In brief

- The Zoreza Global Analytics Platform (LXA) is a flexible ecosystem of applications rather than a single monolithic application, offering broad functionality across the entire wealth management lifecycle

- With user-friendly UIs and modular components, LXA makes it easier for both technical and non-technical staff to develop advanced use cases and adapt the platform to their needs

- LXA ushers in next-generation wealth management with rapid time to value and machine learning models that facilitate customer segmentation and predict customer attrition

Zoreza Global Analytics (LXA) is an advanced analytics platform. It’s a powerful general-purpose stack, an ecosystem of applications rather than a single monolithic application.

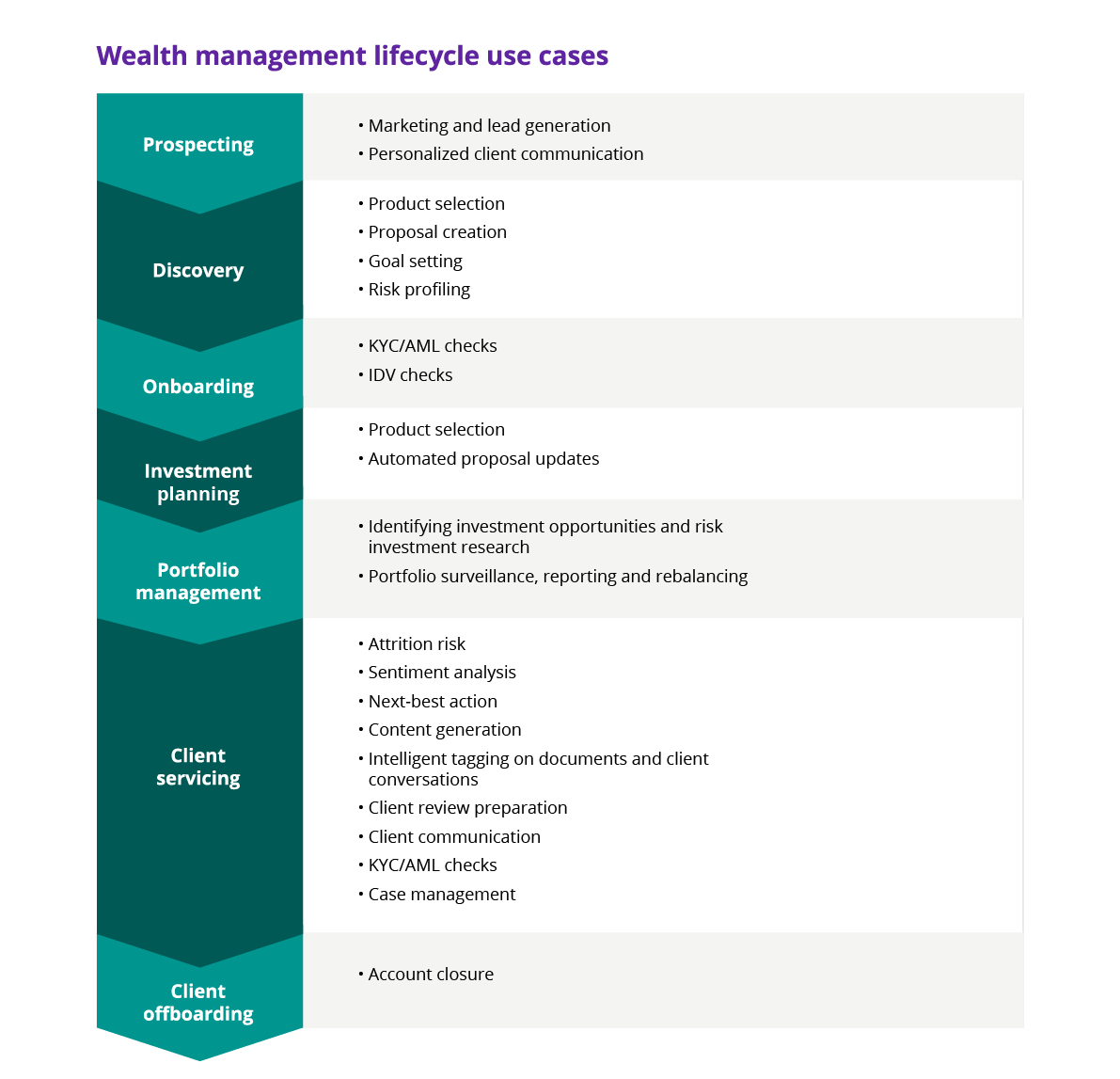

This super-platform uses data analytics as a mechanism for driving automation and, being generic, you can use it to build a wide range of use cases across most business functions within the wealth management lifecycle from discovery through to client offboarding.

The illustrative use case we’re using here is for predicting which clients are likely to leave. We can combine this with the client segmentation model and recommend other products to sell based on clients with a similar profile.

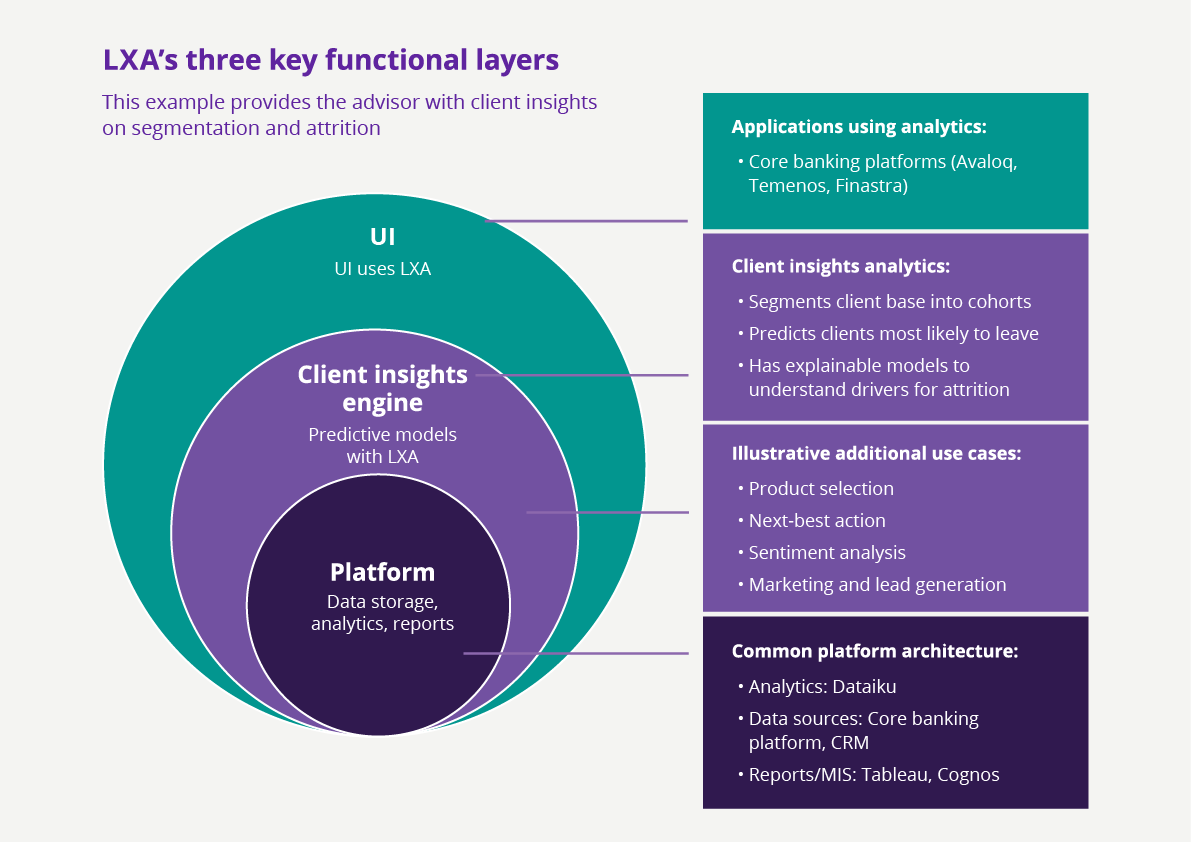

The “Client insights engine” layer in the above diagram refers to things you can build on the platform. Our value is in combining Zoreza Global’s domain expertise with our top data scientists and ISV specialists to build relevant predictive models for the industry.

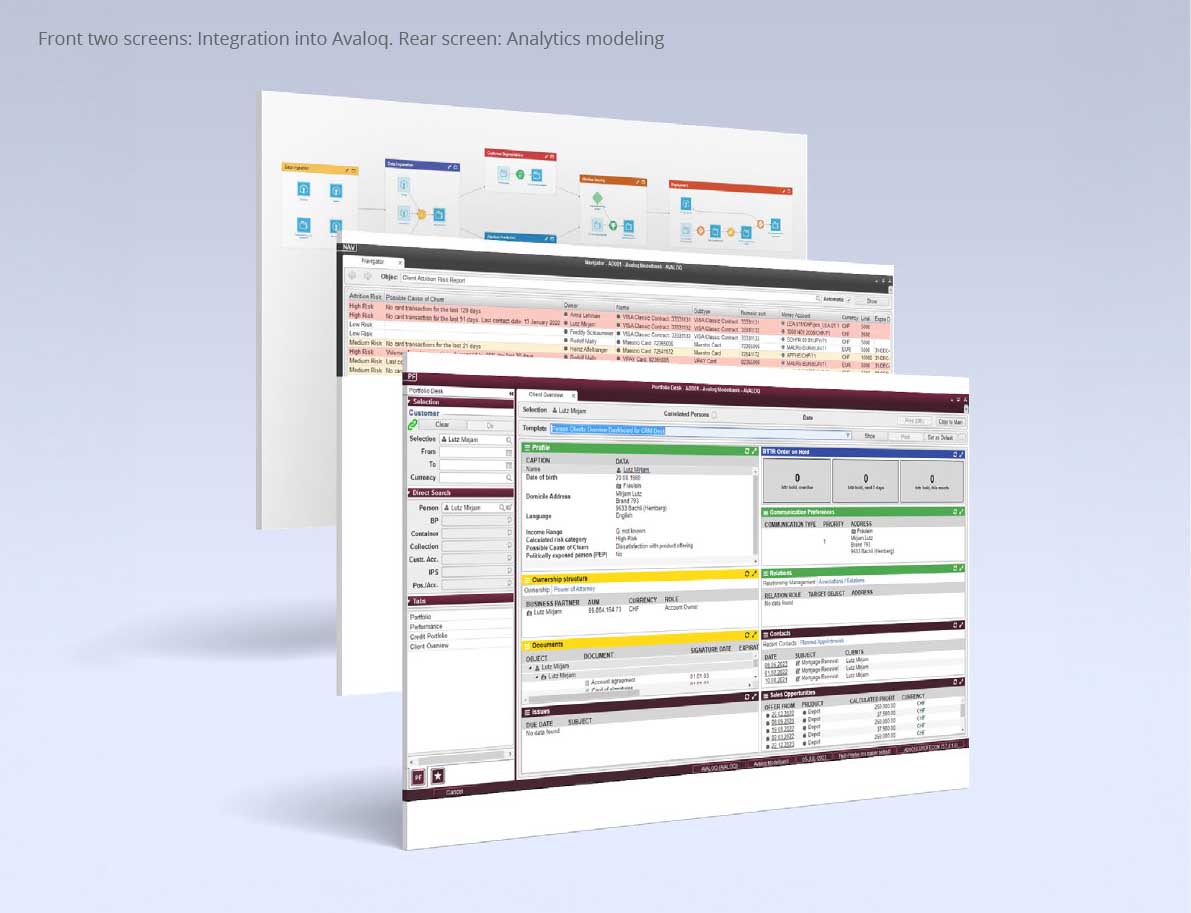

The “UI” layer refers to the front end, where the results of the analytical models can be viewed. In the above case, the front end is Avaloq, so the results are seamlessly integrated into the advisor’s daily dashboard.

Zoreza Global can also improve the front end using a low-code/no-code environment (e.g., Appian, Pega, UiPath, etc.). We develop the application in close collaboration with our client, creating an engaging front end — fully integrated with the client’s environment — in weeks.

Predictive models

Client segmentation:

Dynamic segmentation characterizes the natural cohorts in your client base. As more information is updated (e.g., new clients, wealth increases), the model learns more about the various groups.

Customer attrition:

This predicts which clients will most likely leave or close a particular product/service based on advisor interactions and client transactions.

Rapid time to value

One of the most significant platform benefits is that clients have a very short time to value for their deployment. Because LXA is a single generic platform, clients and their customers benefit from visually appealing workflows, and it provides an easy way to prepare for next-generation analytics.

In the above example, we built a client insights model. Many more use cases across the wealth management lifecycle could provide valuable client insights to the advisor and reduce the back office cost for servicing clients.

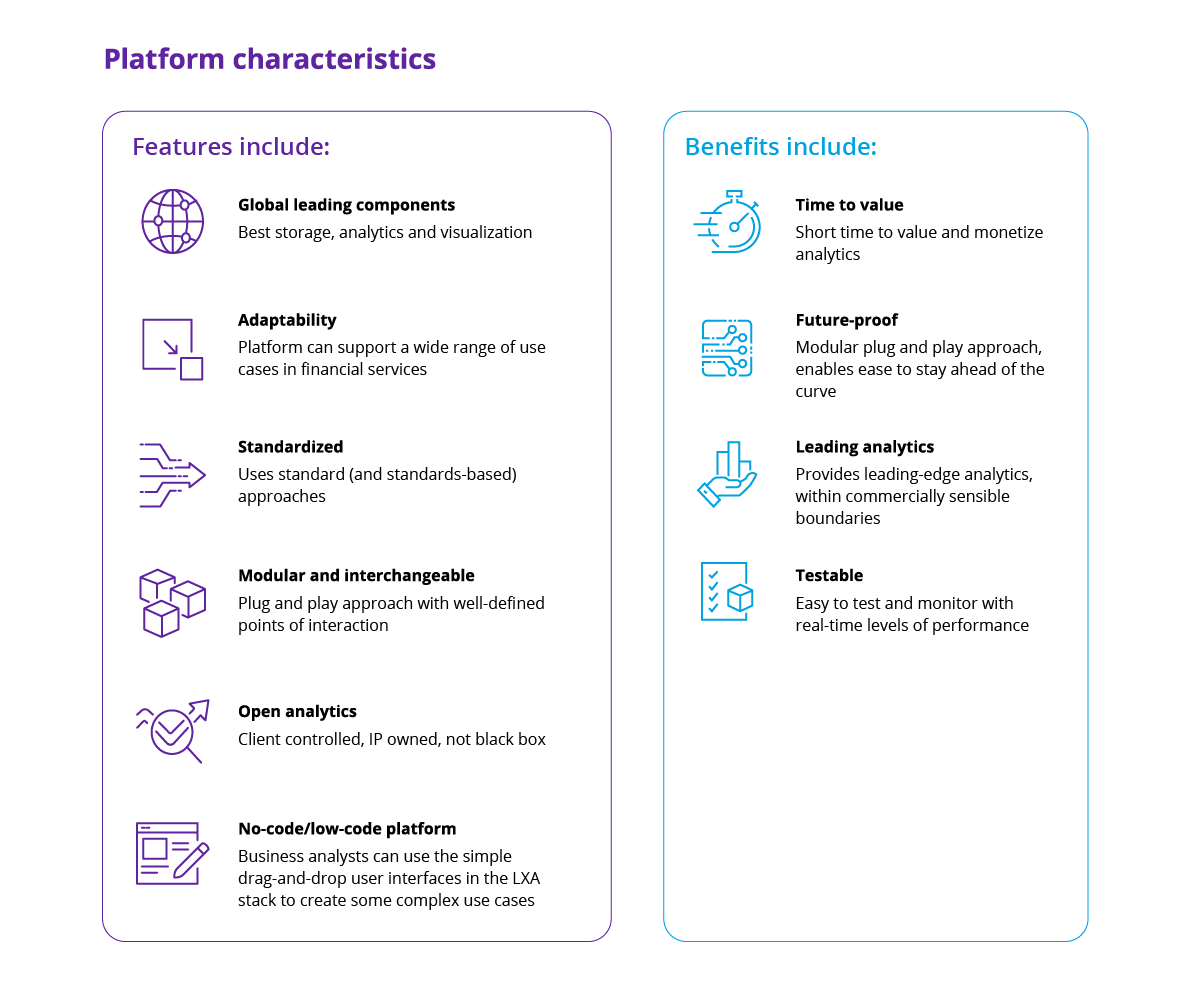

LXA is different

The difference between LXA and more traditional types of applications is that LXA is an ecosystem of best-of-breed apps. It’s not a single monolithic application. LXA is modular, very flexible, extremely fast (rapid time to value) and easy to adapt to changing client circumstances. Here’s a quick reminder of the platform’s features and benefits:

Prepare for next-generation wealth management with LXA

- The LXA platform is pre-integrated into popular vendor platforms (e.g., Avaloq) with a reduced cost and setup time.

- It’s an easy-to-maintain, no-code solution.

- Our experts understand wealth management.

If you’d like to find out more visit the LXA Platform page or consult one of our experts.