In brief

- Integrating mainframes with hybrid cloud architecture offers the best of both worlds: mainframe reliability and security, plus cloud scalability and innovation potential

- Reliability is essential for “always on” banking. For instance, a major European bank reported an impressive 99.999% availability after integrating their mainframe system with a hybrid cloud deployment, underlining the mainframe’s extraordinary resilience

- A cost-effective mainframe hybrid cloud strategy allows banks to modernize without discarding existing investments and expand mainframe capabilities with cloud service agility. In fact, a leading U.S. bank leveraged this architecture to modernize its applications, achieving a 70% reduction in processing time and significant cost savings

Not so long ago, mainframe hybrid cloud for banks was little more than one of many options.

Now, it’s a strategic imperative.

Increasingly, progressive banks looking to thrive in the digital age are embracing hybrid cloud architecture and integrating their mainframes. It’s a high-performance solution to the perennial challenge of maintaining the secure, agile, and reliable IT infrastructure demanded by the banking industry today, coupled with the need to look forward.

The main advantage

For decades, mainframes have formed the spine of banking operations. They provide robust processing capabilities, super resilience and unparalleled security. Mainframes handle massive transaction volumes with ease. According to IBM, they process something like 30 billion transactions a day, plus 87% of all credit card transactions, highlighting their critical role in banking.

Hybrid cloud

Hybrid cloud architecture combines public cloud flexibility with private cloud security and on-prem infrastructure. It allows banks to scale resources on demand, rapidly responding to market developments. Gartner predicts that by 2025, more than 90% of enterprises will have a hybrid cloud infrastructure and platform. However, fewer than 10% have an effective multi-cloud strategy to address complexity, attain simplicity and take advantage of the opportunity.)

Mainframe hybrid cloud

Integrating mainframes with hybrid cloud architecture offers the best of both worlds: Mainframe reliability and security, plus cloud scalability and innovation potential.

Cloud migration is gathering serious momentum

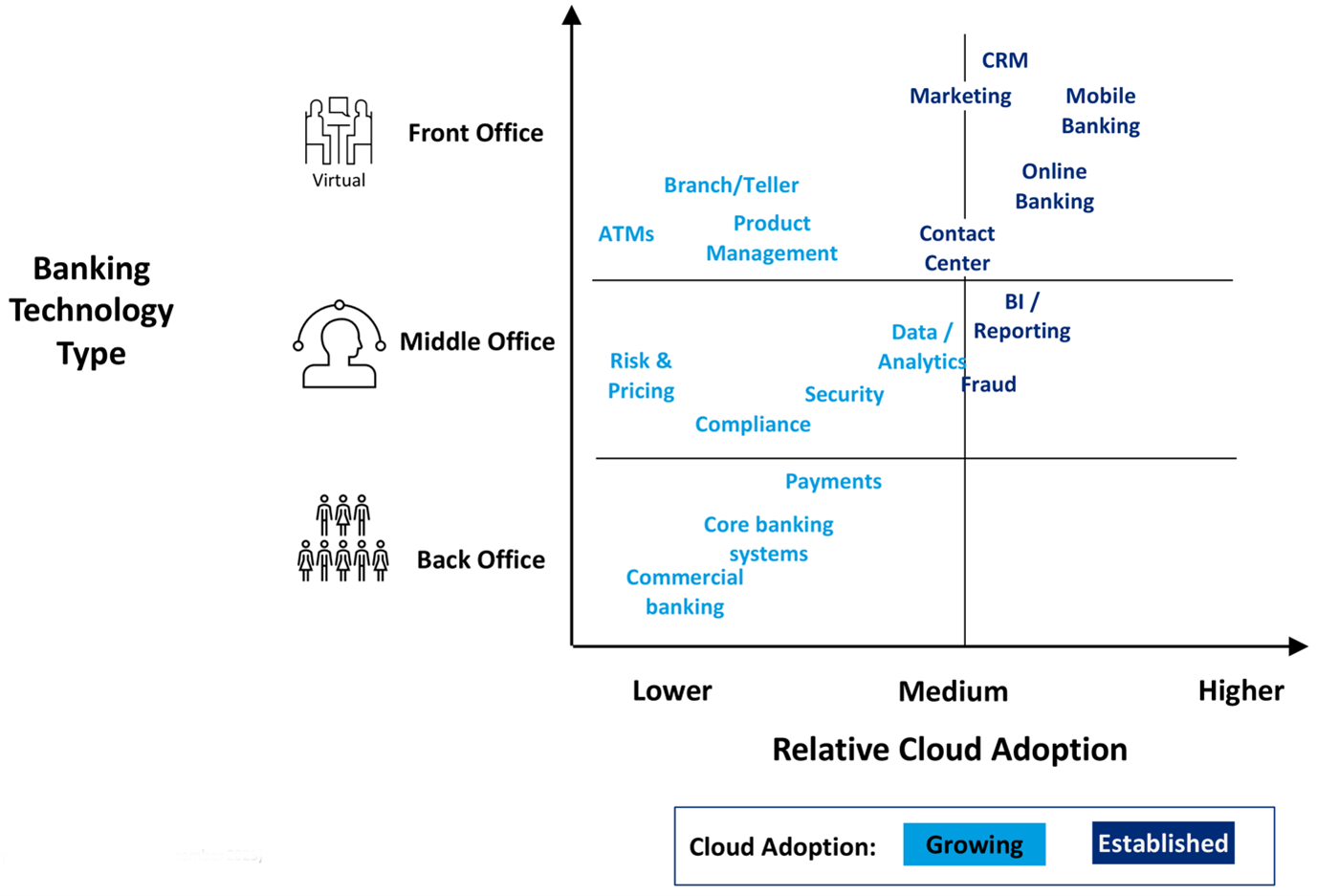

So says a 2023 Celent survey of financial institutions. Migration to the public cloud includes moving from legacy on-premises applications to the public cloud, hybrid cloud, public cloud on IaaS, public cloud on PaaS and SaaS:

Some technologies and processes, such as workplace systems that post and retrieve information with minimal data exchange, are better suited to the cloud. On the other hand, heavier, more complex solutions that manage massive amounts of data and transaction volumes are better on-prem and run in a mainframe.

Source: Celent: Improving Operational Excellence While Migrating To a Hybrid Cloud, Multi-Cloud World – Report 2023

Horizontal applications (especially customer-facing, front-office technology) are also moving to the cloud. These solutions often require real-time data and customer interaction for sales and service and usually have low data requirements. As are mobile/online banking, call-center technology, Salesforce, CRM and advisory relationship solutions that combine agent-assisted sales and service engagement with digital self-service.

Mainframe hybrid cloud implementation helps modernize on-prem infrastructure, enabling greater automation, expanded self-service capabilities and flexible workload deployment and management.

Peerless security and compliance

Security breaches can have catastrophic consequences, so the mainframe’s reputation for stiffened security is a significant draw. Its ability to handle encryption and security protocols at scale is unmatched — an IBM Z mainframe can process up to 12 billion encrypted transactions a day.

Complying with regulations like GDPR and PCI DSS is a must for banks. The mainframe’s robust audit and compliance tools offer a sheltered environment that helps meet the exacting requirements. This is crucial because a single oversight can bring hefty penalties and reputational scrutiny.

High availability and reliability

Downtime is banking’s nemesis. Fortunately, mainframe systems are noted for maintaining decade-long business continuity. They offer high availability features such as IBM Parallel Sysplex, which enables banks to run a cluster of up to 32 servers in parallel, ensuring high performance and continuous availability (even during maintenance or upgrades).

This reliability is essential for “always on” banking. For instance, a Central European bank reported an impressive 99.99% availability after integrating mainframe systems, underlining their extraordinary reliability.

Scalability and hybrid flexibility

Banking workloads fluctuate with market conditions, customer behavior and transaction volumes. Mainframes are ideal for scaling up to meet peak demands without compromising performance. And when integrated with hybrid cloud services, the scalability becomes even more remarkable.

The hybrid model allows banks to leverage cloud resources for less critical, variable workloads while keeping core, high-volume transactions on the mainframe. This blend of on-prem high-performance and cloud flexibility is perfect for banks rapidly responding to fluctuating markets.

In addition, banks seeking to grow through mergers and acquisitions have the assurance of scalability. Many that have adopted Hogan (running on the IBM Z mainframe) have been among the world’s fastest-growing banks.

Cost-effective modernization

Modernizing IT infrastructure is expensive. Importantly, a cost-effective mainframe hybrid cloud strategy allows banks to modernize without discarding existing investments and expand mainframe capabilities with cloud service agility. In fact, a leading U.S. bank leveraged this architecture to modernize several of its workplace applications, achieving a 70% reduction in processing time and significant cost savings.

Innovation and agility

The agility provided by a hybrid cloud model is a primary driver for digital innovation. Mainframe systems offer a stable, high-performance foundation. At the same time, integration with cloud services enables banks to experiment with the latest front-end technologies and generative AI, machine learning (ML) and advanced analytics without disrupting core banking functions. Banks can deploy a combination of ML cloud models to score on mainframe transactions to enhance the customer experience or improve risk management and tackle fraud.

Enhanced data management and analytics

The importance of effective data management is well known and mainframes offer superior capabilities in managing vast data volumes. Banks can use cloud analytics tools to glean actionable data insights while their mainframe systems ensure that high-quality, high-volume data is processed efficiently.

A long-standing Zoreza Global client, a large multinational bank, integrates mainframe data with cloud analytics to gain real-time insights into customer behavior, improving decision-making and customer service.

Simplifying IT complexity

Inevitably, as a bank grows, its infrastructure becomes increasingly complex.

Cloud costs have also increased, e.g., mounting transaction volume and platform management. Consequently, banks are looking to accelerate hybrid cloud efficiency and procure the appropriate internal and external resources to make this happen. A recent report into the escalating cost of cloud computing showed that spending had overtaken security as the #1 management challenge and a lack of resources/expertise was next in line.

Source: Celent: Improving Operational Excellence While Migrating To a Hybrid Cloud, Multi-Cloud World – Report 2023

Mainframe hybrid cloud offers a streamlined solution to simplify IT management. The centralized nature of mainframes makes them easier to manage and secure. At the same time, cloud integration provides the flexibility to deploy new services rapidly.

Simplicity and ease of management are crucial for banks, allowing them to focus more on their core business and less on complicated technological issues.

ESG (environmental social governance)

An often-overlooked advantage of the mainframe hybrid cloud architecture is environmental sustainability. Combining agile cloud working with energy-efficient mainframes enables banks to optimize their data center footprint and energy consumption (data centers use around 1% of the world’s electricity), contributing to a greener planet.

Consolidating Linux workloads on 5 IBM z16 systems instead of running them on compared x86 servers under similar conditions can reduce energy consumption by 75%, space by 50% and the CO2e footprint by over 850 metric tons annually.

A strategic imperative for banks

Mainframe hybrid cloud architecture in banking is not just a technical choice. It's a strategic imperative, balancing the need for security, reliability and scalability with the agility and innovation demanded by digital working. By integrating mainframe resilience with the flexibility of cloud computing, banks can remain competitive, compliant and customer-centric. Success relies on using this to maximum effect, ensuring that banks not only master current challenges but are also primed and ready to exploit future opportunities.

As technology evolves, mainframe hybrid cloud strategies will play a pivotal role in banking’s digital transformation, mapping a journey that pairs tradition with innovation, stability with agility and performance with efficiency.

A mainframe hybrid cloud architecture harnesses the proven reliability and security of mainframes while embracing cloud scalability and innovation. This synergy is critical in an industry where trust and innovation are central to customer attraction and retention. And while mainframe hybrid cloud architecture is laying a secure foundation, it’s also preparing the bank for a future where agility, foresight and an unwavering commitment to customer service are attraction and retention table stakes.

The Hogan x core banking system

As a processor and system of record, Zoreza Global’s Hogan core banking platform has become the driving force behind some of the most influential banks in the world.

Now, we’ve enhanced Hogan’s exceptional mainframe hybrid cloud solution by taking the best IBM Z solutions and providing blueprints for banks with aging cores to be “migrated to platform.” Or Hogan x can help you create a whole new digital bank, i.e., our “Bank in a Box.”

Hogan x follows the BIAN (Banking Industry Architecture Network) principles of being componentized and composable. It also takes advantage of Z Linux and other containerized and cloud-native solutions. Zoreza Global can also deliver Hogan x in consumption-based, as-a-Service models.

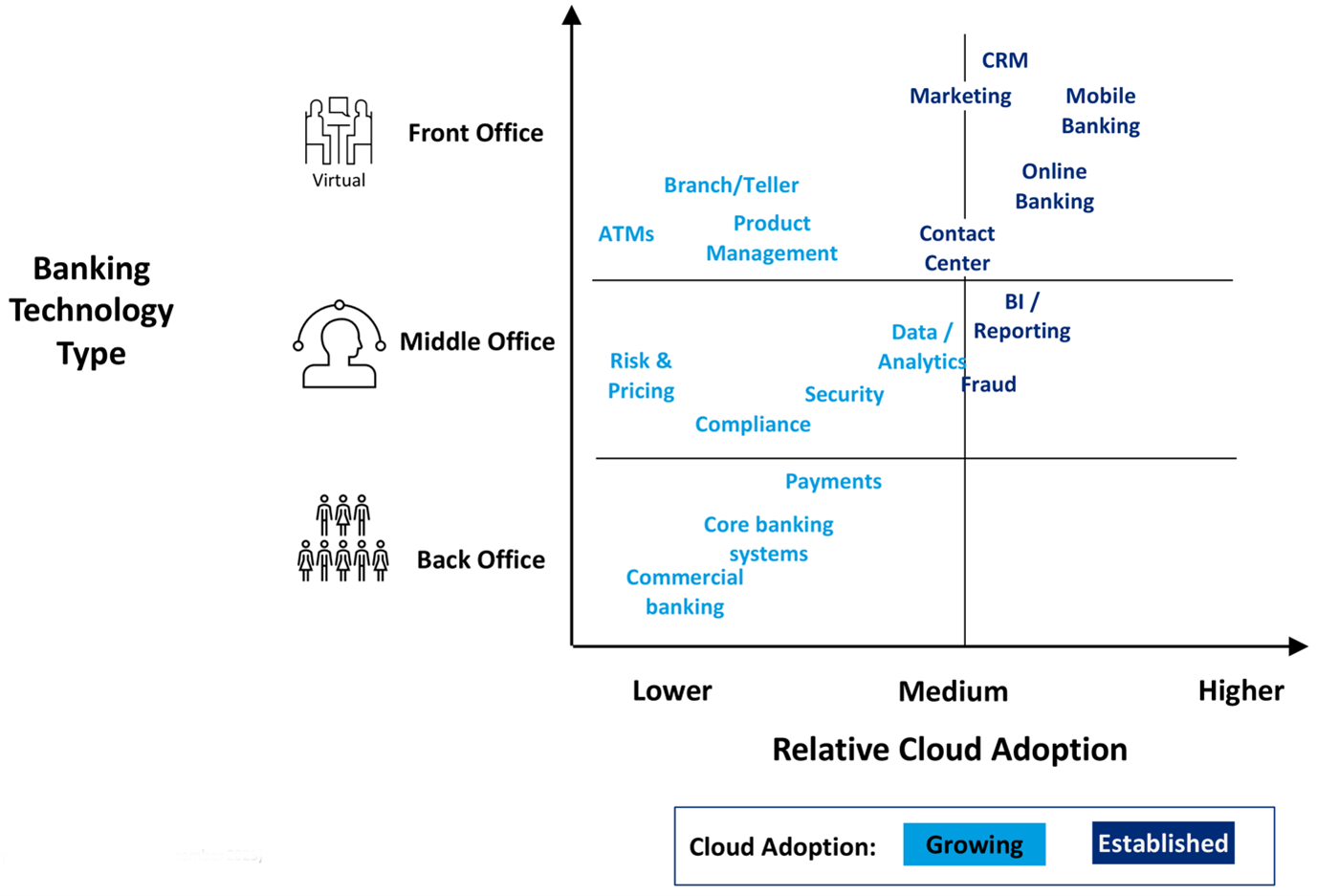

Adopt a best-fit strategy

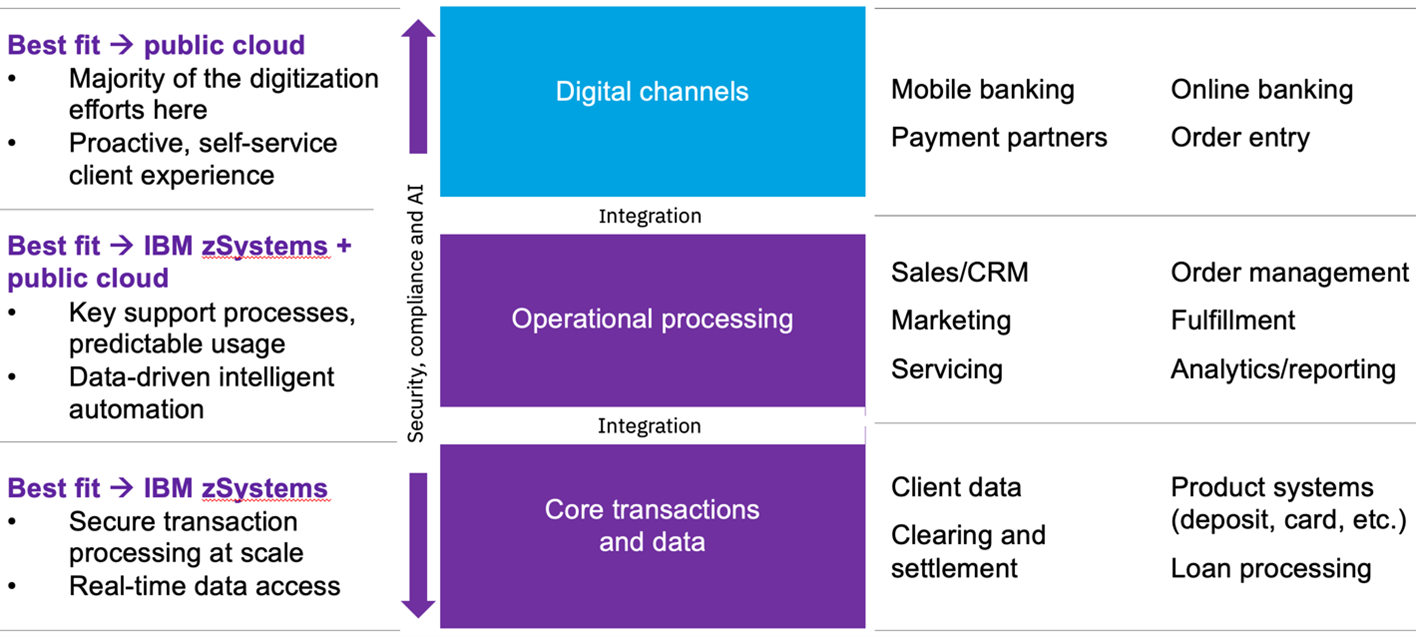

Mainframe hybrid cloud architecture allows you to adopt a best-fit strategy for application deployment. Here’s a representative application ecosystem (across IBM Z and cloud) for banking.

Source: IBM

The applications are divided into three distinct areas: Digital channels for client engagement, operational processing (e.g., order management, marketing and sales) and core transactions and data (core banking and credit cards). All these applications must work together to share real-time information and maximize their business effectiveness. Integration is vital for achieving wholesale interoperability.

A mainframe hybrid cloud model with IBM zSystems helps clients optimize costs, performance and agility based on their application type and best-fit infrastructure. Take digital channels, for example. A high degree of omnichannel interaction relies on partner and customer-information integration to create the best possible customer experience. This, plus variable change and workloads, make cloud-based solutions your perfect choice.

Get moving with Zoreza Global and IBM

A mainframe hybrid cloud architecture that includes IBM zSystems allows clients to select best-fit infrastructure, optimizing cost, scale and sustainability while reducing duplication, strengthening security and delivering simplicity. All this while providing modern data access across your application ecosystem.

Zoreza Global and IBM are working to help banks optimize and transform their core banking systems, anticipating lifestyle and offering innovative solutions. The combination of Hogan and IBM z16, with its robust data-processing capabilities and enhanced security features, enables banks to protect data, ensure compliance and improve the customer experience through faster, frictionless processes.

IBM z16, Hogan and quantum safety

Speaking of innovation, the prospect of quantum computing is already changing the way we think about how to secure sensitive information and maintain essential application and infrastructure integrity.

Although practical quantum computing is several years down the road, we need to develop quantum-safe cryptographic strategies now while we still have time to consider the business and social impact. Integrating crypto-agility with system modernization will be a massive undertaking for top-tier banks, involving the entire cast of financial services players and standards bodies (e.g., NIST) and underpinned by cross-industry cooperation at all levels.

Any classically encrypted (e.g., public-key cryptography) wire-tappable communications are vulnerable and already at risk, the idea being to “harvest data now, decrypt later” when quantum decryption solutions are finally realized. The IBM z16 provides extra protection by encrypting data wherever it resides — at rest, in-flight and now, in use with fully homomorphic encryption.

Hogan mainframe hybrid cloud

Hogan-powered, mainframe hybrid cloud architecture is the preferred choice for banks. It allows them to keep their core systems of record — which run well on mainframes — but open them up to greater possibilities. Sensitive data is secured in a fully customizable private cloud infrastructure, and less-sensitive assets are shifted to one or more highly flexible, low-entry-cost public clouds. That said, banks cannot achieve this holistic solution without accurately aligning core and new systems and developing an exceptional customer experience.

Digital modernization eases cloud deployment, but greenfield implementation increases risk and budgetary pressure for a large-scale operation. Banks need to move at least half of their systems to cloud providers to realize even the primary benefits of cloud services. However, this can bring additional risk and inconvenience. While a private cloud might strengthen your control and resolve many compliance challenges, firewalls could inhibit collaboration and innovation.

We’re banking’s biggest supporters

Dominant marketing strategies are based on the fact that the successful adoption of a mainframe hybrid cloud banking solution is not just about the technology. It also relies on the partnership and guidance we provide throughout the journey. Here are four prime elements that make a strategy effective:

- Customized solutions: By partnering with banks individually, we can tailor Hogan x to their unique needs, ensuring a seamless fit with their existing infrastructure and future goals

- Expert guidance: We act more like a trusted advisor than a simple vendor. Zoreza Global and IBM experts guide banks through the complexities of migration and platform selection, helping them make better-informed decisions

- End-to-end support: Hogan x offers comprehensive support from pre-implementation consultation to post-implementation support. We march alongside our clients throughout the transformation journey

- Relationship building: Building long-term relationships with our banking partners fosters trust and confidence in Hogan x. This approach aligns with our portfolio’s core purpose, emphasizing partnership and empowerment

- Value-driven results: Solution-centric partnering ensures that banks buy into our technology and derive maximum value. We focus on delivering results that positively impact our clients’ operational efficiency, agility and competitiveness

Find out more

To learn more about how Hogan-powered mainframe hybrid cloud enablement works in practice, visit our website. However, if you’d like to delve deeper and discover what implementation could do for your bank, contact us.