In brief

- Zoreza Global digital banking experts accommodate all levels of technological maturity, whether you’re considering a transformation journey or looking to rescue a current transformation in danger of failing

- McKinsey suggests that three quarters of all digital transformation programs fail due to employee resistance and lack of support from management. See how Zoreza Global teams guard against this problem

- Zoreza Global’s five guiding principles underline our approach to protecting the bank’s customers while radically changing the way the bank operates and delivers technology value. Find out how

Finding a technology partner with deep domain expertise that can evaluate and help improve your technological maturity is crucial for ambitious banks looking to thrive in today’s complex digital environment.

Zoreza Global Banking Transformation Advisory helps financial organizations plan and execute their IT and business strategies. Our experts prioritize assessing and understanding each client’s specific needs to unearth the precise insights necessary for guiding convoluted projects to a successful conclusion. That applies to financial services institutions across the board, whether considering/embarking upon a digital transformation journey or desperately trying to recover a live transformation that looks like failing.

Preparing for transformational challenges

To face the transformational challenges, banks need to arm themselves with a contextualized IT operating performance and support model, taking an agile approach to business measured by relevant cost and strategy metrics. Here are some of the prime considerations:

- Transformations for banks that rely on legacy applications will take longer than average

- 70% of all digital transformation programs fail due to employee resistance and lack of support from management (McKinsey)

- Inevitably, a digital-first operating model will mean cultural and organizational changes, including new staff and technology

- The ‘Buy Now Pay Later’ (BNPL) market is forecast to grow steadily in the coming years, reaching a total transaction value of US $576 billion by 2026 (US $120 billion in 2021)

- Chatbots are older than the internet. Now, nearly 40% of internet users worldwide prefer interacting with chatbots to virtual agents

- The number of banks that deployed machine learning tripled by 2023

Digital transformation key drivers

Long-term success depends on banks committing to solid and consistent digital technology investment. Forecasts show the continuation of a rising trend.

Composable platforms

Banks must use AI, analytics and automation to increase business resilience and deep customer insight. Also, a composable platform gives a bank the agility to launch new products faster and react to competitive pressures more efficiently.

“Composability” is creating software using building blocks of fungible business capabilities. And composable platforms enable nontechnical users to build complete solutions by mixing and matching the blocks.

Diving a little deeper, composable platforms allow software developers and other IT team members to implement an enterprise-wide integrated architecture. This enables software engineers and end-users, wherever they sit, to design and hook up with composable tools regardless of their frame of reference.

Advanced analytics

An ever-changing consumer landscape craves expanded personalization, recommendations and customer experiences. AI- and ML-derived data help banks personalize services, predicting customer preferences and reformatting them as recommendations.

Along with AI, ML, large language models (LLM) and natural language processing (NLP), robotic process automation (RPA) has become a byword for simplification and operational efficiency, improving the customer experience and overall performance. RPA reduces manual work and human error, automating mundane and repetitive tasks while freeing employees to focus on more valuable tasks.

Regulatory compliance

Risk and compliance management relies on financial institutions committing to a planned and unwavering data and technology system expenditure program. Accordingly, banks must build platforms to manage transactions, engagement, back office processes and regulatory reporting. Consequently, they need to prioritize and accelerate their digital transformation programs by partnering with platform experts.

Optimizing the IT TOM

Banks must optimize the target-state IT operating model (TOM) in their digital transformation programs.

Automation, DevOps, microservices and cloud are central pillars in managing IT TOM changes. Implementation reduces cost and increases IT reliability while increasing service harmony and the consistency of transformational quality.

Upgrading customer experience, reducing fraud and providing a 24x7 service are bank priorities that need a contextualized IT operating performance and support model and an embedded agile work culture with appropriate metrics to pinpoint success.

Digital transformation strategy metrics

So, banks are redesigning the IT organization into an agile business monitored via suitable strategic and financial measures:

Cost

- Streamlined, cost-efficient and improved operational efficiency

- Harmonious IT structure, systems and workflows

- Business continuity strengthened by automated and self-resolving operations

Quality

- Consistent quality across the banking, financial services and insurance value chain

- Application of best practices enabling IT to ease into different surroundings

- Straight-through processing (STP) for apps, data, security and infrastructure

Speed

- Rapid proactive and reactive support for convoluted business environments

- Agile service and product provision

- Automation and integration in line with exceptional cloud and DevOps delivery

The Zoreza Global Banking Transformation Advisory

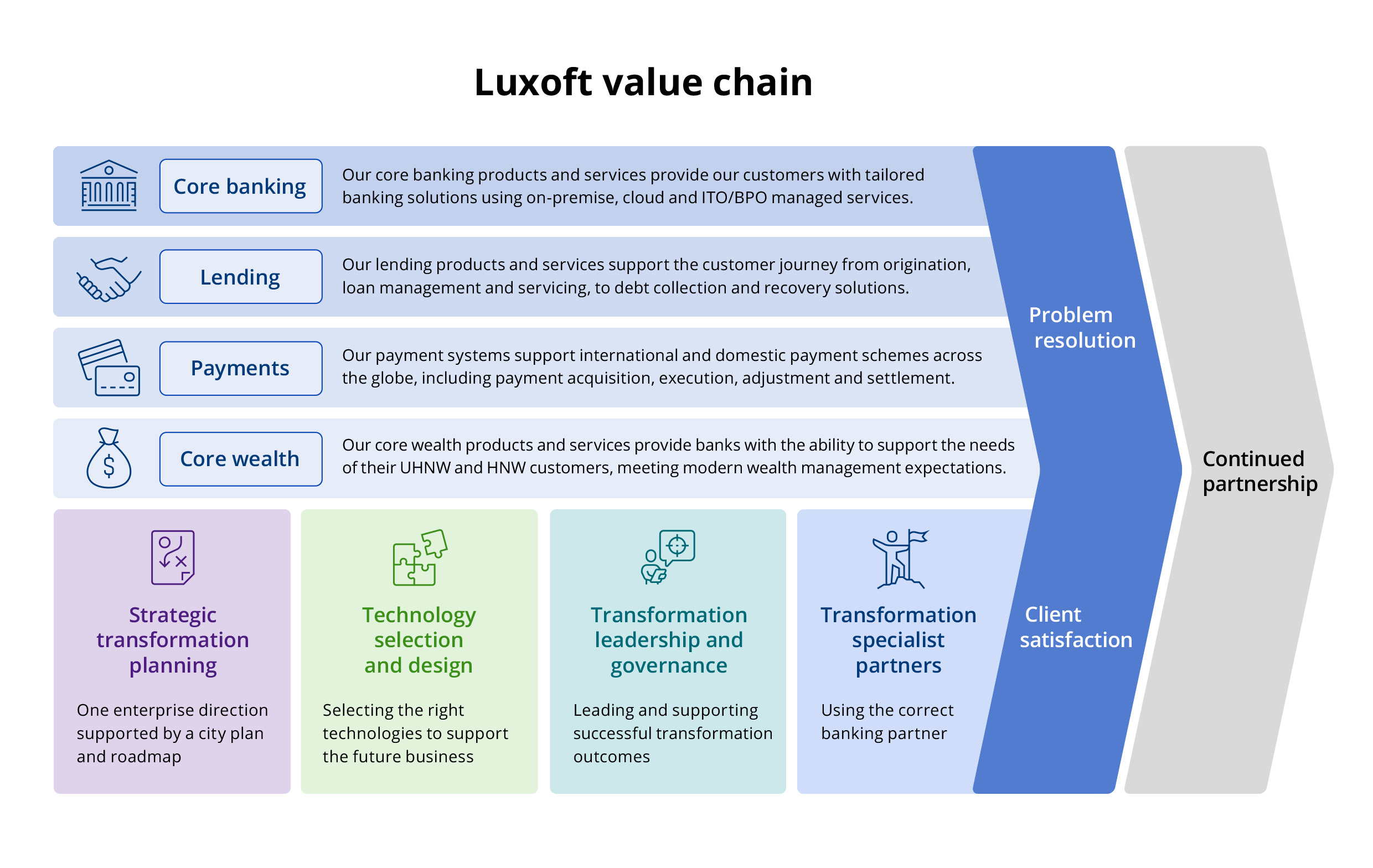

Our Banking Transformation Advisory helps financial services institutions plan and execute their IT and business strategies across the evolving digital landscape. We work hard to understand each organization’s unique needs, providing Individual guidance to ensure even the most complex projects achieve their objectives.

Zoreza Global domain experts accommodate all levels of technological maturity, whether you’re considering a transformation journey or looking to rescue a current transformation in danger of failing.

Four service offerings

Our transformational services can be engaged wholly or partially, depending on the challenges the bank is facing and the route taken to arrive at the best solution.

1. Strategic transformation planning

Problem: Aligning IT with the bank’s business direction can be neglected. This results in an inability to reach banking goals due to IT constraints.

Solution: We introduce a simple and methodological approach to aligning the business and IT goals and objectives, designing a city plan and roadmap.

a. Transformational challenges

Banking transformations are seriously challenging programs that, when done badly, can impact customers, corporate branding and reputation, drawing the attention of regulators and investors:

- Transformations take key resources away from other essential commitments

- The lack of relevant knowledge and experience intensifies the risk

- Misalignment of business and technology will short-circuit business value

- The bank must understand and adopt the right transformational model for future business

- Determine where the bank is now before working out how to get to the target state

- Select and invest in the right technologies for the bank’s future state plan

- Existing technical debt can mire transformation. Navigating this issue is critical

- Delivery pressure causes insufficient planning, introducing significant program risk

- Corporate politics that impact workforces require a mix of firmness and sensitivity

- Ensure transformation doesn’t affect customers and operational processes

b. Five guiding principles

Zoreza Global’s guiding principles underline our approach to protecting the bank’s customers while radically changing the way the bank operates and delivers technology value:

- Protect existing banking products and services

Transformation must have minimal impact on the bank’s customers, and business continuity must be maintained - Adopt a business-driven approach that aligns business and technology

The future business and IT direction must be aligned and addressed as a single strategic transformation plan - Proceed with C-level stakeholder commitment and direct support

Large and complex banking transformations endure risk and cost and must be sponsored at the C-level - Mobilize the right people for success

Assemble the bank’s key resources and motivate them with transformational experiences from system integration (SI) partners - Determine and select the right transformational model

Based upon the strategic transformational plan, determine whether greenfield or brownfield transformation is most appropriate

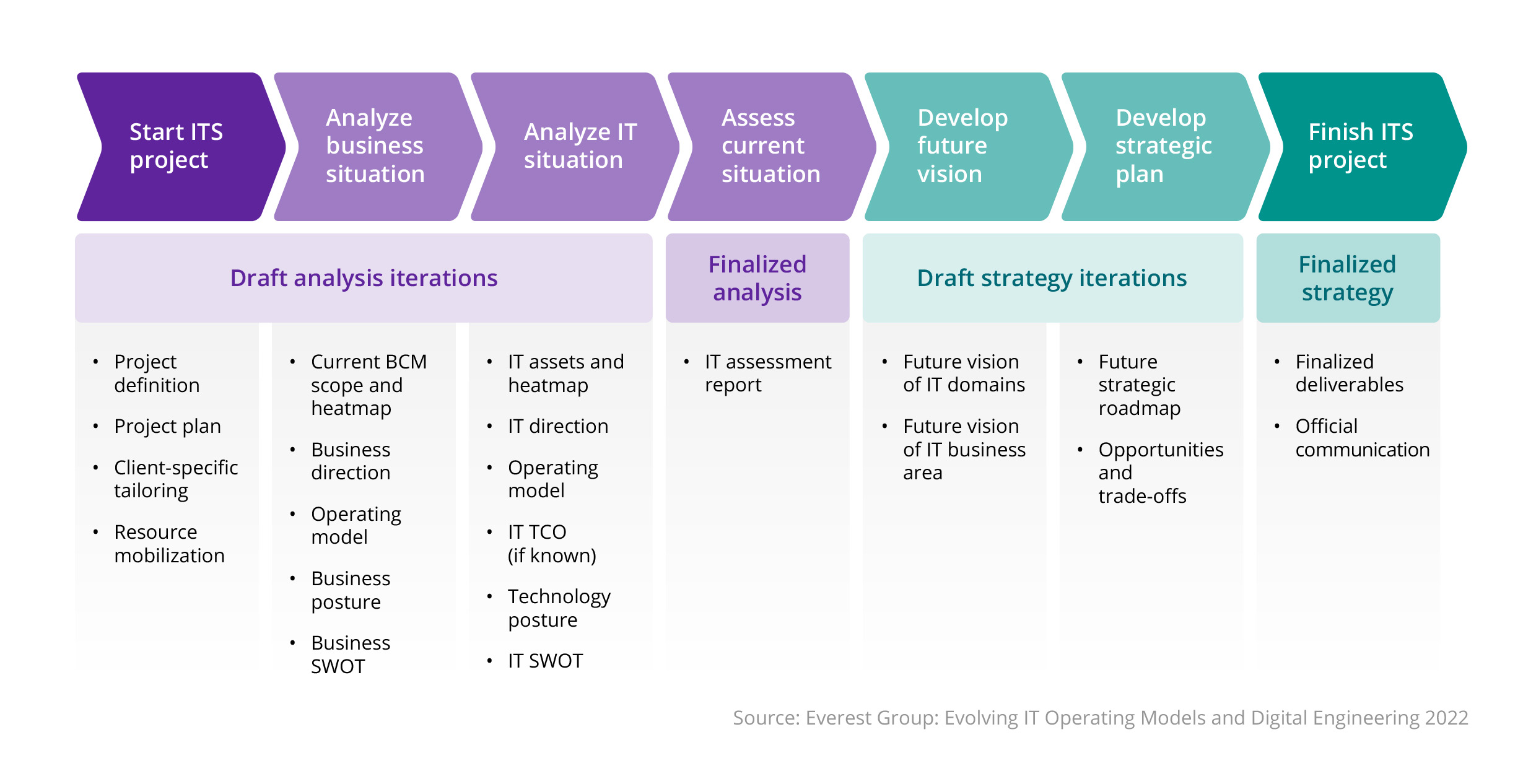

c. High-level process

We introduce a simple and methodological approach to aligning the business and IT goals and objectives, creating a city plan and roadmap.

d. Questions addressed

Transformation is complex, and clients need to understand the strategy and execution completely. Here are some vital questions:

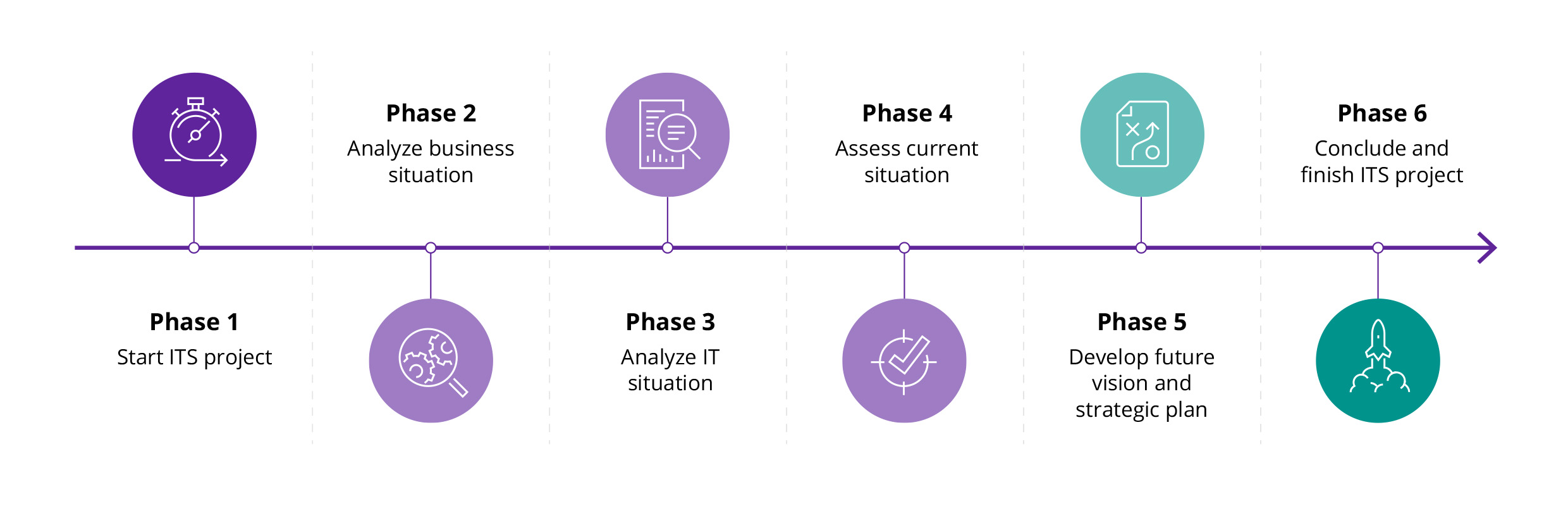

e. An ITS project consists of six phases (with prime resources, < 4 weeks for even large clients)

Unsurprisingly, most clients expect an IT strategy to be completed quickly. A total ITS approach takes around 3 months; however, this timeframe will lengthen and shorten according to available material and the size and complexity of the organization.

f. When strategic planning is applied to our banking areas

When combined with our banking areas, the generalized framework provides a specialized product-based transformation.

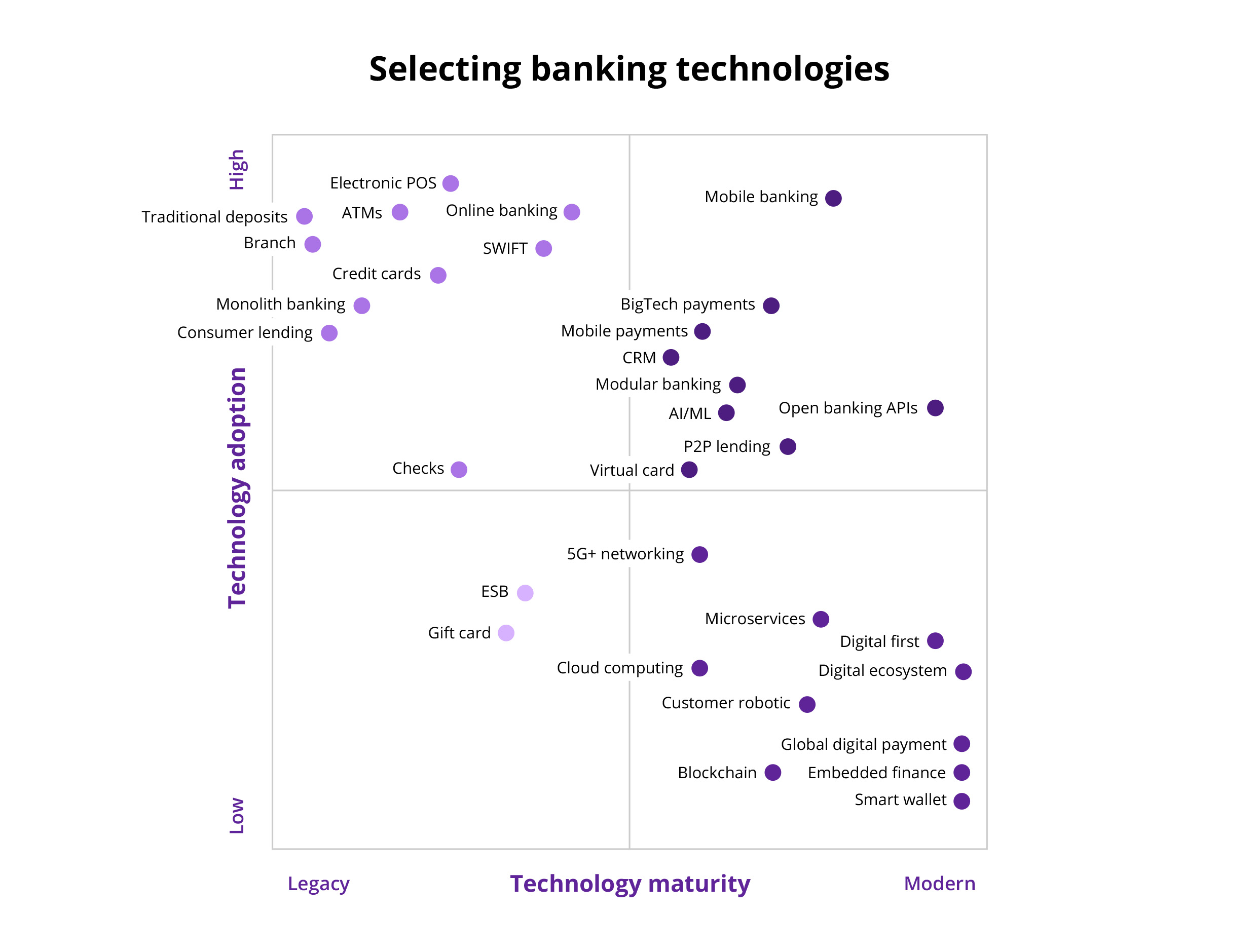

2. Technology selection and design

Problem: Banks typically have a highly complex technical environment. Often, these environments have evolved rather than been designed, as a consequence of A&M, short-term tactical fixes and old strategic initatives. This can result in wrong technologies and is further compounded by poor technical design.

Solution: We keep track of emerging technology trends across most industries, and our domain SMEs can support choice and design. The Advisory team has developed a document suite that compare all the major retail, corporate and commercial banking software products by function and geography. This reference bank allows banks to focus on COTS products that best meet their needs.

The diagram below identifies some of the leading technical capabilities, that the bank should consider intergrateing, these capabilities need to be carefully architected into the final end state solution.

Banking technology is evolving

- The frequency of technological change has increased tenfold over the last 30 years

- Legacy banking systems are now struggling to support modern consumer demands

- Banks are agonizing over the change management of technology for the ever-changing consumer market

FinTechs and BigTechs are challenging banks

- With fewer regulatory constraints, FinTechs and BigTechs can use modern technologies to deliver financial services

- Next-gen customers are looking at alternative banking provision

- These firms lack domain experience, so they target niche financial services, challenging poor banking sectors

Keeping a close eye on emerging banking and technology trends is crucial for helping clients navigate the future financial services landscape.

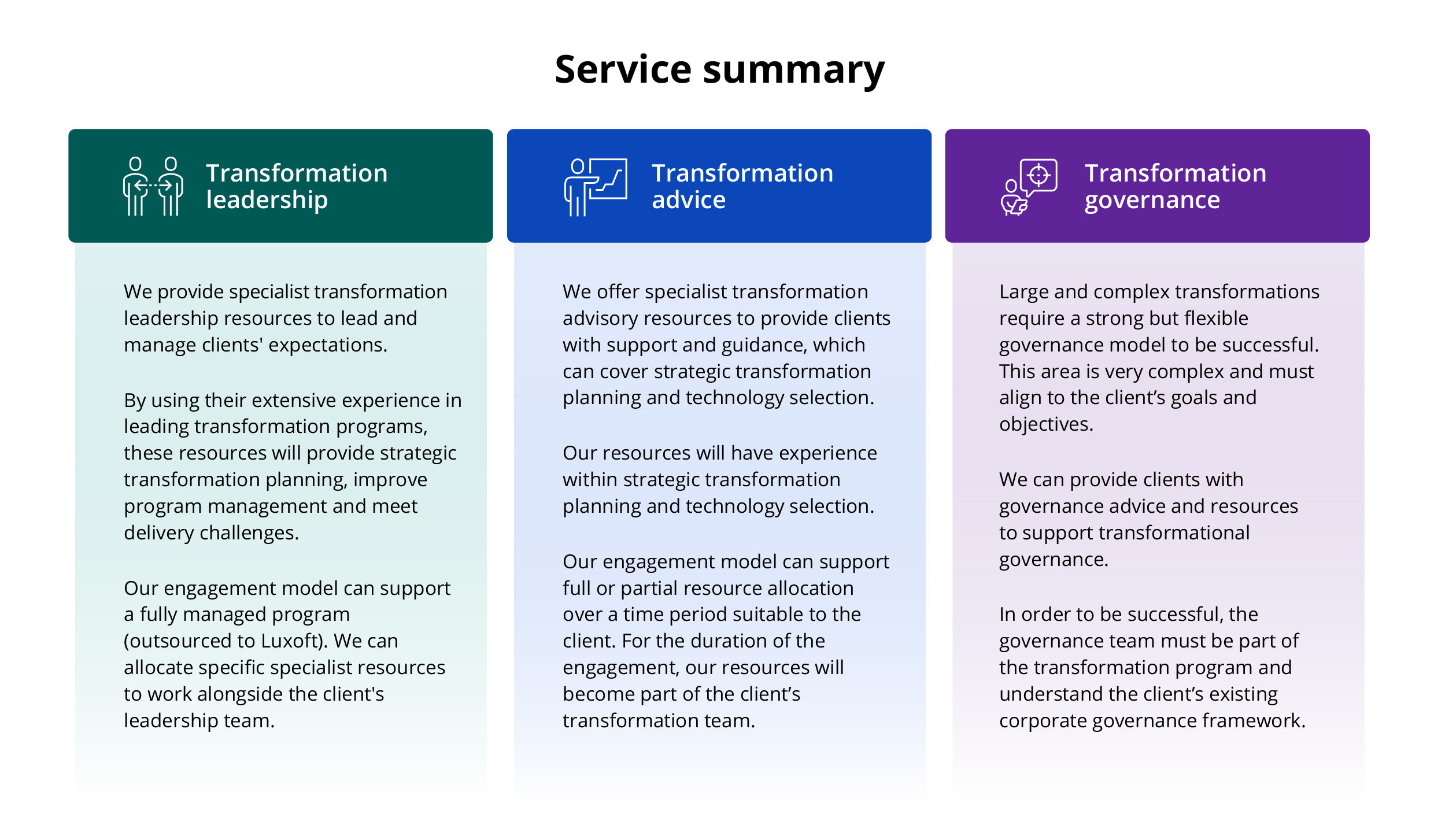

3. Transformation leadership and governance

Problem: Large and complex transformation is complicated and a significant risk to the bank, especially banks that lack recent experience.

Solution: We provide transformation leadership and governance, guiding the bank in transformation best practices and identifying potential threats.

Replacing or modifying a core banking system has been compared to performing heart surgery.

So transformation must be performed by system integration specialists working in collaboration with banking technologists.

Engaging a global technology delivery organization on the delivery of the transformation program will reduce reputational risk while allowing the bank to remain focused on a successful outcome.

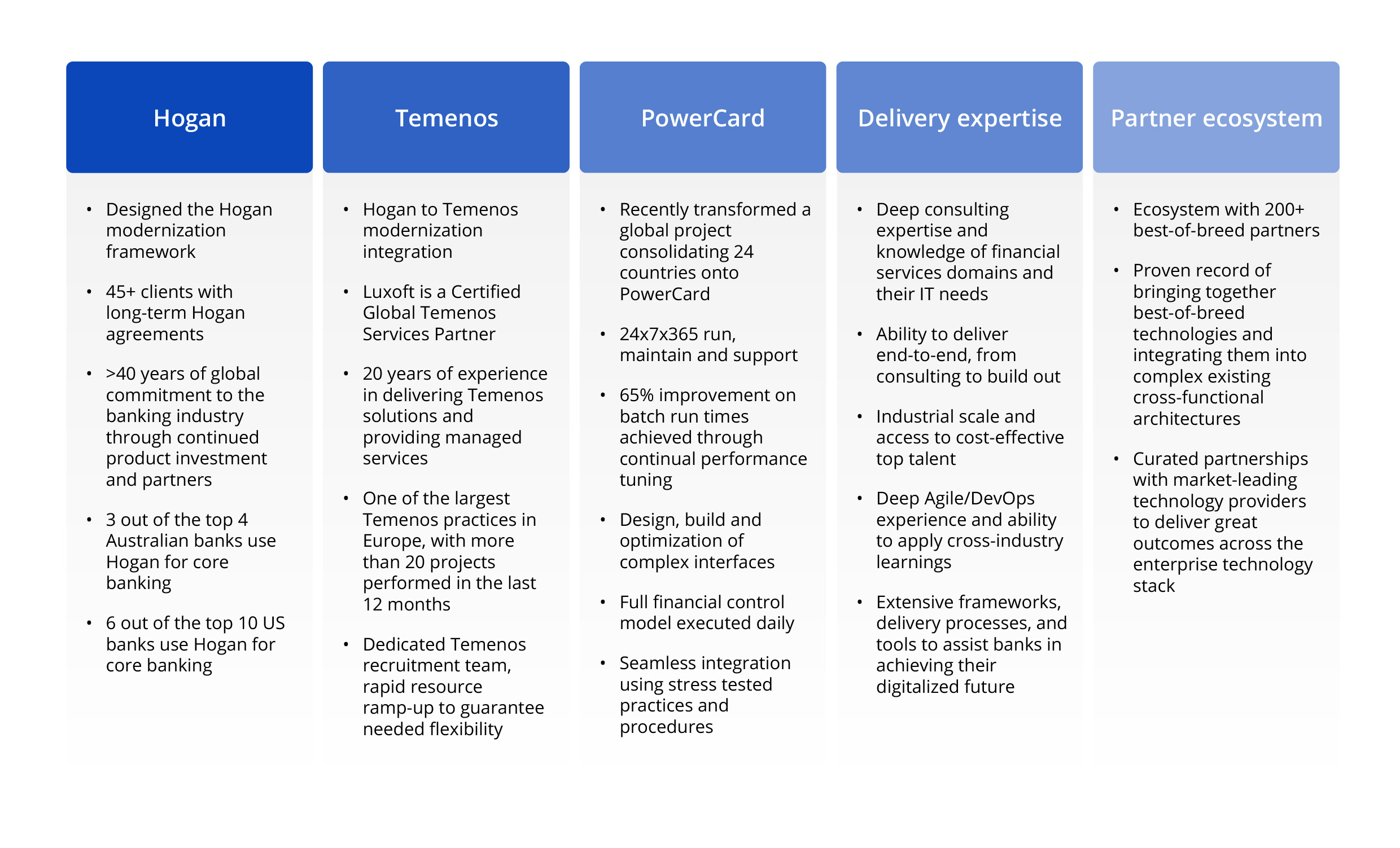

The most complex aspect of transformation is bridging the gaps between old and new technologies (e.g., across Hogan, Temenos and other banking systems).

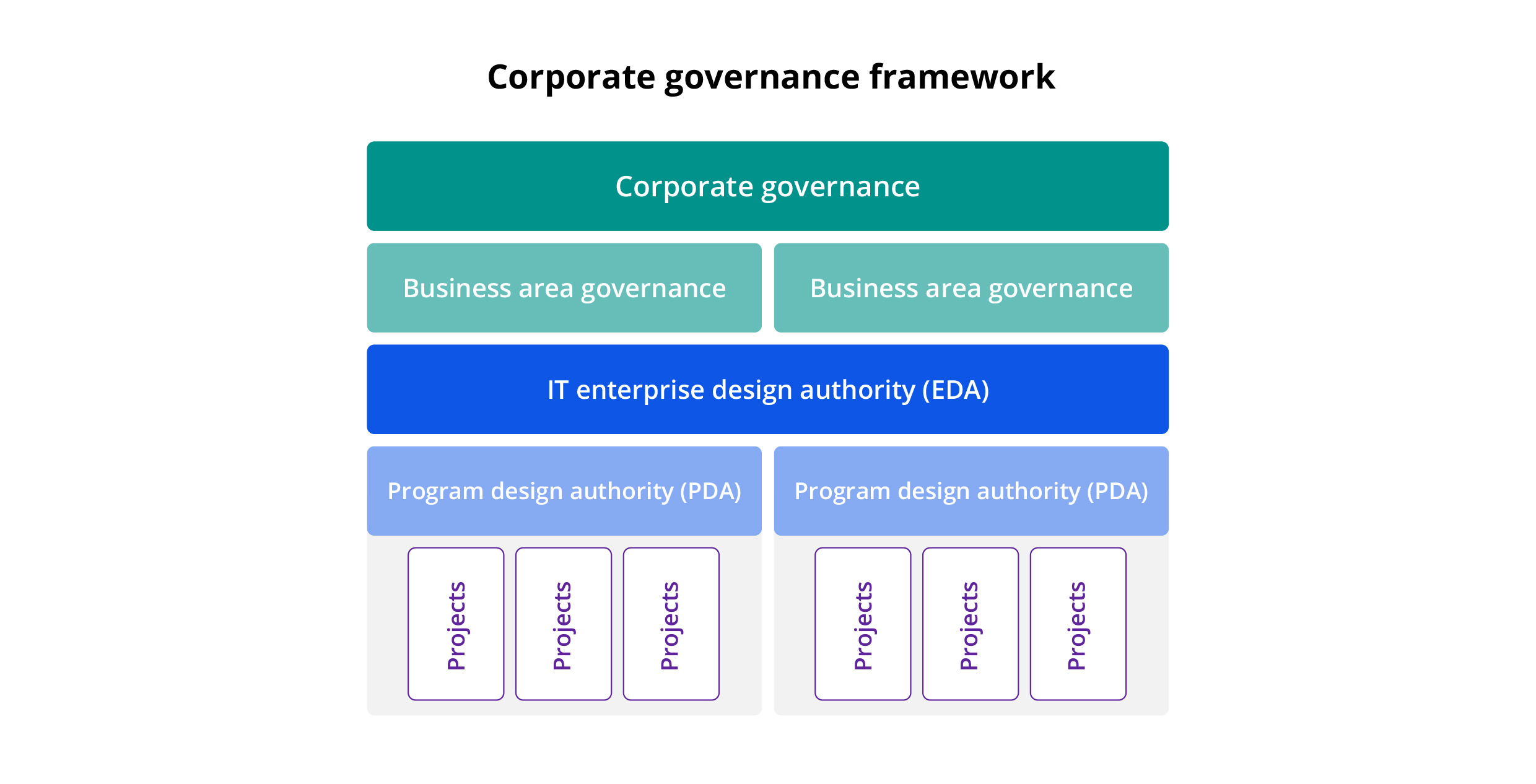

Program government alignment

The program design authority (PDA) is key to a successful transformation and must align with the client’s corporate governance framework.

Governance maturity

- Governance maturity is based on the bank’s need to comply with its policies and standards

- It’s a heavily regulated industry. Most banks have a governance capability, but it doesn’t necessarily extend to IT program delivery

- Centralized or federated, governance is vital

How we help

- We review governance frameworks at all levels and provide guidance or recommendations based on our analysis

- We determine the best governance approach for clients using a federated or centralized model

- We provide or manage program design authorities (PDAs)

Strategic transformational planning provides a guide for achieving business goals and objectives. The PDA function allows the program team to check where they are on that journey.

4. Transformation specialist partner

Problem: Banks often feel that partners don’t accept adequate responsibility for their role in the transformation program.

Solution: Our approach is to partner at C-level. So, partner responsibility is embedded at the highest level of engagement.

We believe that banks don’t get the best out of transactional engagements and that utilizing a specialist banking system integrator is the key to transformation program success.

As a transformation specialist partner, we are responsible for and committed to doing what’s right for the bank. Together, we’re accountable for the success of the transformation, and we work as a single team.

Partnership enables us to identify opportunities and threats the bank’s resources may not have spotted. It allows us to discuss banking topics that will drive our client toward a successful outcome — the future bank.

Core system replacement or upgrade

Our unique position allows us to share impartial advice based on experience and lessons learned through engagements with other clients.

Why choose Zoreza Global

- 500+ transformation experts

- 30+ countries

- 40+ successful projects

Sectors we serve

- Retail banking

- Commercial and business banking

- Corporate banking

- Wealth management and private banking

- Building societies, credit unions and cooperative banks

Intrigued?

If you’d like to learn more about what the Zoreza Global Banking Transformation Advisory Services could do for your organization, visit our website or contact us.