In brief

- APIs provide a revolutionary way to streamline operations, generate new revenue, and unify systems in the insurance industry

- Four types of APIs can be leveraged: Public, Partner, Private and Composite APIs

- Use cases for insurance APIs include collecting IoT data, integrating chatbots, unifying internal systems and more. They can benefit not only insurance companies but also industries like finance, legal, and auto dealerships

- Zoreza Global has vast experience in leveraging APIs for enhancing insurance processes, from unifying systems to automating claim processing and underwriting

Application programming interfaces, or APIs, have been praised as the “secret ingredient to a tech leap” and “a competitive edge across industries” for several years. But that’s not just hype; these small pieces of code do have the potential to pave the way for innovative products and streamlined workflows.

In insurance, APIs offer a relatively inexpensive way to reinvent operations to weather uncertain market conditions and adapt to the digital-first world.

Insurance APIs enable insurers to generate new revenue streams, streamline processes from underwriting to claim processing and unify legacy systems in a single platform. The latter is a pain point for many, since insurers’ IT applications are 18 years old on average.

At Zoreza Global, we have turned to APIs over and over again to help our clients in the insurance industry attain their goals. Today, we’ll draw on our expertise in insurance APIs to break down what they are, how they work, and how they can serve industry actors.

What is an API in insurance?

API stands for application programming interface, and it’s a piece of software that is ubiquitous across all industries. It allows applications to exchange data and share functionality with each other without jeopardizing the security of the data or exposing the underlying business logic.

There are four types of APIs insurance companies can use based on access restrictions:

- Public APIs are available for use by any third party without formal approval

- Partner APIs are accessible only to a selected group of developers and companies approved by the API owner

- Private APIs are used within the organization to share functionality and data between internal systems

- Composite APIs combine two or more types of APIs in a single codebase

How can APIs be used for insurance?

In insurance, APIs typically serve as the intermediary between multiple insurers’ applications or between their systems and the external software of their business partners.

For example, APIs can be used to monetize customer data by securely sharing it with select partners (with the user’s consent). Or insurers can use APIs in a new solution’s architecture to centralize their data siloed away in multiple internal systems.

Similar to the banking sector, the adoption of the insurance API drives the concept of open insurance. Open insurance means insurers make their data available to other industry players and non-insurance organizations via APIs.

This paves the way not just for price comparison sites and reduced barriers to entry, but also for:

- New streams of revenue, such as data sharing with business partners

- 360-degree customer view with advanced personalization and behavior prediction

- More accurate risk modeling and underwriting

- Streamlined embedded insurance offerings

Who uses insurance APIs?

There are numerous use cases for APIs insurance companies, agents, and brokers may leverage, but they aren’t the only ones who stand to benefit from this technology.

Third-party companies outside of the insurance industry can also leverage insurance APIs. For example, APIs provide access to insurers’ data or allow organizations to embed insurance products.

How does an insurance API work?

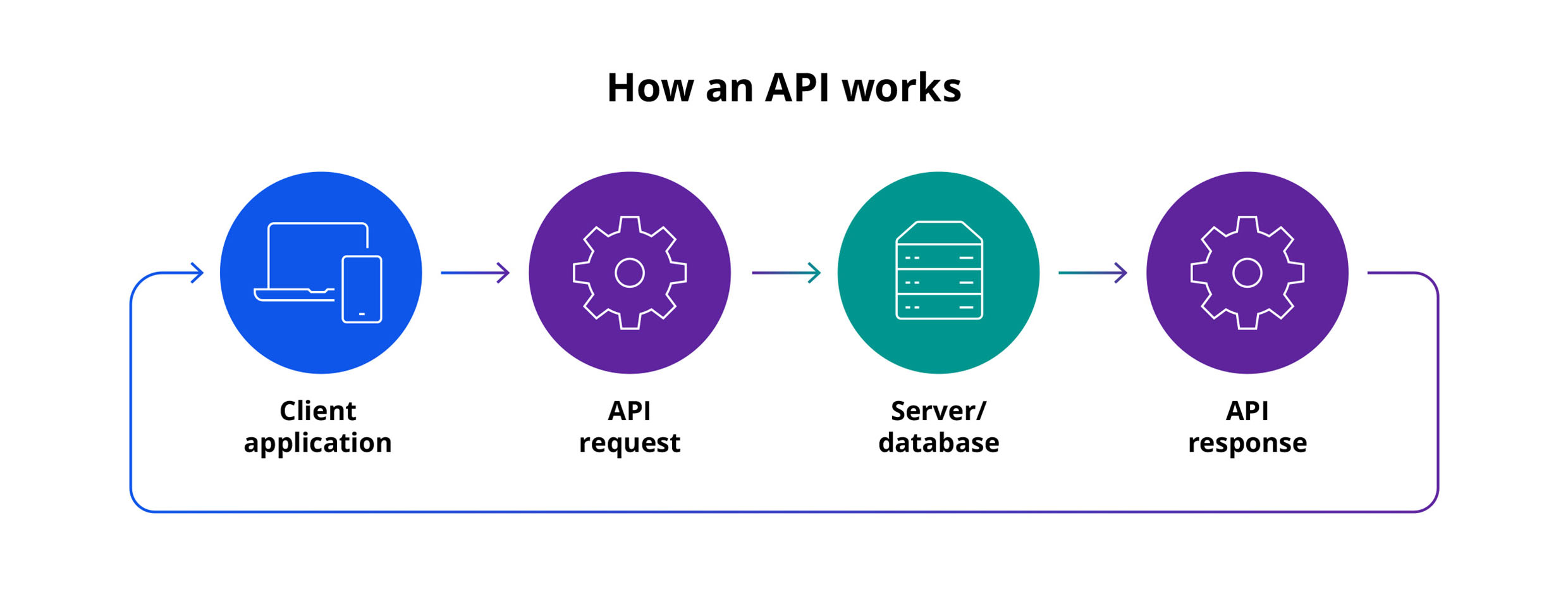

In broad strokes, any API functions by the following scheme:

1. When prompted by a user action or another trigger, the application sends a request for specific data to the API

2. The API screens the request and forwards it to the other application’s server or database in the cloud or on-premises

3. The server processes the request and either declines or authorizes it. If the request is authorized, the server sends the requested information back to the API

4. The API relays the received data to the initial application

Six use cases for APIs in insurance

An insurance API lets IoT devices collect data, chatbot integration, and a more accurate damage assessment, among others. Let’s break down these and other common use cases of this technology in the insurance industry.

Collecting data from Internet of Things devices

Internet of Things (IoT) refers to a network that connects various devices: sensors, wearables, hearables, smartphones, smart home assistants, and more. These devices collect and exchange data with other devices via APIs over the internet.

With an estimated six billion connected devices in the world as of now, the Internet of Things represents a data trove for insurers. Connected devices in vehicles, for example, can notify the insurer when an accident occurs or whether the driver regularly speeds. The data from medical devices and wearables can inform life and health insurers’ risk assessment.

Tapping into the IoT device data can help insurers:

- Assess risks more accurately and continuously adjust premiums based on customer behavior and other factors

- Gain more insight into customer behavior and preferences to make personalization more efficient

- Offer new insurance products, such as pay-as-you-drive car insurance

- Automate the first notice of loss (FNOL)

- Concentrate on predictive maintenance to reduce the number of claims through prevention

Shipping APIs

Shipping carriers like USPS, DHL, DPD, and FedEx offer shipping APIs to developers. While these APIs are popular with solutions that facilitate multi-carrier shipping for ecommerce merchants, they can also enable innovative insurance products.

Take EasyPost as an example of a shipping insurance provider that leverages API for insurance purposes, among other things. With it, the company offers insurance coverage for 100+ carriers. Shipping APIs verify when the package is lost, facilitating claim processing.

Integrating pre-built chatbots

Insurers no longer have to build chatbots from scratch to introduce them into their customer-facing applications. Now, they can tap into the latest advances in generative AI and large language models without substantial upfront costs with the help of API integration.

This enables insurers to easily add chatbots to their systems for any of the following common purposes:

- First notice of loss (FNOL) processing

- Standard claim processing and notifications

- Self-service customer support

- Personalized quote calculation

- Customer service via messengers and social media channels

Unifying internal and customer-facing insurance systems

One benefit of APIs for insurance companies is the technology’s ability to let the data flow seamlessly and securely between their applications. For instance, an API can connect a customer-facing mobile app with the customer relationship management (CRM) system and helpdesk.

APIs allow insurers to turn legacy applications into a truly unified digital ecosystem at a fraction of the cost. This brings several benefits for insurers that choose to do so:

- Unlocking data from silos and maximizing its utility via advanced data analytics

- Adopting a truly data-driven approach to decision-making with real-time analytics

- Gaining a 360-degree customer view that improves customer satisfaction, lifetime value and retention

- Improving operational efficiency by removing the need to re-enter and re-request data

Guidewire InsuranceNow API

Guidewire InsuranceNow is an example of a core platform for P&C insurers that leverages APIs for unifying internal systems and centralizing data. Its RESTful API allows insurers to easily integrate their applications with InsuranceNow.

Streamlining damage assessment

Multiple third-party insurance solutions can be integrated into the internal ecosystem via APIs, and damage assessment platforms are no exception.

These platforms can automatically process claims by analyzing photos and videos of the damage customers submit. To that end, they use a combination of AI-powered computer vision and image and video data labeling.

As a result, insurance companies can dedicate their human resources to complex claim cases. Claim processing also becomes faster, reducing costs and improving customer experience in the process.

Automotive API

APIs integrate third-party applications with vehicle systems, allow users to lock and unlock their vehicles using a mobile app, and ensure road safety with the help of sensors. The number of connected vehicles is expected to rise to 400 million by 2025.

When it comes to claim processing and management, the automotive API an insurance company can leverage comes in handy during:

- First notice of loss (FNOL): Data regarding airbag activation or damage to the vehicle can automatically be transmitted to the insurer, serving as the FNOL

- Damage assessment: Data from various systems, gyroscopes and accelerometers can contribute to reconstructing the accident by capturing which vehicle parts suffered damage and whether the driver’s behavior disqualifies them from compensation

- Preventative maintenance: Sensor data can inform the algorithms that determine when maintenance is best done and notify the driver about it

Here’s an example of how an automotive API works, as presented by Smartcar’s Head of Sales and Business Development:

Accelerating claim processing and management

Traditionally, claim processing involved manually gathering and comparing data from multiple sources to weed out fraudulent claims and award fair compensation. Today, most of that data can be automatically verified with the help of APIs connecting insurers with third-party data sources.

The benefits of using APIs in insurance claim processing include:

- Partially or fully automated claim processing

- Reduced costs

- Mitigated risk of fraud

- Improved customer experience

- Increased operational efficiency

- Stable performance during spikes in claims (e.g., during a natural disaster)

Weather API

In claims where weather conditions play a role (e.g., P&C and car insurance), weather APIs can automate the verification of those conditions. This allows insurers to accelerate claim processing while reducing costs and boost employee productivity at the same time.

For instance, OpenWeather API allows pulling both current, forecasted, and historical weather data. So, when a claim is filed for hail damage, for example, third-party weather data can automatically be used to corroborate or deny the claim.

Here’s an example of how weatherstack API can be used to supply real-time weather data to an application:

Making underwriting more efficient and accurate

Insurers no longer need to rely on static demographic data like age and occupation to assess risks and determine premiums. They also don’t have to spend valuable working time on data verification for underwriting purposes.

APIs can connect insurers with relevant data holders to enhance the risk assessment with more data and streamline data verification. For example, a weather API can provide historical hail data for more accurate risk assessment with predictive analytics algorithms.

Furthermore, APIs can allow brokers and insurers to seamlessly exchange underwriting data, removing the need to enter and send it manually.

Health API

Health data, shared through APIs, is invaluable for life and health insurance companies. This data from healthcare providers, fitness devices, pharmacies, labs, and health apps can improve and streamline risk assessment, underwriting, claim processing, and more.

Human API is a prime example of an API allowing insurers to access over 30,000 health data integrations. This data can inform underwriting by automatically identifying undisclosed medical conditions and generating health check reports. Here’s how it works:

How insurance APIs benefit other industries

Insurance companies, brokers and agents aren’t the only ones benefiting from APIs. This technology can also enable them to share their data with non-insurance companies for various purposes.

Let’s break down how insurance APIs can enhance enterprise operations in three industries: finance, legal and auto dealerships.

Finance

An insurance API provider can use the technology to enable financial services companies to embed insurance offerings in products and applications. As a result, insurance companies extend their reach while their finance partners earn a cut and provide a better customer experience without venturing into the insurance industry themselves.

Legal

In the legal industry, insurance API integration can streamline access to relevant information for lawyers and other legal professionals. For example, if the insurance company allows data sharing and verification via an API, a lawyer can use it to determine the client’s insurance coverage to negotiate a fair settlement.

Auto dealerships

APIs can also enable embedded insurance offerings in auto dealerships. Since all vehicles have to be insured by law, the burden of verifying car insurance lies on auto dealerships. Insurance APIs can streamline this process, saving auto dealerships from having to do it manually for every customer.

Zoreza Global expertise in insurance API integration

At Zoreza Global, we often turn to APIs to achieve various tasks, from unifying separate applications in a single digital ecosystem to automating claim processing and underwriting.

For example, we helped a multinational insurance company unify its internal legacy systems on a new portal using this technology.

Our client turned to us with a request to assess and improve customer experience maturity. But as its legacy systems and workflows were in dire need of modernization, achieving an excellent digital customer experience would have been impossible without addressing those issues first.

We didn’t just modernize all the legacy systems. We also used the power of REST API to share enterprise data between those previously separate applications and a new portal that centralized all information and workflows.

As a result, employees no longer had to notify their colleagues about a bill paid or a report prepared. Data became easily accessible to those who needed it, and everyone was now on the same page.

Ready to leverage insurance APIs?

If you want to pinpoint how insurance APIs can help you achieve your business goals and unlock new revenue streams, we’d be honored to lend you a hand. Drop us a line, and we’ll get back to you to discuss how API technology can boost your efficiency, enable digital transformation, and enhance customer experience.