In brief

- Nowadays, you rarely hear insurers talking about replacing systems wholesale. It’s more about enhancing heritage apps, core banking and core insurance apps

- Banks work off 20-, 30-, 40-year-old platforms. So, even if they move to proven technology that's 10 years old, it's a leap forward that could help them avoid the merry-go-round of searching for the next big thing

- Take a look at your current tech stack and make sure you're fully exploiting it. You'll probably find you can leverage significantly more from your considerable investment and leave chasing the tech unicorn to others

About 10 years back, a major bank kicked off a program to reengineer its heritage infrastructure and create an app. The firm spent millions of dollars on technology and achieved virtually nothing. Meanwhile, in real-time, startup banks were busy launching a slew of apps and other digital innovations.

Contrary to popular opinion, the transformation argument isn't about what's happening under the hood. Most of the C-suite couldn’t care less about frantic activity in the engine bay among the financial rods, cams and pistons. No. Banks and insurance companies want the ultimate reassurance of knowing they're in for a safe, no-hassle journey, with time to appreciate smooth lines and head-turning performance.

First things first

Eventually, the bank’s decision-makers realized they should have invested in the front end to make their app slick and appealing and worried about the underlying infrastructure over a longer timeframe. Why? Because if you change the underlying infrastructure first, you lose all your customers.

The idea is to develop a new customer experience, new product sets and an enhanced rating. Deliver that first, and once you've secured your revenue stream, put together a long-term strategy for fixing the legacy technology. As long as continuing to use legacy tech isn’t going to cause the business to fall over, of course.

What’s the word on the street?

The consensus is that, nowadays, you rarely hear insurers talking about replacing systems wholesale. It’s all about enhancing heritage apps — core banking and core insurance apps.

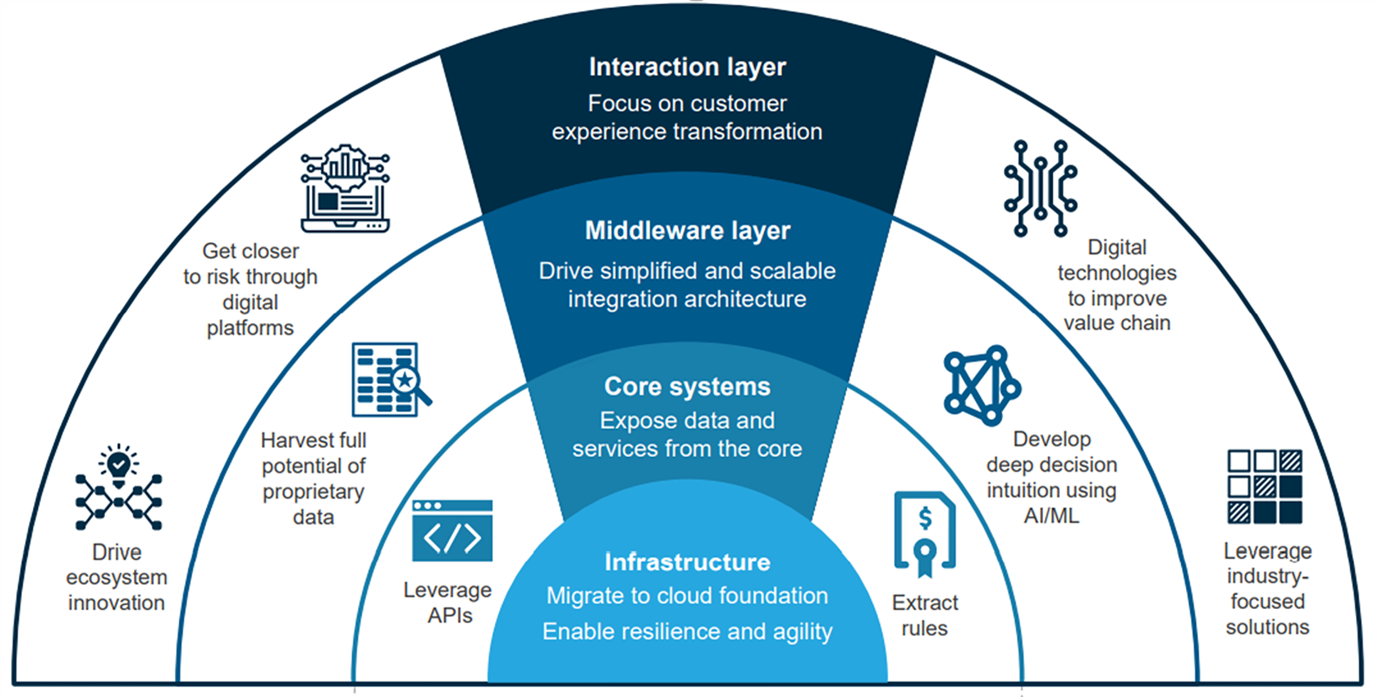

Where insurers were investing in 2021

It’s costing one particular household name around $2 million a year to maintain its insurance platform. Strategically, decision-makers are eager to get onto the company’s global enterprise system, a legacy platform 20 years out of date. So, they’re paying a provider $20 million to enhance their “new” but still legacy enterprise system. Once that’s done, they intend to migrate off the insurance platform onto the enterprise system, which will cost them a further $80 million.

And after spending a grand total of $100 million, they will still be on a legacy platform, having made no improvement to their insurance services and done nothing for their customers.

Short-term profits, long-term problems

At a conference a couple of months ago, one of the delegates pointed out that no Lloyds syndicate considers customer service, which got me thinking.

A well-known logistics company employs fleets of commercial vehicles worldwide. Many of the vehicles have onboard computers that record how well or not-so-well drivers are performing. Strangely, the insurer has never considered how it could use that data to help fleet managers improve fleet risk.

I mean, with all this driving skill data to hand, why isn’t the insurer telling the fleet manager to fire someone because they're continually breaking the speed limit and are revving up for a high-speed crash? Particularly if that someone drives a massive juggernaut and is in danger of killing innocent people.

Thinking back, the household-name insurer is replacing its platform to reconcile how much money the company’s bringing in and how much it’s paying out. But it’s not bothering to work out how to get hold of underwriting data that will help them get a better handle on fleet risk so they can encourage fleet managers to improve that risk.

Standing still is moving backwards these days

The greatest risk in business is to do nothing.

Not doing anything is easy. A year or two in insurance doesn't seem like a long time. At the aforementioned conference, one insurer said, “There's so much new stuff, we don't know which technology to back, so we'd rather just wait for a leader to emerge.” I said, “Fine, but when a leader finally emerges, it will be two years out of date. And you won't have a business because your competitors will be on one of the latest technologies with much greater capabilities.”

There are two prominent risks, though.

Chasing the unicorn is pointless

First, as soon as you commit to becoming digital and innovative, you’re chasing the unicorn, the one thing you need to make everything perfect. One insurer I know quite well spent years trying to sort out its data analytics platform. Whatever was top of the internet conversation boards was being trialed by this company. However, running 20 insurtech pilots is not a feasible or sustainable strategy. It's a desperate attempt to keep your innovation team happy.

There’s an adage that says, back 20 horses, and if one comes in, you’re “quids” in. But that's not a practical strategy. That's just gambling. So, make sure you’re not backing lots of horses and throwing away the insurtech. Treat innovation as a DevOps task. Try something quickly; if it wins, it wins; if it fails, it fails. All insurers should be running this constant cycle of new initiatives.

Back to the future

The second point is about chasing the unicorn. Banks are working off platforms 10, 20, 30, sometimes 40 years old. So, even if they move to proven technology that’s 10 years old, that’s a leap forward. You don’t need to search for the next big thing, necessarily. The next big thing might already be here.

So you can deliver change faster. Take Pega, for example; it’s been around for years. There are new, cheaper, faster, low-code platforms but Pega is a workflow system with great functionality around machine learning and automation. So, rather than hunting the unicorn, look at your current tech stack and make sure you're fully exploiting that. You've probably already made a considerable investment and will be able to leverage more from that than trying to track down a unicorn.

Some know the price of everything and the value of nothing

One of the best examples of innovation is the combination of data analytics and Dataiku. People look at Dataiku and think it’s an excellent analytics platform but expensive. What they fail to recognize is that Dataiku can run your machine learning and automate all your insurance transactions. Buying it as a data warehouse platform would be a waste of money. The technology is there; it's proven. So, why pilot the latest fintech if that platform is already there?

Pega and Appian are tried and tested workflow solutions. They can do OCR and automation. If you've invested and you’re only using 60% of the functionality, come to Zoreza Global, and we’ll show you how to unlock the other 40% of the potential in the existing app. We're not advocating replacing everything. We're telling insurers, specifically, “Tell us what you've got, and we'll see how we can get more out of it.”

A stitch in time

If I had a penny for every time companies have said, “We're at a sticky point in this project. What can you do to help?” Nine times out of ten, our team says, “Well, we wouldn't have started there.” Bringing us in earlier — potentially on a free consultancy basis — because your internal dev might be looking to make a name for him or herself as a first adopter of the latest whiz-bang technology. But is that likely to generate the right decisions for their employer?

If you want to be sure, take advice from experts who have already seen the new and recent technologies deployed across industries and under many conditions.

Who can you believe?

And what about vested interests? I’ve seen a few insurance companies that have built a good, but not perfect, solution that starts to absorb more and more resources. The guy who built the system doesn't want to scrap it because of massive technical debt. Their IT provider doesn't want to scrap it because, having started with 10 support analysts, they're up to 15 and on their way to 20-25.

However, the system has a fundamental negative issue that must be either resolved or the system redesigned. A second set of experienced, external eyes is invaluable in such a situation.

Settling the “experts or bodies” argument

On the most cost-effective Zoreza Global engagement, teams go in, deliver change and then step away. And because our solutions are always on point and the cost-benefit ratio is so good, we keep getting new projects, enabling us to develop creative and dependable relationships with clients. Zoreza Global is change- and project-led, unlike the many providers whose entire raison d’être is to take over the process and grow the number of external bodies on client premises.

This “expand and grow the offshore delivery by eating the internal resources” strategy is a significant challenge for insurers. Gathering “more bodies” momentum, the provider absorbs internal roles, and when good designers leave, they get replaced offshore.

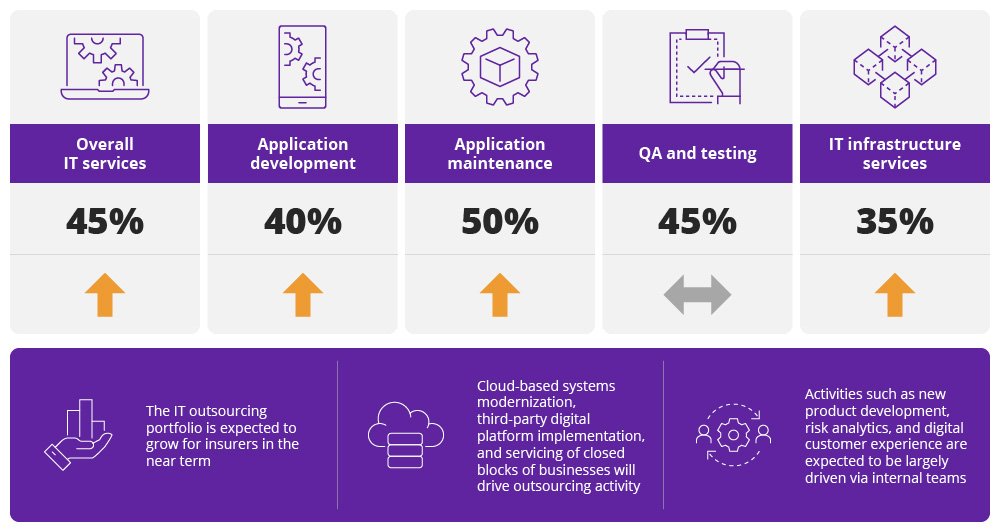

Outsourcing activities are on the rise for insurance companies

Too many cooks

So, the insurance company is held to ransom, utterly reliant on divisive offshore support, when your offshore support requirement should be shrinking. Zoreza Global’s view is if you do it right in the first place, you won’t need substantial offshore support because you fixed the problem. Our teams take ownership of and iron out the immediate issue, then move on to help solve the next.

Grand-scale consultants allow one conversation, and then you’re on the clock. Zoreza Global sits to one side of the inappropriate billers and the obsessive outsourcers. We don’t have a business agenda to take as much of your work offshore as possible. And we certainly won’t start billing you on day one, either. We'll guide you to an accountable stage in your journey to ensure that when you do start paying, you're buying something tangible.

We believe gratis and freely given pre-sales consultancy should be par for the course. Just describe your problem, and we'll help you figure out a solution. And only then will we start reckoning up.

Let’s talk value for money

By now, you’re aware that our go-to-market approach is about small, deliverable chunks, so our clients see the value as we progress together, as opposed to their signing up for a massive change program, sight unseen.

If you’re sufficiently intrigued by what you’ve read to want to find out how partnering with Zoreza Global works in practice, contact us.