In brief

- An integrated mainframe hybrid cloud approach combines the resilience of on-prem mainframes with the agility of modern cloud and digital technologies, improving mainframe energy efficiency, enabling dynamic scaling and ensuring that resources in data-heavy operations are prudently consumed to reduce the overall carbon footprint

- A mainframe hybrid cloud strategy is a powerful ESG enabler for banks, providing a stable and scalable framework to support the three ESG pillars — environmental sustainability, social responsibility and governance

- Learn how a hybrid cloud approach deepens tangible benefits toward ESG pillars while boosting profitability through insights on our Hogan-powered mainframe partnership with IBM

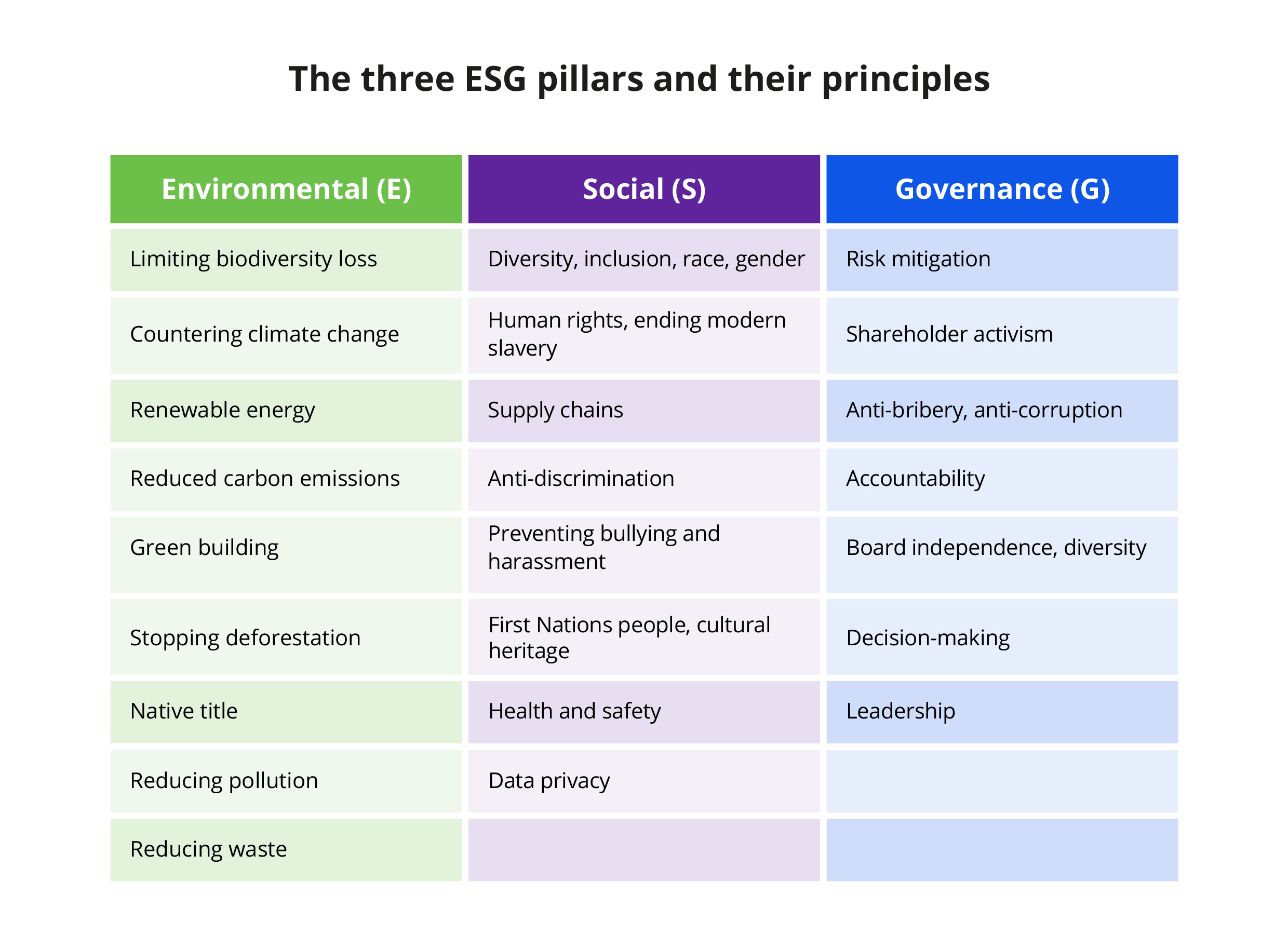

An overview of environmental sustainability, social responsibility and governance (ESG) pillars

ESG is a framework for heightening credibility and delivering value within each pillar. This paper introduces the ESG pillars, offering industry examples and insights into their impact on banking.

Why are banks embracing ESG?

1. The environmental sustainability pillar

Environmental sustainability refers to the responsible use of natural resources and the protection of ecosystems to maintain or enhance the quality of the physical environment for current and future generations. The principles of environmental sustainability revolve around promoting renewable energy, fostering sustainable development, conserving biodiversity, reducing waste and ensuring environmental justice.

For banks to make a mark on the physical natural environments, leaders within these institutions must analyze and minimize the environmental risk in their lending, investing and advisory services. As climate change becomes a major factor in risk management for banks, championing environmental sustainability initiatives such as green bonds, sustainability-linked loans and investments in renewable energy and clean technologies supports sustainable business practices and credibility toward meeting their ESG initiatives.

The environmental sustainability pillar of ESG in action: A leading global bank agrees to log net-zero carbon emissions across its finance portfolio by 2050, establishing a green financing framework, prioritizing loans and investment in renewable energy, energy-efficient infrastructure and green buildings, and issuing green bonds to fund qualified initiatives.

2. The social responsibility pillar

Social responsibility encompasses better labor practices, increased diversity and improved human rights and community engagement. The relevant social criteria assess customer, employee and community relationship management, incorporating fair lending, financial inclusion and community development programs.

Banks are shifting their lending and investment practices to improve social impact, often pivoting away from industries with adverse social outcomes (e.g., firearms, tobacco and fossil fuels). Socially responsible investing (SRI) and impact investing have gained speed, diverting money to organizations and initiatives that deliver quantifiable social benefits and a sound financial yield. In 2020, Goldman Sachs announced that it would not take companies public unless they had at least one diverse board member, demonstrating robust social responsibility for diversity and inclusion.

The social responsibility pillar of ESG in action: A multinational bank introduces a holistic diversity and inclusion program to increase the representation of underrepresented groups in leadership positions. It also initiates financial literacy and inclusion programs in disadvantaged neighborhoods, offering banking and credit services and subject matter experts to people who would typically have to work around those obstacles on their own.

Companies with executive teams in the top quartile for gender and ethnic diversity have a 39% greater likelihood of outperforming their peers in the bottom quartile for diversity.

3. The governance pillar

Governance expresses the internal conventions, controls and processes a bank uses to govern itself, make sound decisions, comply with financial regulations and satisfy stakeholder demands. Strong governance produces clear accountability, resilient risk management, ethical tactics and strategies, and transparent reporting and disclosure.

The banking industry is leveraging innovative technologies to navigate complex regulatory requirements and adhere to compliance standards. New and emerging regulatory technology (RegTech) simplifies compliance processes in banking, promoting risk management and increasing stakeholder reporting transparency. Recent shifts in governance include the deployment of AI and advanced analytics in risk management, which illustrates how banks use technology to support governance standards. These technologies bolster ESG governance by enabling real-time transaction monitoring, predictive analytics in fraud detection and sophisticated risk assessment models.

The governance pillar of ESG in action: A global bank leveraged its mainframe computational capabilities and advanced analytics to power real-time fraud detection and risk management. In addition to protecting company assets and analyzing massive volumes of transactions and market data, the move also complied with international regulations and boosted stakeholder confidence.

An EY Global Institutional Investor Survey reported that 72% of investors said they conduct a structured and formal review of ESG disclosures, highlighting the importance of governance and transparency in investment selection.

Putting ESG to work in banking

Integrating ESG principles into banking business models involves carrying out the following:

- Materiality assessment: Arrive at the optimal ESG criteria for your bank and stakeholders, prioritizing areas and resource allocation

- Strategy integration: Embed sustainability into your corporate strategy and align ESG with the bank’s business goals and stakeholder demands

- Product and service innovation: Progress and market sustainable products and services (e.g., green bonds, sustainable loans and ESG-focused investment portfolios)

- Risk management: Integrate ESG considerations into risk assessment and management frameworks to identify, analyze and control ESG risks

- Reporting and disclosure: Create transparent reporting procedures to relay your bank’s ESG performance and impact to stakeholders

Investment banking with all ESG pillars in action: A leading bank establishes an all-inclusive ESG reporting framework that carries meticulous disclosures on its ESG strategy, governance infrastructure, risk management processes and performance criteria. Transparency nurtures investor and regulator trust, highlighting the bank's commitment to ethical business practices and sustainable growth.

An ESG framework helps reinforce an overall positive trend in the sustainable finance market where investors continue to show interest in the resilience and impact of sustainable investment strategies. However, information and education are still needed to empower customers further. “Around 40% of customers are already open to sustainable financial products, but further education and advice are needed to make informed buying decisions.”

Challenges and opportunities of adopting ESG principles

Challenges

- ESG integration includes data inconsistency, a lack of standardization in ESG reporting and the necessary cultural shift. However, these challenges also provide innovation, differentiation and sustainability leadership opportunities

Opportunities

- Technology plays a pivotal role in enabling ESG integration: Advanced analytics, AI and ESG data collection, analysis and reporting, delivering more detailed and reliable insights into possible risks and opportunities

- Cultivating closer links with regulators strengthens ESG standards and frameworks, reducing complexity and developing a more joined-up approach to integration

Mainframe hybrid cloud strategy alignment with ESG

A mainframe hybrid cloud approach is a powerful ESG enabler that handles an exceptional volume of transactions, high-level security and advanced analytics while championing energy efficiency and operational effectiveness. The setup provides a stable and scalable framework to support environmental sustainability, social responsibility and governance.

The benefits

The benefits include environmental sustainability, energy efficiency and a reduced carbon footprint. Combining ESG adoption and a mainframe hybrid cloud approach increases mainframe energy efficiency. This enables dynamic scaling, ensuring that resources in data-heavy operations are consumed prudently to reduce the overall carbon footprint and cut the bank’s environmental impact.

Take a mainframe hybrid cloud approach to adopting ESG principles and increase profitability. A leading global bank implemented a mainframe hybrid cloud strategy, optimizing workload distribution between mainframe and cloud environments. This significantly reduced energy consumption and carbon footprint, exemplifying environmental stewardship (e.g., reducing our reliance on fossil fuels*) while maintaining high performance and customer service standards.

Social benefits: Broader financial inclusion and community investment

A mainframe hybrid cloud approach guarantees exceptional handling of sensitive data with peerless security to guard customer information and cultivate trust. Combining mainframe reliability with cloud adaptability, banks can tailor services to suit disparate customer requirements and fulfill their social responsibilities. Supporting a central ESG principle that advocates treating stakeholder data ethically and responsibly promotes secure, accessible and fair banking services.

The social responsibility pillar of ESG in action: A regional bank leveraged its mainframe hybrid cloud system to support micro-loans and a mobile banking app designed for remote regions with little or no access to regular banking services. While expanding its market reach, the bank also played a leading role in encouraging local entrepreneurs, stimulating economic growth and growing financial literacy and inclusion in the area, in keeping with the social aims of ESG.

A safe and secure strategy

Adopting a mainframe hybrid cloud strategy strengthens a bank’s governance capabilities by providing a safe and resilient platform for managing data and transactions with integrity. It also leverages immense mainframe processing power, advanced data analytics and cloud-based agility to empower real-time monitoring and reporting. In compliance with financial rules, this provides actors with clear insights into the institution’s operations and commercial well-being.

In short

The mainframe hybrid cloud approach paves the way for banks to align with ESG principles. By combining mainframe computer power with new and emerging technologies, banks can achieve environmental sustainability, social inclusivity and strong governance while establishing operational resilience and promoting innovation.

The Hogan-powered mainframe hybrid cloud setup

Mainframe hybrid cloud enablement is becoming a great favorite of Hogan clients keen to boost speed, scalability and revenue growth. On-prem data centers store extra-sensitive encrypted data. And by shifting mission-critical applications, data and analytics to a careful mix of private and public clouds, banks can enjoy the best of the new while keeping a tight rein on their most valuable assets.

The Hogan-powered mainframe hybrid cloud concept is a popular choice for banks. Adoption allows them to keep their core systems of record — which run well on mainframes — but opens them up to greater possibilities. Sensitive data is secured in a fully customizable private cloud infrastructure, and less-sensitive assets are shifted to one or more highly flexible, low-entry-cost public clouds. That said, banks cannot achieve this holistic solution without accurately aligning core and new systems and developing an exceptional customer experience.

Digital modernization eases cloud deployment, but greenfield implementation increases risk and budgetary pressure for a large-scale operation. Banks need to move at least half of their systems to cloud providers to realize even the primary benefits of cloud services. However, this can bring additional risk and inconvenience. While a private cloud might strengthen your control and resolve many compliance challenges, firewalls could inhibit collaboration and innovation.

Hogan’s IBM z16 partnership

Zoreza Global and IBM are helping banks optimize and transform their core systems, anticipating shifts in lifestyle trends and offering forward-thinking solutions. The IBM z16 provides extra protection by encrypting data wherever it resides — at rest, in flight and now, in use — with fully homomorphic encryption (performs operations on the user's encrypted data without decrypting it). This combination of Hogan and IBM z16 enables banks to protect data, ensure compliance and improve the customer experience through faster, frictionless, sustainable processes.

IBM z16 A01 multi-frame by numbers:

- Up to 200 cores

- 7nm technology, 5.2GHz, 1.5x cache

- 11% per core performance improvement

- 17% total system capacity growth

- 25% more processor capacity per drawer

- Up to 40TB of memory

- 1 to 4 19-inch frames

Lower ASI inferencing energy consumption

ASI inferencing energy consumption refers to the energy used by an artificial superintelligence (ASI) system while making predictions. Consumption is a critical consideration in developing and deploying ASI systems, as it can affect the system's cost, efficiency and environmental impact.

The IBM z16 delivers a massive reduction in ASI inferencing energy consumption. It also has a much smaller carbon/physical footprint and significantly more sustainable processing power.

Dedicated low-latency, on-chip AI accelerator

It includes an industry first, integrated on-chip AI accelerator designed for high-speed, latency-optimized inferencing that maintains sustainability as a core principle:

- Reduces energy consumption for inference operation processing by 41x using the Integrated Accelerator for AI versus running inference operations remotely on an x86 server using an NVIDIA GPU*

- Manages up to 300 billion deep-learning inference requests a day with a 1ms response time*

- Returns up to 19x higher throughput and 20x lower response time co-locating applications and inferencing*

*Source: IBM

The IBM zSystem’s on-chip AI accelerator enables Hogan and related zLinux workloads to run real-time AI capabilities on the platform where the data currently exists. This improves AI performance, security and cost. Also, activities like automated credit decision-making and loan modification can be done directly on the Z platform, making AI insights and business decisions quicker and easier to perform. Celent estimates that if 100% of transactions were screened, each bank could save in the region of $100 million.

Operational resilience

Recognizing the ever-increasing risk of cyberattacks, the Digital Operational Resilience Act (DORA) will focus on strengthening digital resilience for banks, beginning January 17, 2025. The new EU regulation will require banks to adopt a multi-cloud strategy (allowing a more energy-efficient mainframe hybrid cloud approach). A recent research report noted: “Across all three countries we surveyed, most companies planning or preparing for DORA already are making multi-cloud a part of their plans.”

In closing

Integrating ESG principles with banking objectives via a Hogan-powered mainframe hybrid cloud strategy is not a passing trend. It's a significant shift toward a more sustainable, responsible and resilient business model. By adopting ESG principles, banks control risk, align with ongoing regulatory developments and create new opportunities for growth, innovation and differentiation.

As the industry's focus on sustainability tightens over the next several years, seamless ESG integration will be a core factor in banking stability, longevity and profitability.

Find out more

To learn more about how adopting ESG principles and enabling a Hogan-powered mainframe hybrid cloud strategy can help manage risk, promote innovation and increase profitability, visit Hogan hybrid cloud services page. However, if you have a particular ESG or hybrid issue you’d like to discuss, contact us.