In brief

- The LXA platform allows clients to productionize their modeling and analytics and make them easily reusable. This environment comprises the whole analytics lifecycle, front-to-back, from raw data to data-driven decisions

- Generative AI is quickly becoming an invaluable ally for wealth managers looking to deliver a hyper-personalized, more differentiated service. This isn't just about crunching numbers faster; it's about elevating the entire client experience and unlocking new potential in portfolio management

- What if you could predict clients thinking of leaving and make product recommendations based on dynamic segmentation to encourage them to stay? Or anticipate niche market movements based on complex global economic indicators? AI has been instrumental in spotting early investment opportunities in emerging markets, undetected by traditional practices

Wealth managers have a lot on their plate at the moment.

New technologies like intelligent automation, machine learning (ML), predictive analytics, cloud, and now, generative AI, are changing the way firms operate.

And although corporate and investment banking (CIB) organizations initially deployed AI and ML decades ago, the rest of the industry is still playing catch up. However, the McKinsey Global Institute estimates that generative AI could bring an extra $200 billion to $340 billion in business value to banking as a whole, through advances like greater productivity.

GenAI enables the creation of new, unstructured content such as text, images and speech. It’s fueled by foundation AI models trained on a comprehensive data set adapted for an extensive range of tasks. These models consistently outperform traditional AI at interpreting and labeling unstructured data.

Now, how will clients receive advice?

Technological innovation has replaced the traditional account manager with electronic communication in many banking sectors but less so in wealth management, where the change is more subtle. Yes, clients are demanding faster, personalized and more joined-up transactions, but for advisory services, most prefer to discuss investment issues with another living, breathing person. So, a wealth manager’s front door has to be a judicious mix of digital and personal.

Consequently, innovation is centered on optimizing efficiency and productivity rather than replacing frontline staff. That said, imagine having your own digital co-pilot, providing real-time customer dashboards, advanced segmentation, financial modeling (even M&A and IPOs), real-time market analysis, risk assessment and personalized investment strategies. Co-pilots leverage advanced AI algorithms and big data analytics to turn raw data into actionable insights, sifting through vast datasets and identifying trends/patterns invisible to the human eye.

They improve predictive accuracy over time by employing machine learning to continuously refine their models. Moreover, a co-pilot would integrate seamlessly with existing systems, enhancing your decision-making process with data-driven insights. Not just a tool; a partner that works 24/7, ensuring you’re always ahead of the game.

Client experience: In light of increasingly aggressive competition, how can wealth managers add extra value to differentiate themselves and create greater appeal for a deepening pool of clients?

Operational scale: How do wealth managers extend their services to a broader range of clients while minimizing costs to make a viable business case for scaling? They must upgrade the efficiency of operating models, minimizing touchpoints, location footprint and their ratio of relationship management to investment consultancy.

Regulations

Firms are always battling with regulations. Due to time constraints or complex data gathering for reporting, sometimes firms apply longer-term tactical fixes instead of a strategic solution, which is never realized. The current regulation focus includes:

- Sustainable finance: Rationalize different approaches across jurisdictions. The United States leads the way, but we need greater regulatory alignment to standardize disclosure requirements for funds

- Systemic, market and liquidity risk in response to the war in Ukraine

- Investor protection: Consumer duty. Consumers should get communications they can understand, equitable products and services, and the customer support they need when they need it

- Widening investor choice: More digitized products such as crypto and tokenized assets

- Technology: Implement generative AI

Key questions

- “Do we have the right tech capabilities to keep up with regulatory developments?”

- “Are we fully aware of all the new, sustainable finance rules and what they might mean for our business and client/fund portfolios?”

- “Are the firm’s liquidity risk management policy and processes aligned to the latest regulatory expectations?”

- “Can we monitor and evidence fair outcomes for investors?”

- “Are we using emerging products and fund structures to their fullest extent and delivering sound investment strategies to investors?”

ESG

The valuation of social, environmental and governance (ESG) impacts is rapidly evolving. Data and analytics capabilities are a vital part of measuring and reporting on ESG.

Client journey

Well-designed customer journeys and seamless omnichannel interactions enhance the client experience and boost advisor productivity. The ability to deliver consistent advice across channels is crucial.

Open ecosystem

Moving away from monolithic platforms to a best-of-breed open architecture setup makes it easier to customize the stack and leverage fintech innovations.

- Unbundle the wealth tech stack (e.g., Wealth as-a-Service) into modular components

- Adopt an API-first strategy, digital technologies and multi-cloud architectures to dismantle silos and form a holistic platform

- Be prepared for other opportunities to automate back-office functions and reduce cost

Data and AI

- Unify data from multiple systems

- Leverage analytics to uncover client insights and support advisors in addressing the client’s holistic financial wellbeing (e.g., which products to offer a client during specific life changes, such us new job, marriage, retirement, etc.)

- Leverage GenAI to automate more of the back office but remain customer-centric

- Work out how to navigate new AI regulations

The data journey

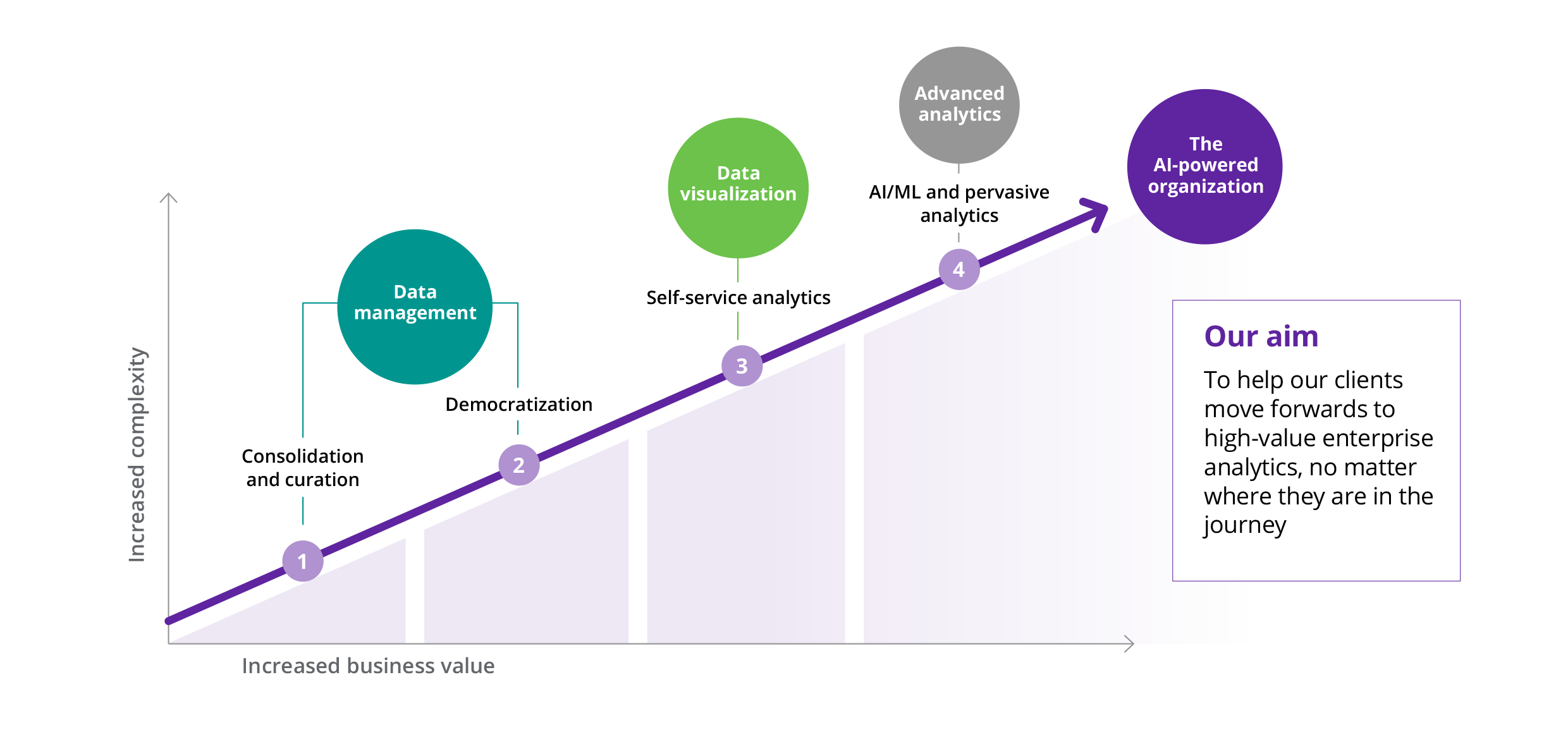

Data journey refers to the overall progression toward AI and machine learning at an enterprise level. End users need to be able to use data and data analytics to make better-informed decisions via machine learning. But there are two prerequisites. Sound data management is crucial together with consistent and coherent data models (data commercial models that make sense to the business.)

Data made available to the business has to live up to its billing. If that’s via a self-service package (Dataiku, PowerBI, Tableau, etc.), it must be complete, coherent and descriptive so users can navigate the data model quickly and easily.

In other words, an organization can’t expect enterprise-wide analytics if it can’t provide self-service analytics for the business. And the self-service component of its data model is the primary success factor for rolling out commercial-grade analytics across the entire organization.

Here are the four stages of the data journey:

Consolidation and curation

- Get all the data into one place

- Why? It’s cheaper for users to connect to one data source rather than 40. Also, it’s easier to do consistent QA

Democratization

- Make the data available to users in the way they want

- Why? If people can’t get the data into their favorite interface, they’re less likely to use it

Self-service analytics

- Provide curated data and data models via a self-service visualization package

- Why? It’s much quicker for users — they know the data best. No need to wait for IT. And many eyes on the data means better reliability

Pervasive advanced analytics

- Implement enterprise analytics that can be used safely for enhanced decision-making. Packages like Dataiku excel in the fourth stage

- Why? It has the potential to add tremendous value to the enterprise and monetize the enterprise’s (often precious) proprietary data. However, it requires all previous steps to have been fully implemented

The first few fundamental points are often taken for granted, but if you don’t get the basics right, you’ll experience severe problems later in your journey.

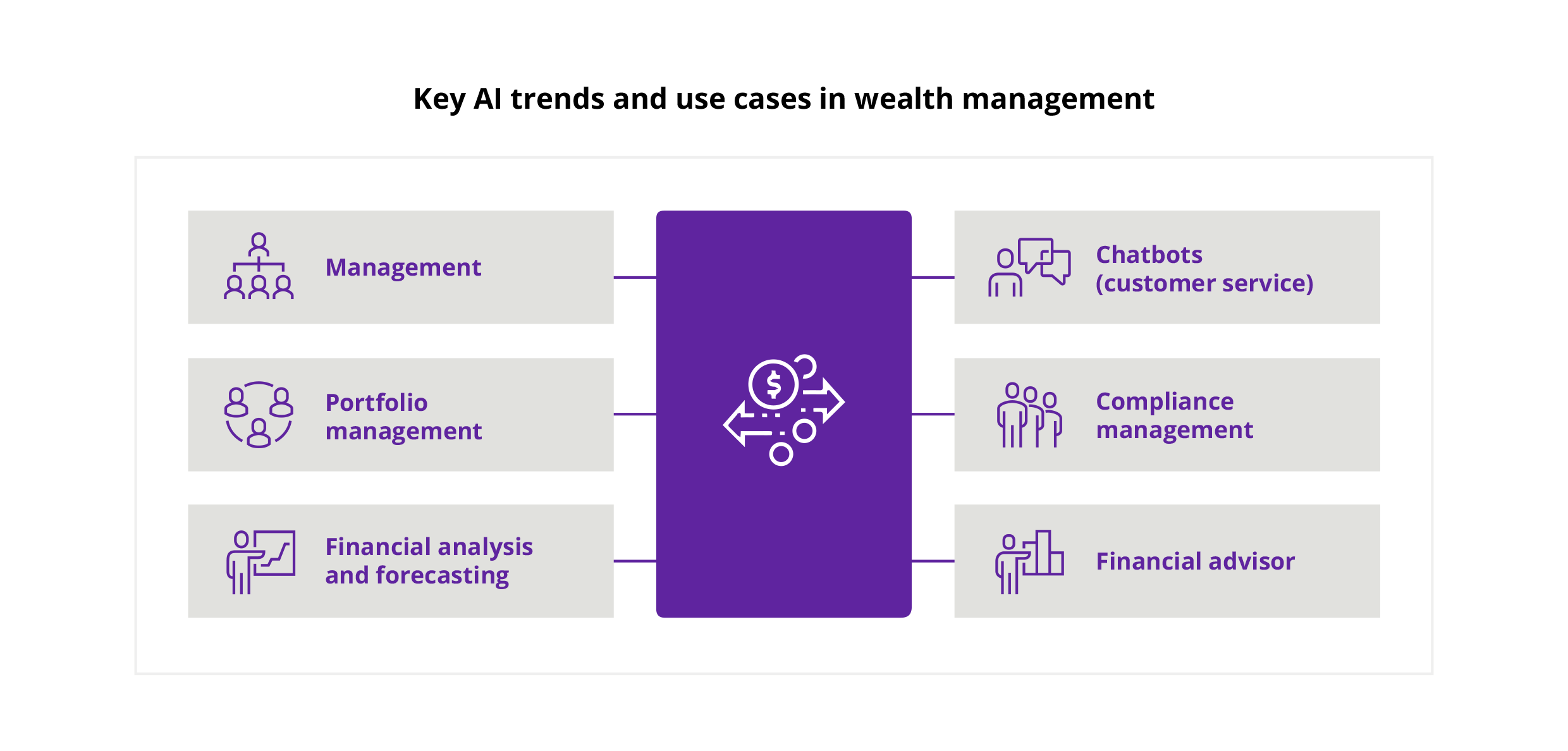

- Providing client-centered financial guidance. Smart search capabilities and intelligent tagging enable wealth managers to stay up-to-date with clients and quickly unearth relevant information

- NLP chatbots. GenAI finds patterns in masses of unstructured financial data, rapidly distilling advisor insights they can communicate via NLP-/LLM-powered chatbots

- Portfolio management. Advisors can search for events concerning client preferences, goals and needs (e.g., natural disasters, trade wars, interest rates, ESG investment mandates, credit and macroeconomic/M&A transactions)

- Financial advisor. Eliminating noise and expanding wealth-advisor data insights cuts time spent on company research and competitor intelligence. NLP models classify document types, specific products, services and companies or people, identify events and analyze the sentiment and relevance of a document, uncovering hidden information connected to a client’s primary assets

- Portfolio surveillance and alerts. Real-time alerts for specific events and companies can be generated with automation, allowing wealth managers to be constantly aware of each client’s portfolio companies and able to act quickly on investment decisions

- Risk management. Scanning unstructured data sets to identify and quantify risks can reveal early warning signals and emerging controversies. NLP accurately identifies the supply chain, reputation, credit, operation and market risks of investments to provide the best, personalized financial recommendations

AI and GenAI at work

Generative AI is quickly becoming an invaluable ally for wealth managers looking to deliver a hyper-personalized, more differentiated service. This isn't just about crunching numbers faster; it's about elevating the entire client experience and unlocking new potential in portfolio management.

AI — recently enhanced by GenAI technology — excels in pattern recognition. It can be used to analyze market trends, auction results, private sales data and decades of market data to uncover subtle trends and correlations that might otherwise elude even the most eagle-eyed analysts.

What if you could predict niche market movements based on complex global economic indicators or identify undervalued assets poised for growth? AI has been instrumental in spotting early investment opportunities in evolving markets, undetected by traditional practices.

Personalization

For example, imagine a client who’s an avid art collector. GenAI can provide insights that align with this client’s passion, helping the wealth manager to provide targeted advice that’s relevant and personalized to that client. This kind of targeted advice is invaluable for wealth managers. It shows you're paying attention not just to the numbers but engaging with your clients’ passions, connecting with them as people.

AI and GenAI look after the basics, too. The tools can be used to generate a client retirement plan that dynamically adjusts to market changes, tax law updates and personal life events, ensuring optimal growth and risk mitigation.

Risk management

But the benefits don't stop with personalization. The tools can be used to turbo-charge risk management functions and, correctly used and implemented, can be used to enhance risk management functions — for example, simulating countless economic scenarios overnight and allowing wealth managers to stress-test investment strategies against potential market upheavals. In other words, giving clients, risk managers and portfolio managers the peace of mind that the portfolios are as robust as necessary and meet the required mandates and risk appetites.

Regulatory

Of course, remaining compliant is a necessary burden for wealth managers. Again, GenAI is increasingly used to assist or accelerate the process of generating regulatory reports and keeping track of changing legislation. This helps to ensure that advice and investments are compliant, saving time and minimizing errors.

Communication

Similarly, via NLP, GenAI tools can be used to draft personalized emails and text messages in your unique style that feel individual and thoughtful, not generic and automated. This keeps the client dialogue flowing, ensuring touchpoints are consistent, relevant and fruitful.

Incorporating AI and GenAI into wealth management isn't just about being ahead of the curve; it's about reshaping the curve. Equipped with AI-enabled tooling, you can better anticipate needs, tailor solutions and engage clients in ways that were once the stuff of science fiction.

And that’s both the present and future of wealth management.

Zoreza Global can help you blend technology and personalization to turn client satisfaction into appreciative delight and repeat business.

LXA: Zoreza Global’s super-app for every domain

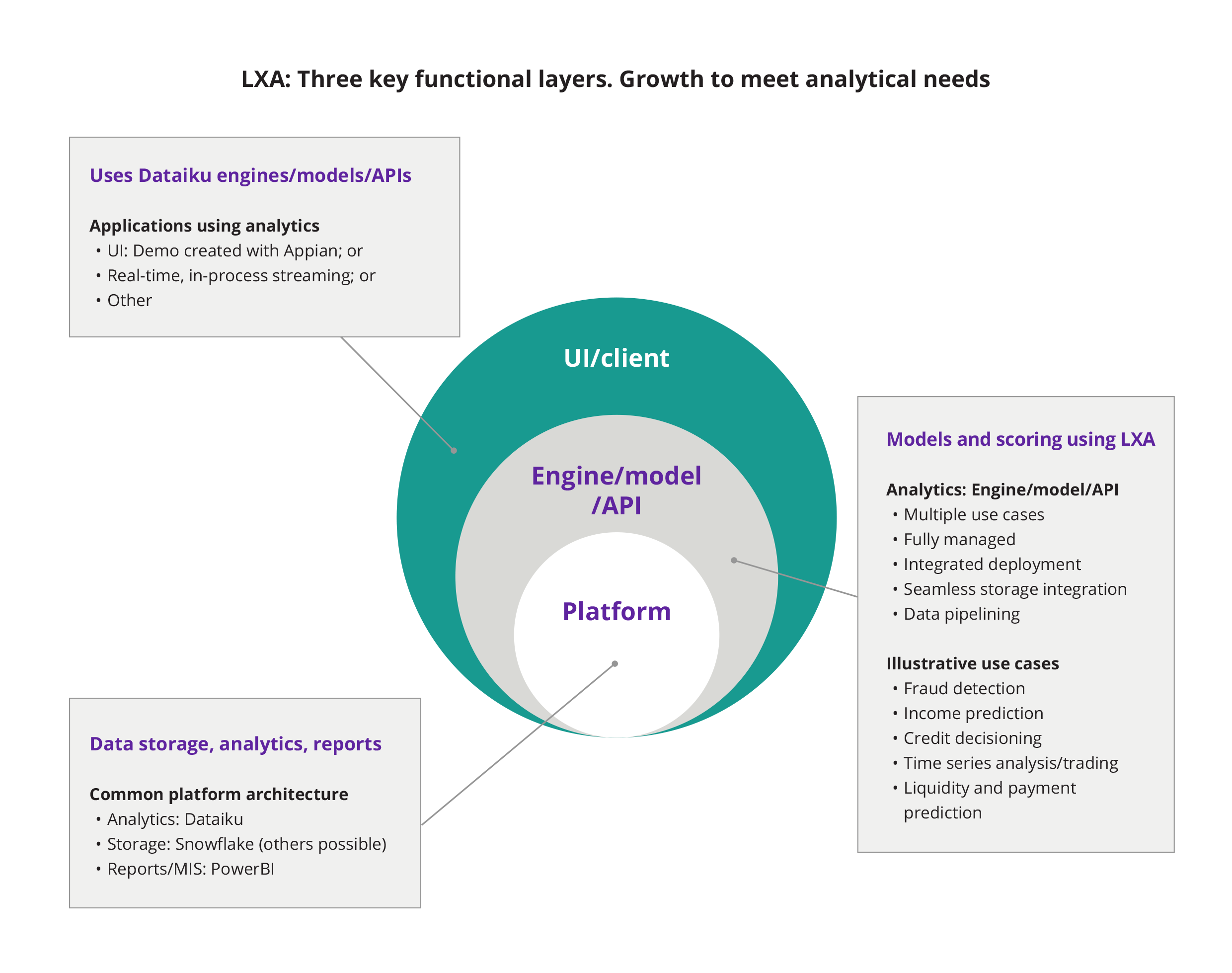

The Zoreza Global analytics platform (LXA) is a powerful, general-purpose stack — an ecosystem of applications rather than a single, monolithic application.

This super-app uses data analytics as a mechanism for driving automation. And being generic, you can use it to build a wide range of use cases across most business domains, including insurance, banking and ESG.

One of the great things about working with an integrated stack like LXA is that non-technical staff can build advanced use cases too, thanks to the stack’s various straightforward, user-friendly UIs.

Being a stack of components, it incorporates the best-of-breed elements in its databases, analytics and visualization and enables the rapid building of custom user interfaces.

LXA’s major components include the following:

- Analytics platform — Dataiku or equivalent

- Storage — any JDBC-compliant storage will work (Snowflake is our default)

- Reporting layer — usually PowerBI, Tableau or equivalent

Once everything’s up and running, we build several analytics use cases using the platform. So, a typical implementation might include 3-6 months of integrating the platform, followed by producing four or five use cases and training internal teams where necessary. The following use-case example is for insurance claims fraud.

The platform sits at the heart of everything LXA.

The second layer in the above diagram refers to the things you build using the platform. This is where Zoreza Global’s accelerators and IP come in because our value is not solely about supplying great analytics experts and top data scientists. It's also the fact that their deep knowledge and expertise are alloyed with the skill and understanding of our subject matter experts.

The third layer depicts the front end. LXA experts develop the front end using a low code/no code environment (e.g., Appian, Pega, UIPath, etc.) Our idea is to develop the application really fast, in close collaboration with the client. Then, after weeks rather than months or years, we get a front end that looks good and is fully integrated with the client’s environment. In addition, it uses one or other of the analytics models in the back end, seamlessly incorporating dashboards produced by Power BI (or whichever visualization application the user prefers).

Leveraging LXA for GenAI

Using the LXA platform, we build an analytics layer over a core banking/CLM platform and create machine learning models to derive insights. The insights are then integrated into the core banking advisor dashboard for actioning.

ML models

- Client segmentation: Dynamic segmentation characterizes the natural cohorts in your client base. As more information is updated (e.g., new clients, wealth increases), the model learns more about the various groups

- Customer attrition: This predicts which clients are most likely to leave or close a particular product/service based on advisor interactions and client transactions

Note: The models themselves are transparent. They use explainable machine learning to help users understand the criteria for making predictions.

The ML models (with GenAI) enable/provide the following:

- Better targeted marketing and product recommendations for clients

- Timely advisor intervention for clients at most risk of attrition, avoiding any negative impact on revenues

- Customized marketing materials via multiple channels for client segments

- Consolidated market feedback and client behaviors that can be fed back into the ML model

- Client meeting agendas to discuss potential offers that could convince the client to stay

LXA is different

The difference between what I’ve just outlined and more traditional types of applications is that LXA is an ecosystem of best-of-breed apps. It's not a single monolithic application. LXA is modular, very flexible, extremely fast (with a rapid time to value) and easy to adapt to changing client circumstances.

However, analyses are not one-off tasks. To ensure meaningful results and more accurate decision-making, data analysis should be regarded as a systematic and repeatable sequence of interrogation and interpretation, particularly given the continuing explosion in data sources.

The tools, processes and operating models around analytics are almost as important as the analytics itself. To this end, our combined platform supports a wide range of monitoring, diagnostics and management capabilities to implement rock-solid processes and workflows.

AI adds real value

The LXA platform allows clients to productionize their modeling and analytics and make them easily reusable. This environment comprises the whole analytics lifecycle, front-to-back, from raw data to data-driven decisions. And with the way we've structured the stack, you get a great user interface and exceptional data pipeline capabilities.

Prepare for next-gen wealth management with LXA

One of the major benefits of the Zoreza Global platform is that clients achieve a very short time-to-value. And because LXA is a single generic platform, clients and their customers benefit from visually appealing workflows while welcoming in next-generation analytics for wealth management, simply and securely. In short:

- The LXA platform is pre-integrated into popular vendor platforms (e.g., Avaloq) with a reduced cost and setup time

- It’s an easy-to-maintain, no-code solution

- Our experts understand wealth management

Talk to a domain expert

If you’d like to find out more about how Zoreza Global can help you meet increasingly diverse client demands with digital transformation, visit luxoft.com or contact us.