is the ability to provide an external viewpoint rather than a narrow insurance perspective. Because we work with different insurers and several other industries, we develop a multifaceted mindset. Consequently, we bring all those varied online and analytics experiences to the insurance sector. That’s where genuine breakthroughs in the financial services industry are made, by thinking outside the box and learning in place.

Still not found what you’re looking for?

If you’d like to learn more about drafting a digital transformation strategy and how Zoreza Global can help beat the blockers, visit our Insurance page or contact Aleksei Kuratau, Market Engagement Lead, Zoreza Global.