In brief

- Digital transformation is essential for traditional banks to remain competitive against fintech companies and neobanks

- Key drivers include high customer expectations, competition for wallet share, operational efficiency objectives, and risks caused by outdated infrastructure

- Technologies such as cloud computing, robotic process automation, advanced data analytics and chatbots are transforming the financial services industry

In today’s digital-first world, customers expect omnichannel service and intuitive digital experiences at multiple touchpoints. And technology is the most potent key to offer those things — while increasing operational efficiency.

That’s why digital transformation in banking is no longer an option. It’s a must for traditional banks aiming to remain competitive against fintech companies and neobanks.

We’ve gathered all the information a bank may need to reap the benefits of digital transformation in this blog, based on our experience in helping hundreds of financial institutions adapt to the emerging digital-first economy. This blog will be focusing on the following issues:

- What digital transformation in banking means

- Why a digital transformation strategy is no longer an option

- What technologies power digital transformation efforts

- What challenges banks can face

- What benefits digital transformation brings

Is it the end of the line for traditional banking?

Why is digital transformation a necessity for incumbent financial institutions today? One word — competition.

Not only is there competition from other banks with a digital transformation strategy in place (three-quarters of them already have one), but fintech startups and neobanks are also putting pressure on traditional banks, competing for their wallet share.

The pandemic only accelerated the digital-first approach to financial services. In the United States, 42% of surveyed consumers reported having at least one fintech account at the end of 2020. The pandemic prompted a 6% increase in the share of fintech users within as little as six months.

The allure of fintech for consumers is simple — convenience. From AI-powered personalization to digital account opening, fintech products make their lives easier. And if banks don’t keep up with the technology-powered services, they’ll lose their competitive edge and wallet share.

What is digital transformation in banking?

Digital transformation (DT) is the strategic embedding of new technologies in the organization’s operations to:

- Optimize and streamline existing processes

- Deliver a more satisfying and valuable customer experience

- Launch and develop a new, innovation-driven activity or product

- Conquer a new market or niche

As Harvard Business Review puts it, digital transformation relies on five essential components:

Examples of digital transformation in banking include:

- Digital account opening for consumers and businesses

- Digital loan origination systems for consumers and businesses

- Person-to-person (P2P) and real-time payments

- Marketing and customer relationship management (CRM) automation

In this industry, digital transformation comes with its challenges — regulatory compliance and cybersecurity. So, keep know-your-customer (KYC) and anti-money laundering (AML) best practices and privacy regulations (e.g., GDPR) in mind.

Six drivers of digital transformation in banking

Here are six key reasons banking institutions begin their digital transformation path.

High customer expectations

Banking customers are “clamoring for a superior cross-channel experience,” according to Deloitte. They want highly personalized, data-driven, omnichannel end-to-end customer experiences.

Today, consumers expect banks to meet them where they are — online and on their preferred devices. For example, only 17% of U.S. bank customers would opt to go to a branch to make a transfer. Instead, they prefer using online (46%) or mobile (30%) banking to complete their transactions. And PwC found that in 2021, 61% of U.S. consumers used digital banking channels weekly.

Competition for wallet share

47% of bank and credit union executives consider fintech companies a significant threat. Neobanks, however, have become less intimidating. Only 21% of executives reported seeing them as a threat in 2023, as opposed to 33% in 2022.

But fintech companies and neobanks aren’t the only one’s that banks will have to compete with in the digital banking domain. Over three-quarters of banks already have a digital transformation strategy and more than 18% plan to launch theirs in 2023.

Operational resilience required

Much like digital transformation itself, operational resilience is no longer an option. Instead, banks have to operate in a hectic market environment, rocked by one event after another. The pandemic, the war in Ukraine, and the ongoing US banking crisis are just a few examples.

Resilience is the ability to withstand these and other trials while maintaining critical operations. To achieve great resilience in a bank, digital transformation is a must. It should include mitigating cyber risks and minimizing third-party dependency. DT also empowers the organization's flexibility to quickly adapt to changing circumstances.

Data influence on the customer journey

Data is embedded in today’s customer journey from A to Z. And every stage of the customer journey can become better — or worse — with data.

For example, data analytics can power top-notch microsegmentation and omnichannel personalization. It will enable banks to deliver timely, well-targeted offers to its customers. Data-driven automation, on the other hand, improves customer satisfaction by expediting multiple front-office processes.

Operational efficiency objectives

Improving loan and deposit account opening productivity are the top two objectives for banks partnering up with fintech startups. But those two goals aren’t the only ones they can strive for in their digital transformation strategy.

Digital transformation for banks promotes data standardization and improves straight-through processing. Thus, it eliminates the risk of human error and automates mundane tasks. Switching from legacy systems to composable architecture solutions, in turn, can reduce IT run costs by as much as 50%.

Risks caused by outdated infrastructure

Once legacy systems start to lag behind what’s considered modern infrastructure, banks get exposed to numerous risks:

- Subpar performance. Handling the rising mountains of data becomes more challenging for legacy systems poorly equipped for it

- Unnecessary complexity. Legacy systems tend to lack in user-friendliness and simplicity, thus hindering employee productivity

- Security risks. Outdated software and hardware may contain all sorts of exploits and vulnerabilities, exposing the bank to the risk of data breaches

- Reputational risks. Since banks deal with highly sensitive customer data, a breach can cost dearly regarding customer satisfaction, wallet share and brand trust

- Higher IT spending. According to McKinsey, 70% of banks’ IT spending concerns maintaining legacy systems

Six technologies transforming the financial services of today

Now, let’s review the six technologies that power digital innovation in banking.

Application programming interfaces (APIs)

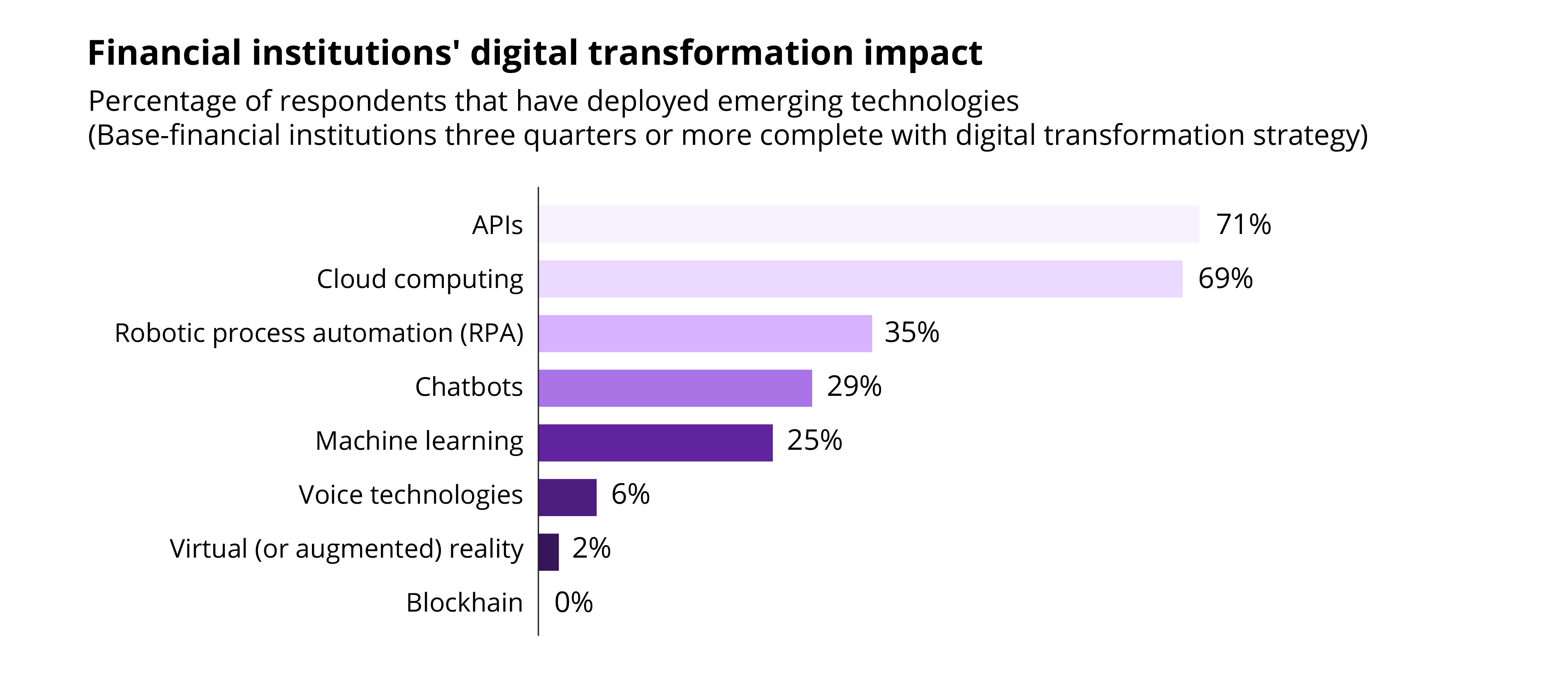

APIs are the most popular technology being implemented in the banking industry today. 71% of financial institutions with DT almost or already completed deployed APIs as part of their strategy.

The reason behind APIs’ popularity is open banking, a practice already well-established in the European Union and Asia-Pacific. Powered by APIs, this term refers to the unrestricted sharing of financial data between fintech companies, banks and other institutions.

Open banking powers new features, like bank account syncing in budgeting apps (e.g., Mint). It also facilitates the lending and digital account opening processes, as well as personalization.

Cloud computing

It is the number two technology already deployed in the industry. Among financial institutions close to completing their DT strategy, 69% have already switched to cloud computing.

Cloud computing has gained such widespread recognition thanks to its many advantages:

- Easy-to-scale infrastructure: No more unexpected downtime or subpar performance irritating customers

- Continuous delivery (CD): No downtime is necessary to update the bank’s system

- Cost efficiency: Banks pay for the resources they use and don’t have to maintain the infrastructure (servers, data centers) themselves

Robotic process automation (RPA)

Robotic process automation comes in the top three popular technologies among DT adherents, although its adoption rate is a bit over half that of APIs and cloud computing (35%).

As its name suggests, RPA seeks to automate certain business processes with the help of rule-based software. In addition, RPA tools make it easier to automate repetitive, tedious manual tasks thanks to their low-code scripting.

This technology increases productivity and reduces labor costs while improving employee job satisfaction and mitigating human error. The beauty of RPA is that it doesn’t require overhauling existing systems; RPA tools are akin to an add-on a bank can easily integrate.

In digital banking transformation, RPA can be applied to:

- Data entry and extraction

- Basic customer service communication

- Trade booking and processing, and more

Machine learning (ML) and artificial intelligence (AI)

Machine learning, on the other hand, is still benched by most financial institutions close to completing their DT strategy. Only 25% of them have implemented this emerging technology.

Despite that, AI and ML power some of the most potent solutions in the banking industry, such as:

- Generating personalized marketing offers and messages based on customers’ behavior

- Detecting fraudulent activity by comparing customer behavior to established patterns

- Creating microsegments of existing customers and prospects

- Expediting risk assessment and loan underwriting process

Keep in mind that AI-based systems are subject to regulations in some jurisdictions. The most notable one is the Artificial Intelligence Act in the EU.

Chatbots

Chatbots, much like machine learning, are also in their early adoption stage (29% deployed). However, they represent the top use case of AI among enterprises in all industries. In banking, they’re ahead of machine learning in terms of adoption rates.

This technology has its allure, notably:

- Chatbots are online 24/7 and can serve thousands of customers simultaneously

- Armed with customer data, they can deliver personalized responses faster than a human representative could

- Customer service costs are lower

However, chatbots aren’t without their cons. They can fail quite spectacularly, misunderstanding users’ queries or encountering an unconventional request. That’s the reason to introduce this technology with caution. That’s why it’s always good to keep the option of a human representative on the table.

Advanced data analytics

Next-level data analytics is another application of AI technology. However, it’s also among the more challenging ones. That’s because only 14% of banking executives rate the quality of data and analytics capabilities at their institution as excellent or very good.

Ironically, the quantity of data available makes gaining insights more challenging. At the same time, around half of executives surveyed say they lack the input they truly need, such as real-time data.

When it comes to the nitty-gritty applications of advanced data analytics during digital transformation in banking, they include:

- Customer analytics: Delivering a highly personalized omnichannel user experience

- Predictive analytics: Forecasting liquidity positions and other metrics based on real-time internal and external data

- Business analytics: Optimizing operational costs by identifying cost-saving opportunities

- Risk analytics: Automatically detecting irregularities and potential issues in daily operations

What may stand in the way of digital transformation in banking?

Although three-quarters of banks are in on the digital transformation game, few report being satisfied with the results. According to McKinsey’s data, the figure is a mere 30%.

Here’s what prevents banks from reaching their objectives and nailing the DT strategy implementation.

Resistance to change

Digital transformation of banks often requires a shift in the organization’s culture. Without it, banks risk resistance to change, undermining its DT results.

For example, resistance to change contributes to a lag in productivity that incumbent banks show compared to digital natives. (McKinsey research puts that lag at 40%.) One way this lag shows is the time-to-market for new features. Fintech companies and neobanks roll out feature updates every two to four weeks, while incumbent banks do so every four to six months.

To achieve this cultural shift, it’s crucial to bring every stakeholder on board to pinpoint knowledge-sharing and training needs. This includes branches in different jurisdictions; front, middle, and back offices; C-level executives to frontline employees.

Lack of skills or resources

Digital transformation in banking requires in-house and external talent, financial resources, and, of course, time. Underestimating how much of each resource is required means creating an additional challenge for the project. However, it’s a common mistake. Over half of DT projects exceed their timeline and budget expectations — or fail.

Executives should approach DT planning with expertise and caution to avoid this mistake. The two will help adequately assess the current state of things and the scale of change digital transformation will entail.

Change complexity

Executives also tend to pay more attention to the complexity of change required for a meaningful, impactful digital transformation in banking. And that mistake translates into underestimating the resources needed for DT.

The transition requires executives to reflect on data management, interdependencies across multiple tools and ecosystems, existing and desired IT infrastructure, and more.

To accurately assess and prepare for change complexity, it’s crucial to involve all stakeholders in strategy development. Executives should also clearly understand the current and desired state of the bank’s digital ecosystem.

Dependency on legacy systems

Before executing a digital transformation strategy, executives need to look hard at the current state of the organization’s legacy systems. For instance, on average, a universal bank application is 14 years old. However, the same indicator for digital banks is only three years.

Addressing the dependency on legacy systems is integral to a successful digital banking transformation. Based on this assessment, addressing the accumulated technical debt by reworking and debugging the code may be an affordable option. Or, the costs could outweigh the benefits — then, migrating to a new system is the solution.

Data security concerns

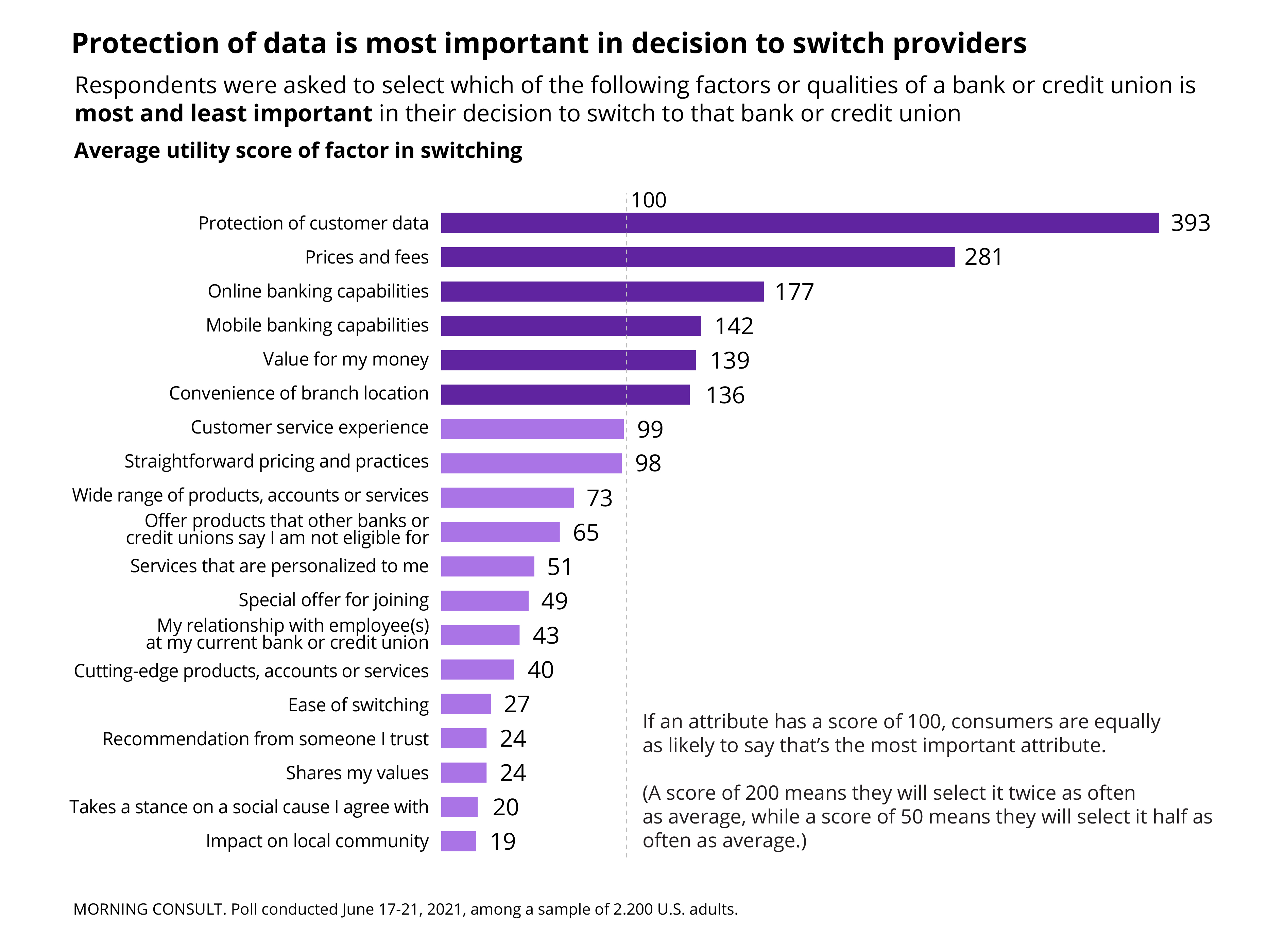

Data security matters for two key reasons: Customers and compliance. According to one survey, data protection is the number one reason consumers switch banks or credit unions. And if banks don’t follow privacy and data security guidelines, they may find themselves in hot water with the regulator.

That said, ensuring data security is easier said than done. It involves many technical aspects, such as making AI-powered fraud detection accurate or conducting penetration testing for legacy systems. That’s why banks need strong technical expertise on board to ensure data security is in every part of the DT strategy.

How banks approach digital transformation: Three case studies

What does digital transformation in banking look like in practice? Let’s break down three examples of how banks successfully made the transition.

Bank of America

As a part of its DT strategy, Bank of America launched several customer products that resonated with consumers:

- Zelle, a real-time payment app. Zelle boasted a user base of 16 million active accounts in January 2022, along with a record-setting number of transactions in 2021 (514 million)

- Erica, a virtual financial assistant. Powered by AI, Erica was sought out 659 million times in 2021 alone

- Life Plan, a personal finance app. It has attracted over 10 million clients since its launch in 2020

- CashPro Forecasting, a tool for predicting future cash positions. Intended for Bank of America’s commercial clients, it was launched in 2022

OCBC Bank

Based in Singapore, the Oversea-Chinese Banking Corporation (OCBC Bank) made headlines several times for:

- Fully digitizing the loan application process and launching an instant approval service

- Investing $20 million to boost its 29,000 employees’ digital skills through training

- Receiving Red Hat APAC Innovation Awards 2022 for its digital transformation efforts

OCBC Bank’s digital transformation is focused heavily on data science as the organization strives to be the leading data-driven one in the region. Data science powers such OCBC Bank’s operations as credit analytics, risk management, anti-money laundering (AML) and chatbot optimization.

Commonwealth Bank

This Australian multinational bank, commonly known as CommBank, was praised for its mobile banking app. It was hailed as the country’s — and perhaps the world’s — ‘best banking app.’

The reason? Extensive customization features, high personalization, and tight security with location-based features. It’s also backed by machine learning that allows sending three billion personalized messages a year.

CommBank also leveraged technology to increase its operational efficiency. In 2021, it adopted a cutting-edge project management tool to ensure the bank’s billion-dollar annual technology budget is spent well.

How banks can benefit from digital transformation

With the right strategy, talent, partnerships, and resource allocation, here are the five benefits banks can reap from digital transformation in banking.

Improved customer acquisition

Digital transformation may involve introducing the tech-driven services that fintech companies and neobanks are usually known for. Doing so will make the bank’s brand more alluring to potential customers who’d otherwise turn to its tech-savvy competitors.

The services in question span real-time payments and transfers, low balance alerts, digital account opening and lending, and more.

Personalizing the customer experience

Leveraging the vast pools of customer data allows banks to microsegment their customer bases based on past transactions, interactions with customer service, and more. Then, armed with all that data, banks can create highly personalized offers for every customer, increasing customer lifetime value.

What’s more, those marketing efforts are easily automated — provided the right tool is in place.

Detailed insight into consumers

All that data serves not only to power personalized multichannel customer experiences, but also to inform the bank with strategic decisions, marketing or otherwise.

On an individual level, these insights will help accurately assess risks associated with each customer, streamlining — and possibly automating — lending decisions.

Enhanced flexibility and adaptability

With a leaner infrastructure that runs like a well-oiled machine, banks can reduce time to market for updates, new features, and products. This will allow for quickly matching new customer preferences, adapt to emerging and existing competitors’ offerings, innovate and respond to market trends.

Comprehensive data security

Overhauling legacy systems or replacing them with data security will improve the bank’s operational resilience and minimize the risk of data breaches. It’s essential for regulatory compliance, plus consumers also cite data protection as a crucial decision-making factor when switching banks.

How Zoreza Global helps banks and financial institutions ace digital transformation

With 45+ years of experience in banking under our belt, Zoreza Global has always been there for financial institutions seeking to modernize their digital ecosystems. To demonstrate how we help banks update legacy systems and unlock the potential of modern technology, let us turn to one of our case studies on digital transformation in banking.

A major Swiss bank turned to us with a request to implement Fenergo CLM for modernizing client onboarding and KYC in its branches worldwide.

During the project, our team adopted the Agile workflow instead of the traditional waterfall approach. We integrated Fenergo with the client’s CRM and consolidated the US and Swiss platforms into a harmonized global model. We also adapted the CLM’s features to match the bank’s needs vis-à-vis automation, functionality and usability.

As a result, the CLM was successfully rolled out in September 2022, serving as a jumping-off point for further implementation of the client’s digital transformation strategy.

Ready to bring your bank to the forefront of the digital revolution?

Digital transformation in banking has an alluring promise to facilitate customer acquisition and retention, improve adaptability, and enhance system security. However, all these benefits are only available to those who overcome the transformation’s numerous challenges, from resistance to change to lack of resources.

To approach, plan, and execute digital transformation, banks must bring the right expertise. We at Zoreza Global would be honored to lend you ours, both industry-specific and technical. We’re fluent in complex problem-solving and remain a trusted change provider for 350+ clients in the financial industry.

Reach out to us to discuss how our expertise can serve your digital transformation goals.