In brief

- Running your core system on z/OS within a mainframe hybrid cloud environment enables Hogan io to provide the agility and flexibility needed to meet current and future business requirements

- IBM z/OS Connect EE exposes and consumes open RESTful APIs to and from the mainframe. It’s a one-stop solution for Hogan io, providing a unified interface for all major subsystems and data on the mainframe

- Hogan-powered, mainframe hybrid cloud enablement secures your most valuable business asset, your data, avoiding security breaches that carry heavy penalties, reputational damage and can even lead to closure

Hogan’s world-class core banking platform delivers intelligent operations for modern banking.

Traditionally, banking operations rely on the proven z/OS-based COBOL core. Day after day, this robust platform has delivered the scale and protection needed to process the financial affairs of millions of customers, which has been the perfect solution to the questions posed by everyday financial services business; until now.

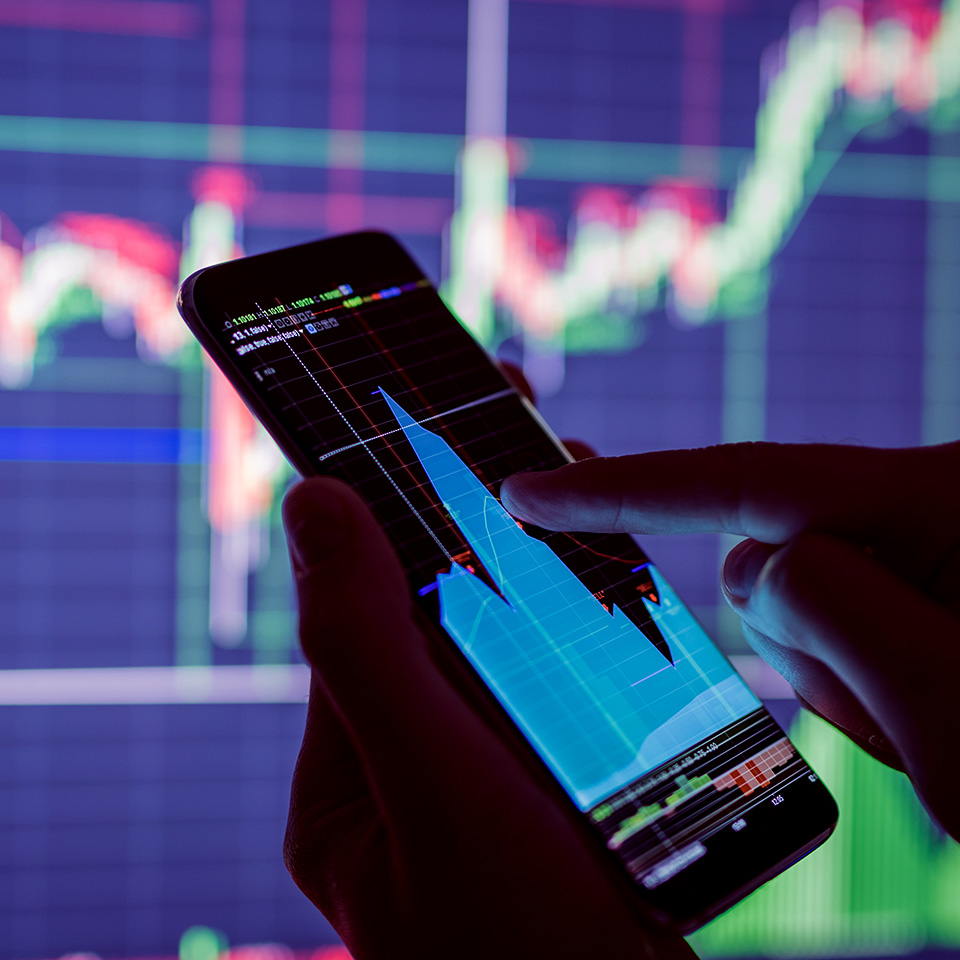

Today, the banking sector faces an aggressive armada of new, more complex challenges. Competitive intensity, speed to market, regulatory pressure, cyber risks, and a scarcity of talent are a few of the mounting issues that banks face.

In the past, the narrative around COBOL cores and Hogan was that it’s a “monolithic application” and a barrier to addressing these issues. Not only is that incorrect, but also with Hogan io and its eight-point plan to modernize and optimize with a mainframe hybrid cloud approach, banking challenges can be addressed, and new opportunities seized.

Hogan has stood the test of time and has a bright future with this new approach.

Core legacy-system challenges

For the business: Research reveals that 95% of mid-market banks are not satisfied with the capabilities of their core banking systems. These banks are at varied phases of their modernization journey. However, few banks have a clear roadmap to adopt a cloud-based core banking system and in many jurisdictions a public cloud solution is not supported by regulators.

For IT: 27% of banks have cited the lack of flexibility and agility to respond to changing customer and business needs as a high-impact challenge. 17% of banks have cited lock-in with a core banking system vendor as a key challenge. 17% of banking executives have cited a shortage of talent for maintaining and enhancing legacy core systems as a challenge.

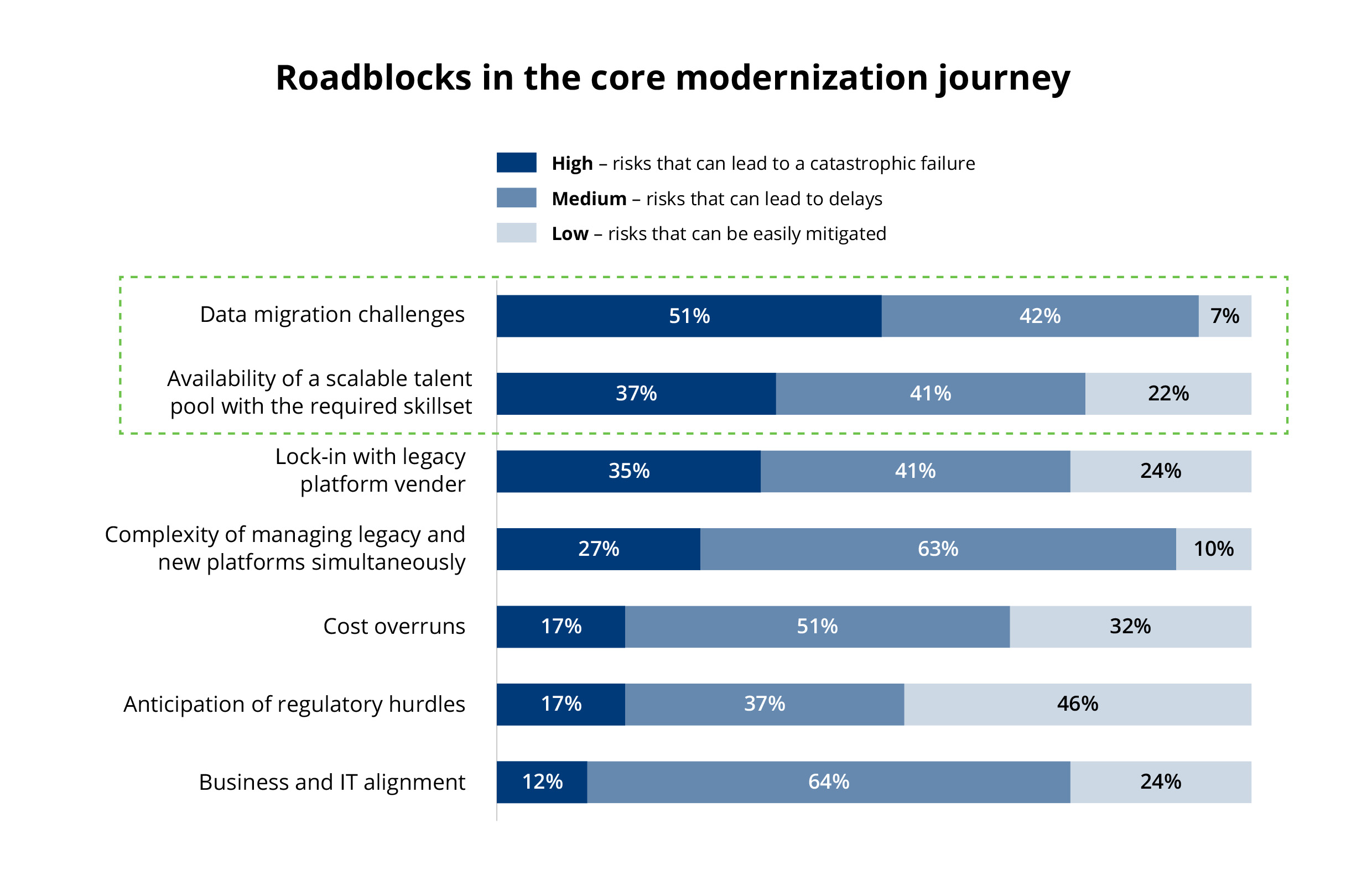

Data migration: As many as 92% of banks consider data migration a key challenge that could lead to a significant delay or failure of the core banking modernization project. The siloed and legacy nature of the core landscape has a complex data architecture, with data in silos across the enterprise and geographical regions.

Talent availability: Almost 78% stated that the availability of a scalable talent pool with the required skillset is a big challenge. Banks cannot attract the right quality and quantity of talent due to competition with other banks and other industries.

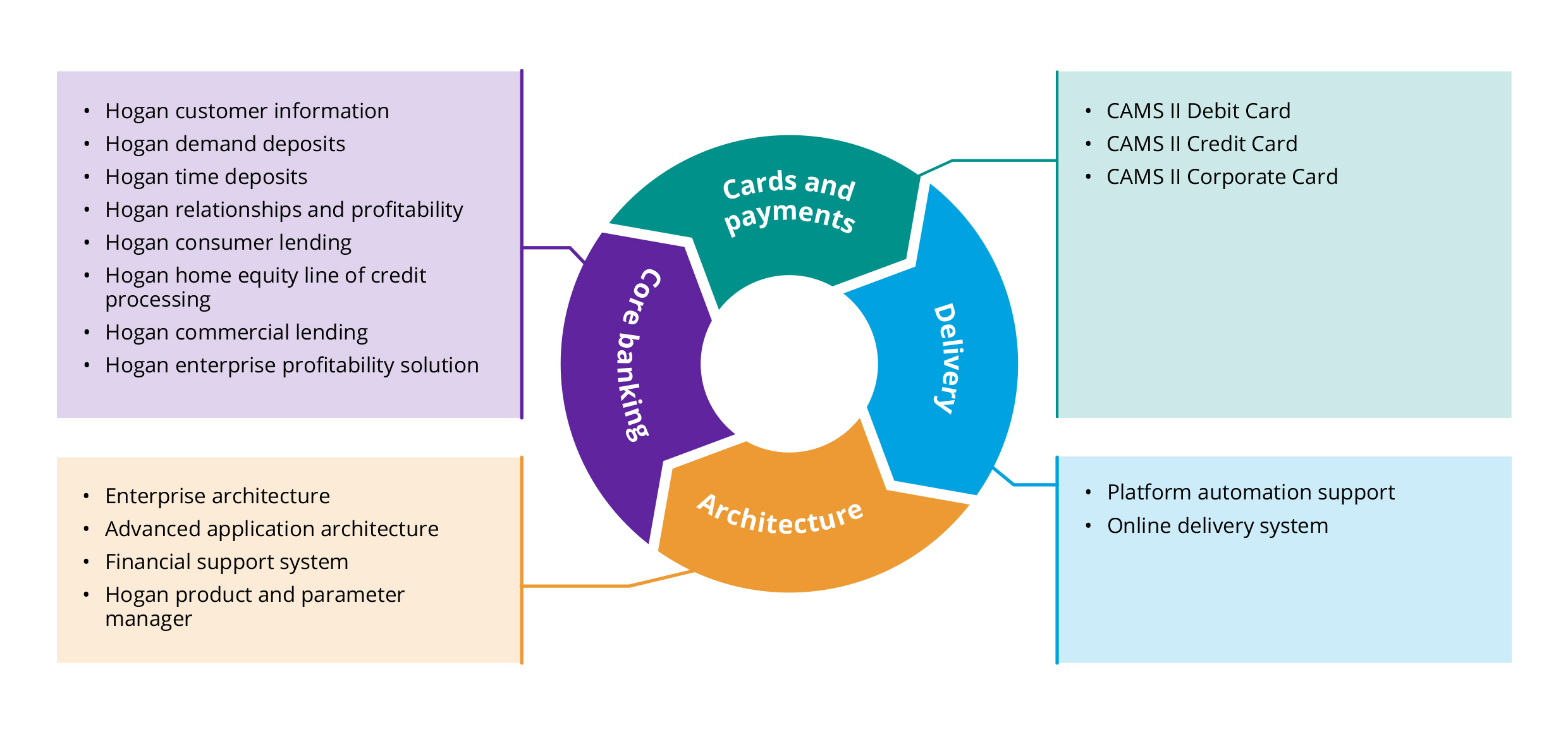

Hogan banking solutions and services

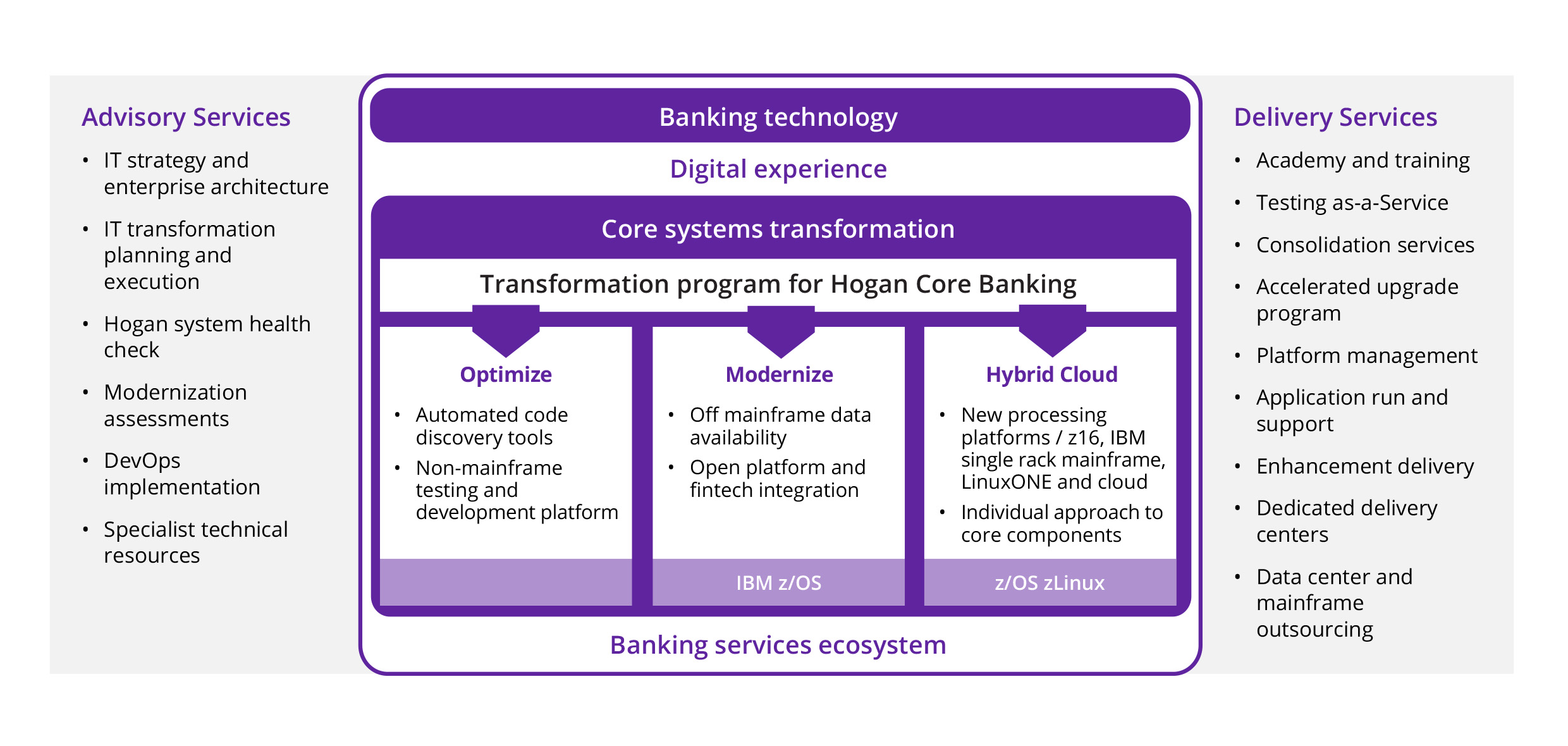

Zoreza Global has developed several solutions and services to address client issues and position them for sustainable innovation and growth. The core platform can be transformed through a range of optimization, modernization and hybrid-cloud initiatives, and augmented by integration into systems of experience and our banking-partner ecosystem. Zoreza Global advisory and delivery services provide essential ingredients for success.

Our core banking applications cover functional banking requirements supported by continuous upgrades to Umbrella, Hogan’s platform architecture.

Stop playing catch-up

At this very moment, Zoreza Global’s agile Hogan io mainframe hybrid-cloud environment is elevating the z/OS cores of some of our most competitive clients. Don’t get left behind. Implement Hogan io and let the energizing force of core banking system modernization transform your organization, making short work of shifting customer demands.

Running the core on z/OS within a mainframe hybrid cloud environment enables Hogan io to deliver intelligent operations, supplying the agility and flexibility needed to meet current and future business requirements.

Ramp-up performance

Hogan io rationalizes and reshapes operations, optimizing the allocation of resources and amplifying security. It’s a safe and profitable way of advancing your customer experience and creating sustainable growth in an unpredictable market.

Hogan io helps you differentiate your bank through enabling rich customer experiences, speeding up the deployment of new products and services and providing one of the world’s most stable and secure platforms that future-proofs your business.

Three approaches to core modernization

- A journey-led progressive approach to core banking modernization is preferred. It aims to help banks reduce their reliance on the core platform as they wrap the core with modular digital components, making them more responsive to changing business and customer needs

- The second preferred approach is re-platforming the core banking system

- Big-bang replacement of the core banking platform is the least preferred route due to the high risk involved and the low-risk appetite of banks

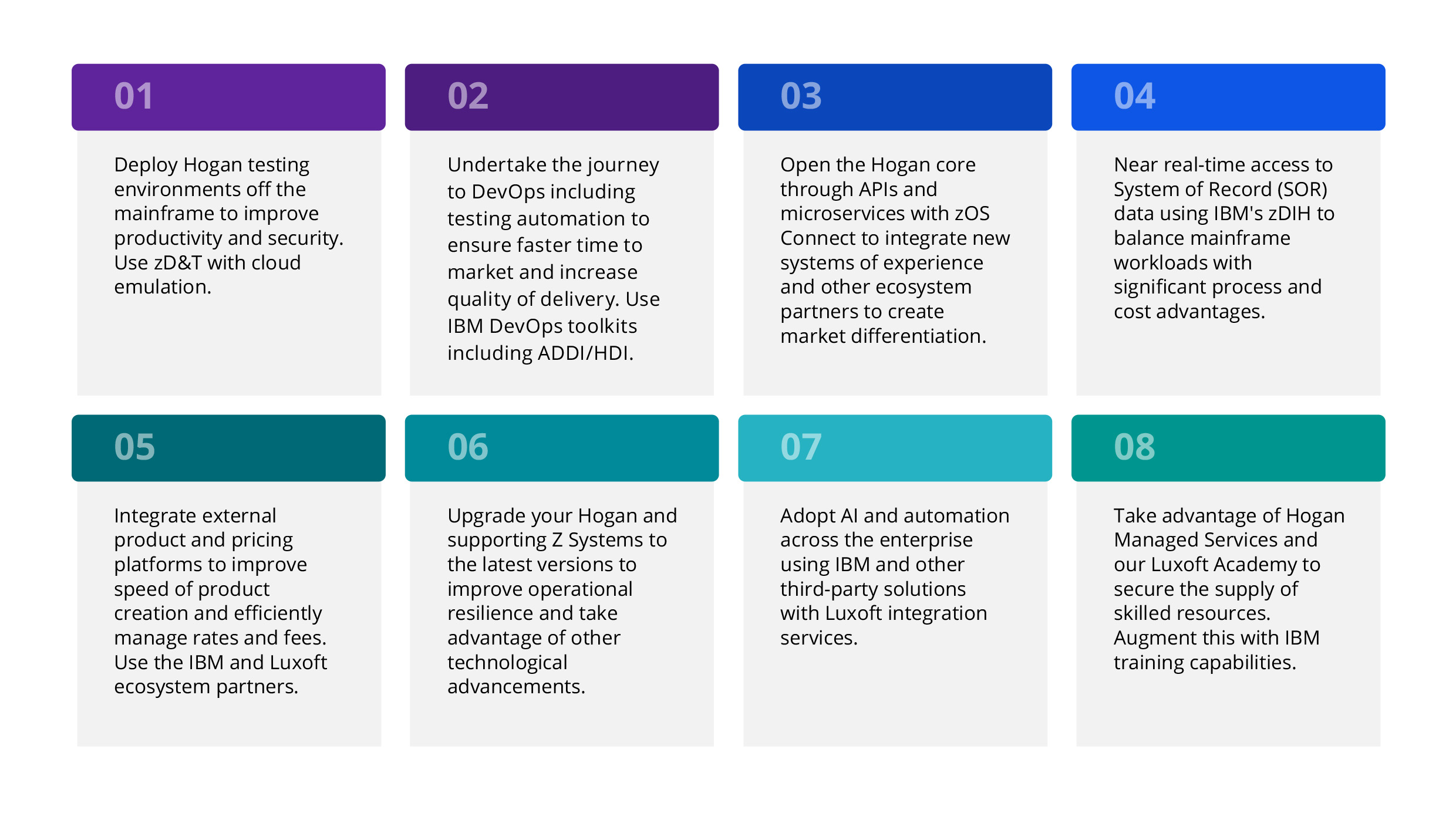

Hogan’s eight steps to core modernization

Here’s how Hogan io rejuvenates legacy systems:

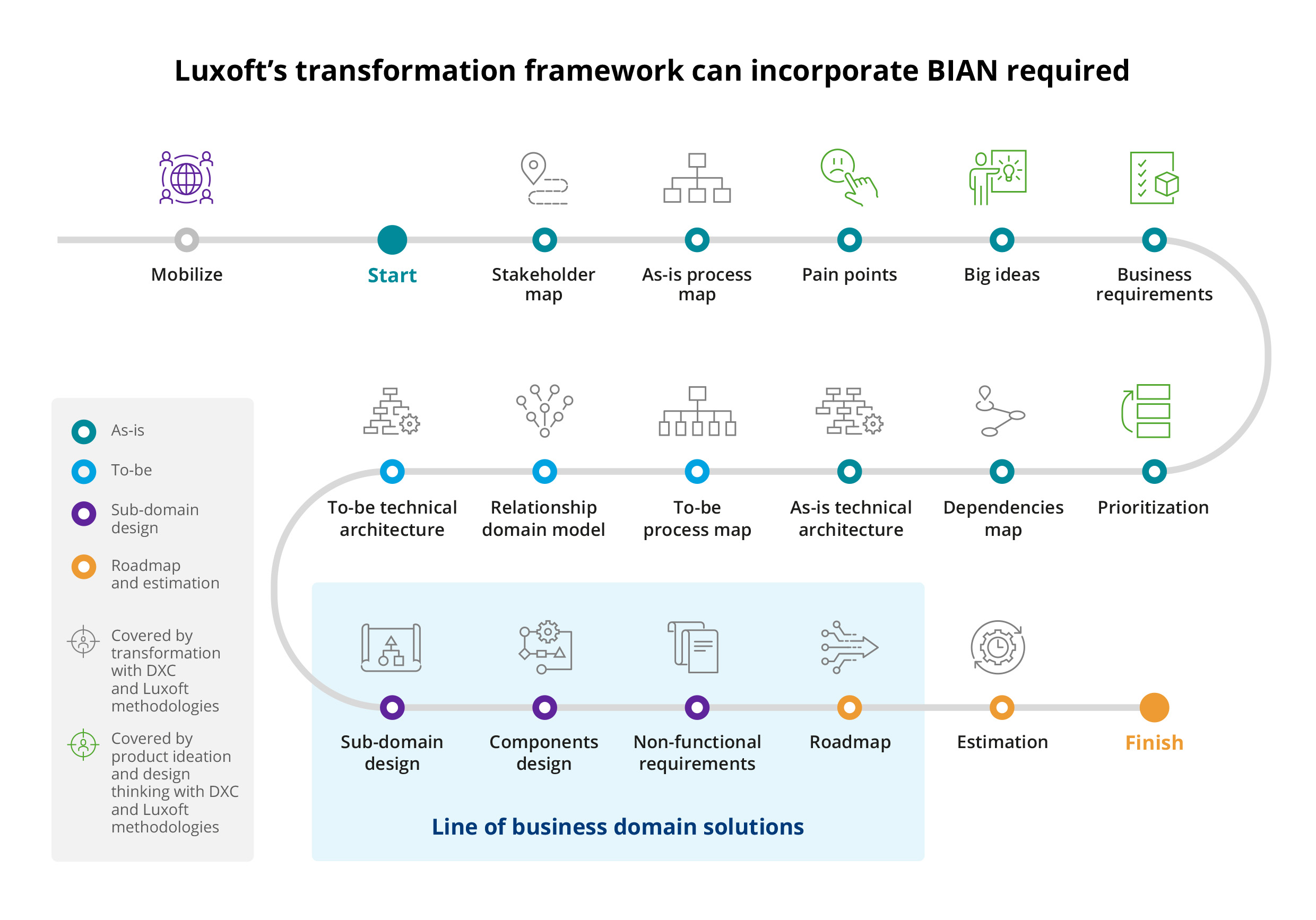

Progressive modernization using BIAN frameworks

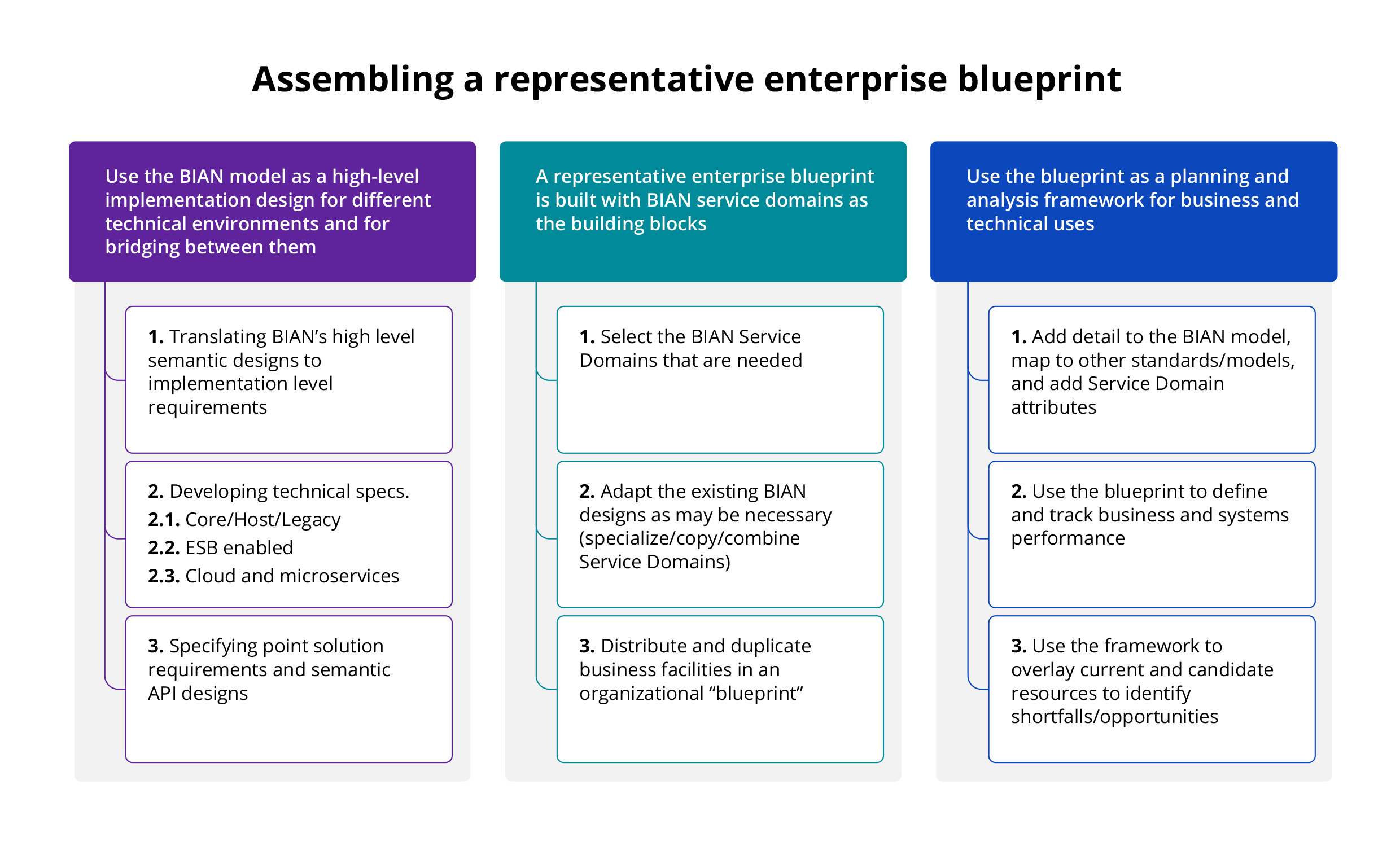

Detailed banking architectures and processes are built into the Hogan core. For componentization of the core applications, Zoreza Global aligned itself to the Banking Industry Architecture Network (BIAN) definition of a service landscape — and, more specifically, service domains — to create a granular view of the core application. Service domains define the building blocks supporting a discrete business capability. And when combined, multiple service domains provide end-to-end business processes and outcomes.

We follow a three-phase process to define a representative as-is and to-be enterprise blueprint.

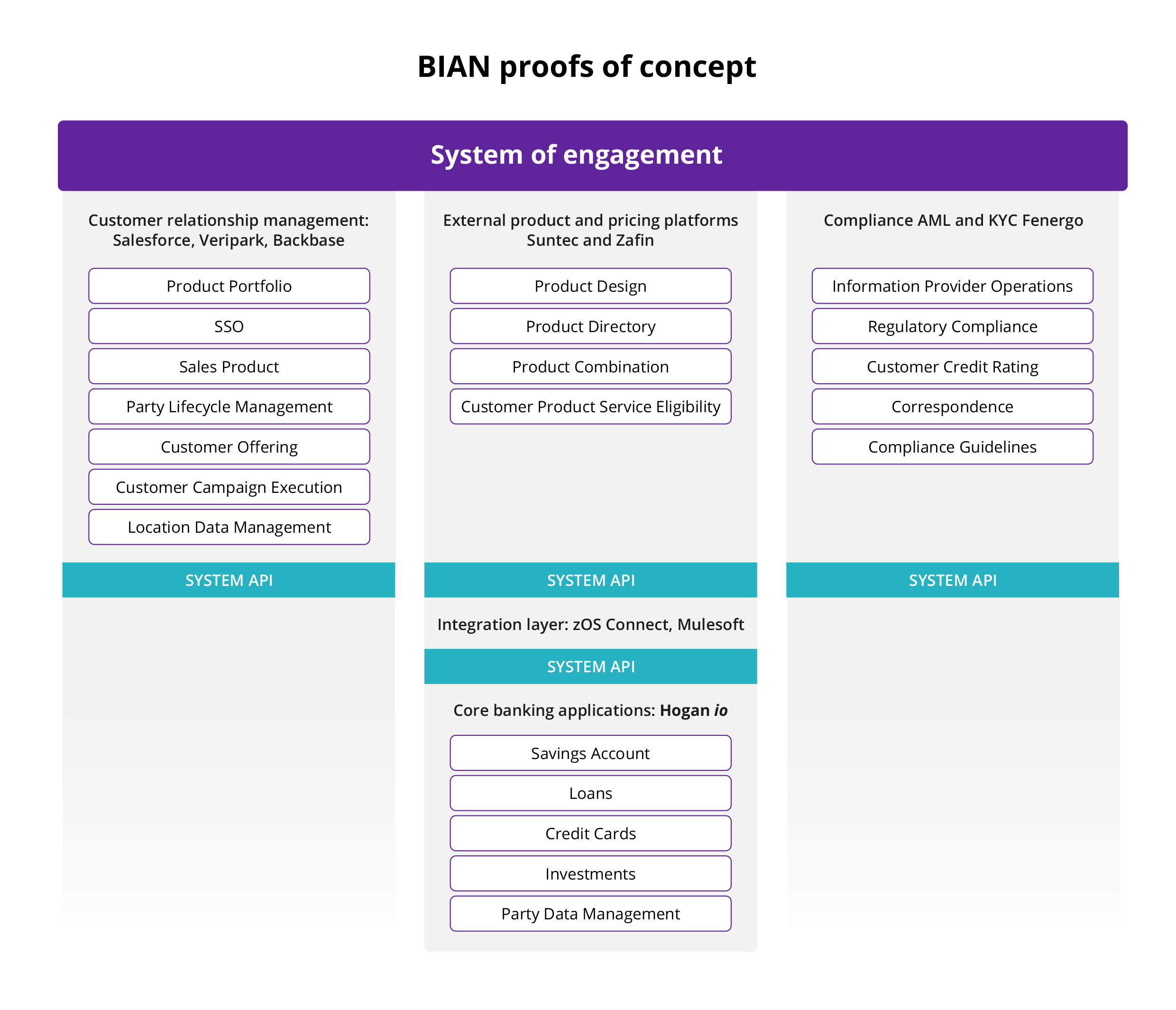

The chart below shows several BIAN-related proofs of concept that we’ve completed.

In addition, we’ve used IBM’s zOS Connect Enterprise Edition to prove how Hogan io extends mainframe assets.

API management

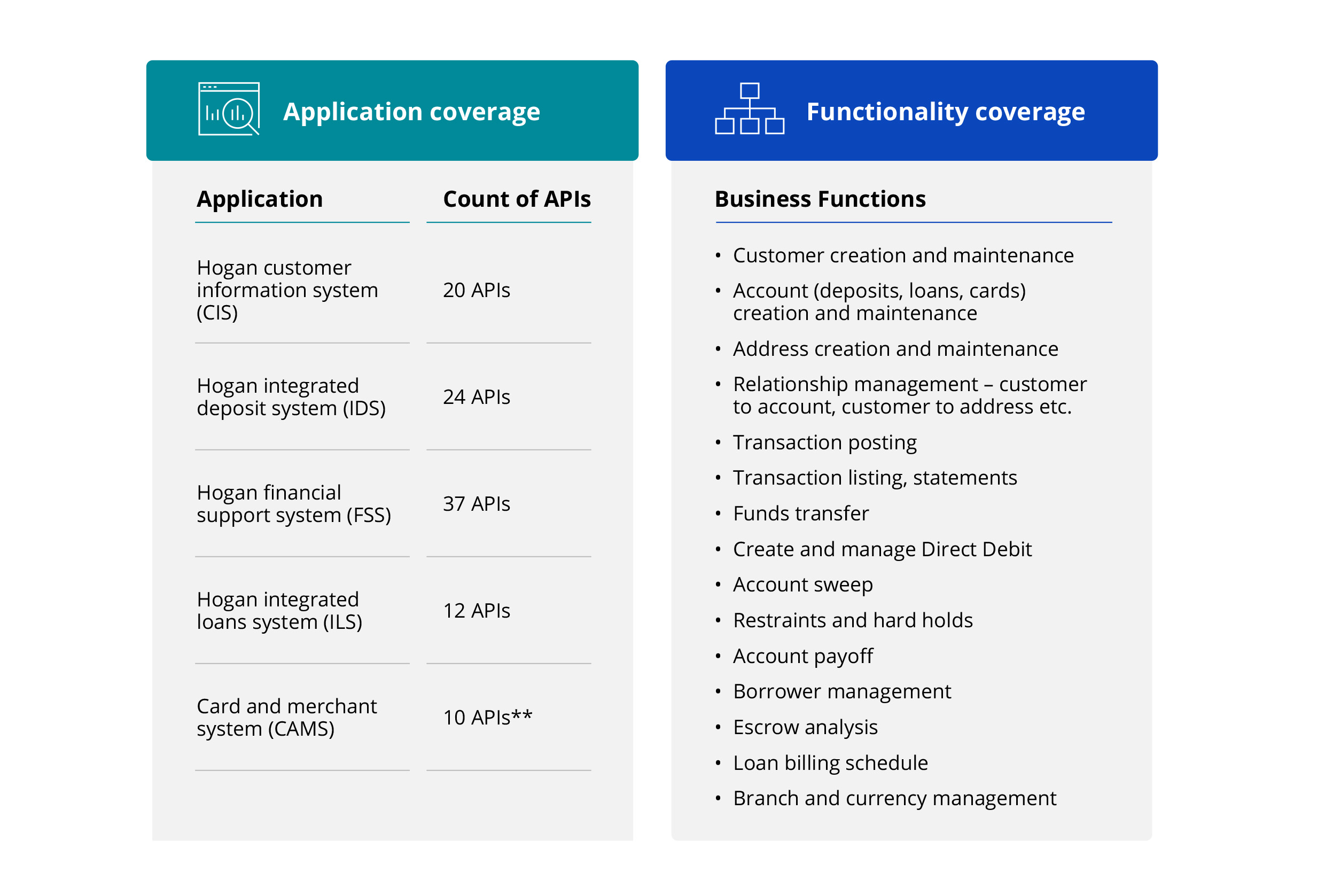

We have a solid inventory of available APIs:

Hogan application APIs

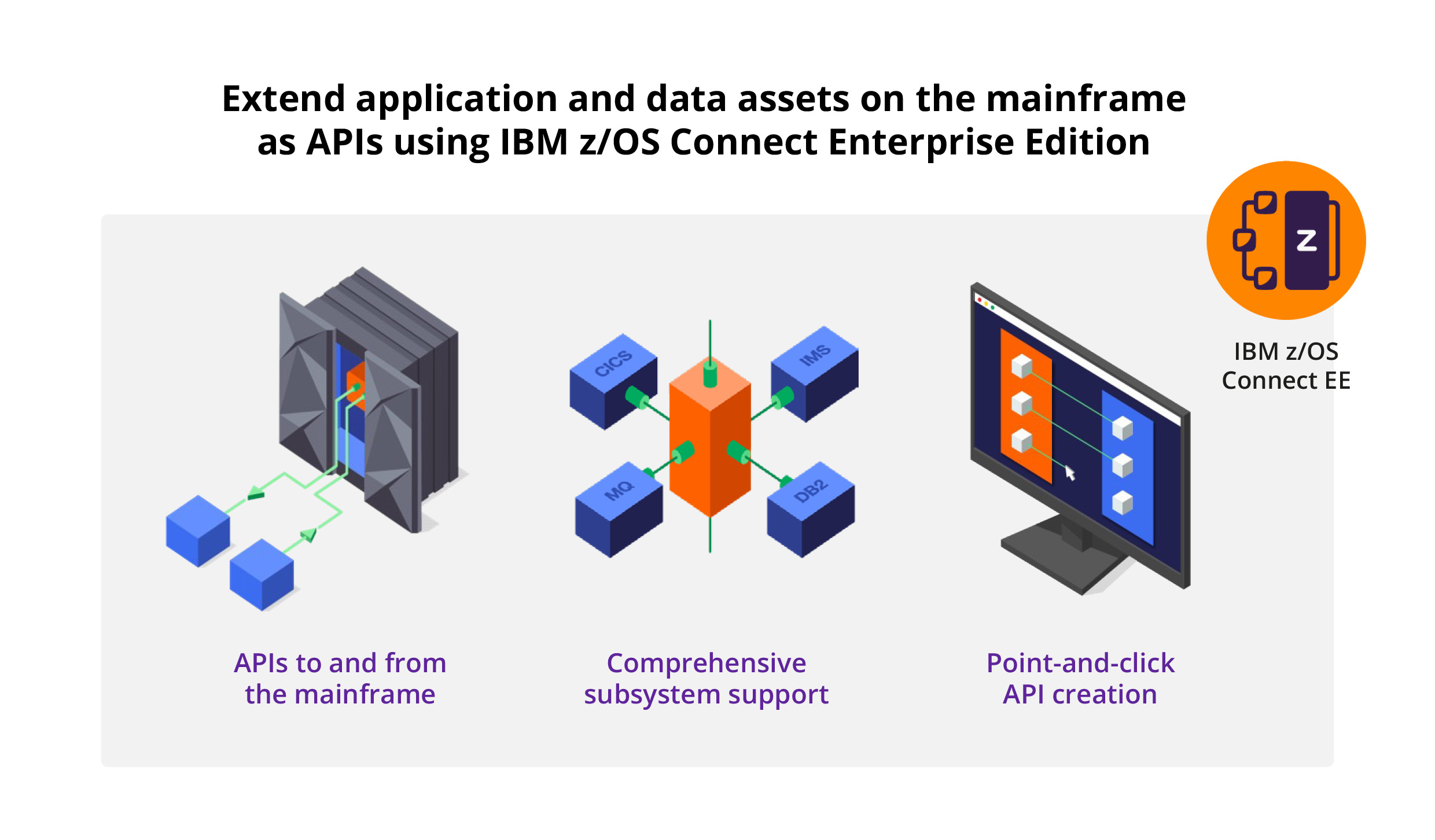

IBM z/OS Connect Enterprise Edition provides a strategic solution to expose and consume open RESTful APIs to and from the mainframe. It’s a one-stop solution, providing a unified interface for all major subsystems and data on the mainframe. The user-friendly, intuitive development and tooling interface allows modern developers to create APIs on the mainframe easily. The solution is based on industry-standard Swagger architecture and works with any standard API management tooling to publish.

Zoreza Global Hogan banking services development

Rather than a barrier to progress, we’ve proven that Hogan is a huge asset and enabler. Hogan enables the following:

Multichannel development:

- Continuing to invest in new technology and new business partners

- Increasing integration of all channels for information and customer experience

- Moving branch activity to advisory and complex services, things customers don’t feel comfortable doing for themselves

- Building a network that will appeal to future generations

- Growing need for cloud-based solutions to create more agility

Marketing:

- Shifting from traditional to digital marketing

- Emphasizing the use of analytics, social media, digital channels, integrated value propositions and mobile sales

- Ensuring new talent reaches leadership positions for both customer-facing and support functions

- Knowing the customer and tailoring marketing accordingly

- Integrating campaign management

Client experience:

- Progressing from product- to customer-centric strategies

- Connecting with customers when, where and how they want

- Providing ultimate convenience for customers as defined by them

- Delivering seamless, intuitive and easy customer access

- Knowing your customers by more effectively mining data, existing data, social data, etc., and having a 360-degree view of them

Data integration:

- Understanding what and where your customers buy is a powerful insight

- Focusing on enhancing user experiences by providing helpful customer data and unique value propositions

- Integrating simplified technology and client wallet

- Using existing data and other forms of data more effectively

“Improvements in platform performance and the broadening functional capabilities in core banking applications are driving CIOs to consider new technology solutions across all banking segments.”

Gartner, “Digital Demand in the Banking Industry and the Impact on Legacy Systems”

Why Hogan io?

Hogan has been serving the banking sector for more than four decades. Over 40 banks and card processors use Hogan as their primary core banking modernization application. Today that means processing over $5 trillion in deposits, which makes it one of the largest core banking systems in the world.

Hogan core banking applications provide a range of platform choices, including z/OS, Linux, Linux for System Z, Windows, or a hybrid of these operating systems. Platform flexibility lets you select a cost-effective environment with high availability, scalability, data security and other essential capabilities.

Mainframe hybrid cloud

The Hogan-powered, mainframe hybrid-cloud concept is a popular choice for banks. That way, they keep their core system of record — which runs well on a mainframe — but open it up to other possibilities. Sensitive data is secured in a fully customizable private cloud infrastructure, and less-sensitive assets are shifted to one or more highly flexible, low-entry-cost public cloud resources. However, banks cannot achieve this comprehensive solution without optimal alignment between core and new systems and an exceptional customer experience.

Digital modernization eases cloud deployment, but greenfield implementation increases risk and budget allocation for a large-scale operation. Banks need to move at least half of their systems to cloud providers to realize even the primary benefits of cloud services, but this comes with some degree of risk. While a private cloud might strengthen your control and resolve many compliance challenges, firewalls could inhibit collaboration and innovation.

Six benefits of mainframe hybrid cloud

Here are the benefits of mainframe hybrid cloud in a nutshell. It enables you to:

1. Increase business agility — fail fast, succeed faster

2. Release locked-in funds from inactive capital equipment, switching CapEx to OpEX

3. Expand scalability

4. Improve productivity via user-friendly platforms and dashboards

5. Upgrade the user experience by enhancing customer communication

6. Deepen partner relationships by collaborating more productively

As our clients continue to adopt mainframe hybrid cloud models, DevOps becomes a central driver, extending agility and controlling the lifecycle. Also, it promotes stability, greater automation and impact-free implementation.

Greater personalization

Holding customer data in product-defined silos blocks the development of a truly excellent customer experience. Without modernizing and committing to hyper-personalization, even simple things like giving each customer a 360-degree view across their deposit, saving and investment accounts are beyond reach. Hyper-personalization uses every conceivable internal and external data source to enable banks to better know their prospects and customers and achieve meaningful third-party collaboration. Mainframe hybrid cloud for banking provides the speed and agility necessary to boost engagement.

Extended partnerships

A transparent partnership ecosystem with access to best-of-breed solutions is central to the future of product innovation and development. That said, meaningful third-party collaboration will rely on cloud-enabled hyper-connectivity, which needs a modern core architecture and the latest technologies to flourish. A mainframe hybrid-cloud approach enhances experimentation, awareness and speed while increasing collaboration across the board.

The DXC, Zoreza Global and IBM partnership

DXC, Zoreza Global and IBM have been in partnership for over three decades. As you can see within the Hogan io eight-point plan, many of the recommendations we make regarding progressive modernization and mainframe hybrid cloud are centered around the latest IBM solutions.

Like to know more?

If you would like to know more about how Hogan io technology could rationalize and reshape your operations, optimizing costs, resource allocation and security, visit our website or contact us.