In brief

- Mainframe hybrid cloud enablement offers speed, scalability, and revenue growth benefits to the banking industry while ensuring data security and operational resilience

- To successfully implement this transformation, banks need to address challenges such as business continuity, workforce motivation, hybrid cloud culture, and convincing stakeholders of the project's value

- Adopting a joint IT-business transformation strategy and thinking long-term are crucial for maximizing the business benefits of cloud migration, while robust governance, security strategies, and best practices like DevOps are essential for success

Mainframes are dead.

Or that’s what a growing number of IT commentators would have you believe. Word on the street is that legacy technology is slow, inflexible and a millstone around the neck of would-be progressive businesses. And there’s a lot in what they say for most industries, particularly when Amazon (moving from simple bookseller to streaming content and cloud services provider) is showing the way with a completely new and wildly successful transactional platform. But banking is different.

The banking industry relies on operational resilience. Banks cannot afford to lose a single piece of the terabytes of sensitive data they hold. Sure, they must move with the times, but not at the expense of data security. And the only way to achieve that securely is by transforming legacy systems in-line with market changes, world events and emerging technology.

Sorting fact from fiction

Mainframe hybrid cloud enablement is becoming a great favorite of Hogan clients keen to boost speed, scalability and revenue growth. On-premises data centers store extra-sensitive, encrypted data. By shifting mission-critical applications, data and analytics to a careful mix of private and public clouds, banks can enjoy the best of the new while keeping a tight rein on their most valuable assets.

As I’m sure you realize, change on this scale is not to be taken lightly; you’re not shopping at the bargain counter. In addition to the expense, there’s the problem of separating crucial guidance from cloud hype. It’s a significant challenge with plenty of imponderables for both individual firms and the industry itself.

How, what, why?

For instance, how will the bank implement this invasive operation (lift and shift, refactoring, rewriting?) without disrupting business continuity? What about embedding an enterprise-wide hybrid cloud culture, motivating the workforce, transferring workloads or adjusting to hybrid cloud work patterns? How will you convince the C-suite that cloud expenditure can reduce TCO or create a kind of hatchery for nurturing and accelerating innovative ideas? Why should decision-makers and front-line employees buy into your flagship project anyway?

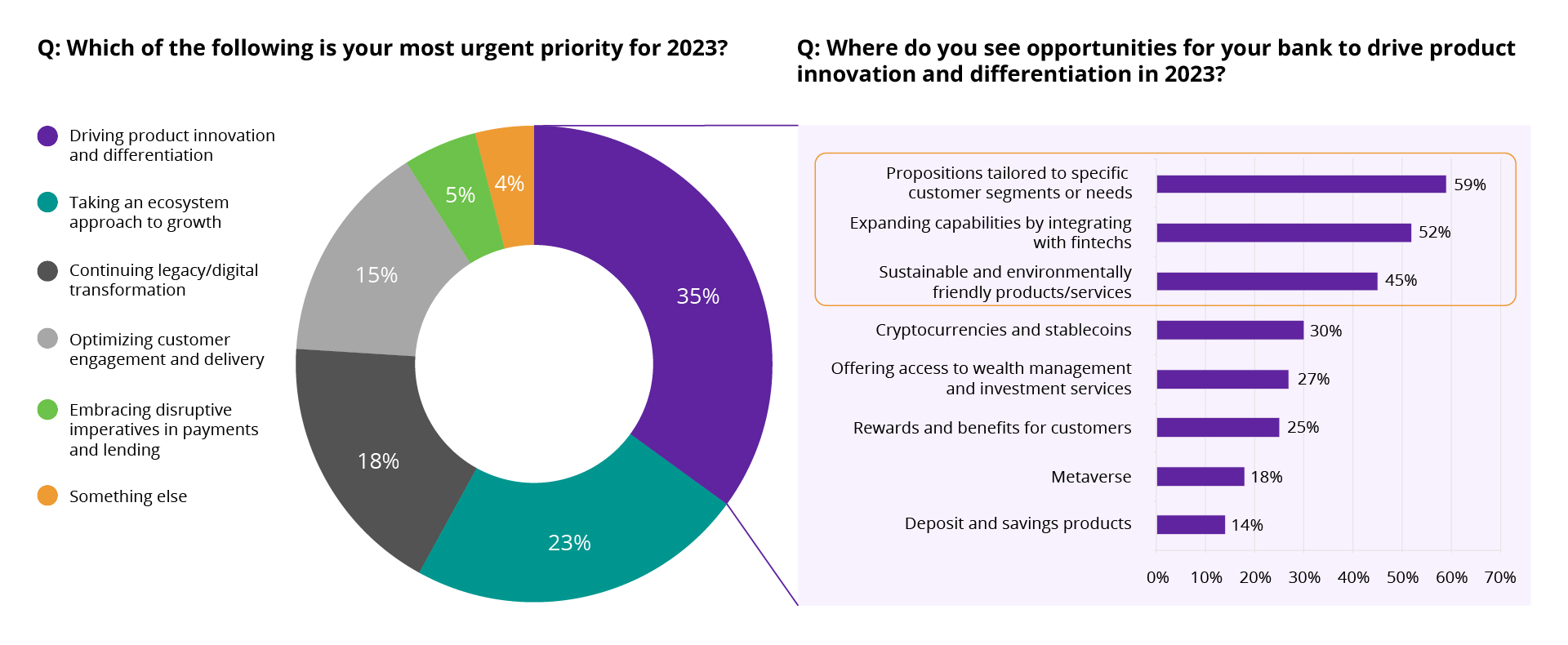

Product innovation is the single most urgent bank priority in 2023

Source: Celent Survey on Banking Trends and Priorities 2023 Summary of Findings

Feel the benefit

Answers to these (and many more) questions will provide the bedrock for your road to cloud banking success. Here are just some of the business benefits of hybrid cloud adoption you’ll enjoy:

- Outstanding productivity — superior efficiency supports growth while cutting costs

- Preserved business continuity — minimal downtime

- Flexible scalability — dial storage up/down at will and only pay for what you use

- Better business agility — fail fast, learn faster

- Advanced analytics — real-time predictive analytics enable hyper-personalization

- Critical access to locked-in funds — shift from CapEx to OpEx

- Smoother user experience — enhanced engagement (including user-friendly dashboards)

- Optimal footprint — more cost-effective

- Closer partner relationships — greater collaboration

Left to their own devices, doubters find their voices. One way to quiet them is to build a holistic business case around a series of use cases centered on security, resiliency and other values listed above. This will encourage colleagues to play down the more shapeless and shadowy cloud theories, focus on the case at hand and recognize the real business benefits of cloud migration.

One head is better than two

To develop a potentially exclusive IT project into a joint IT-business transformation strategy, attitudes must change. Exclusive tech and business factions need to work together as cross-functional teams, reorienting the initiative to highlight the business value that cloud migration will generate.

Also, launch migration with a wholesale product, service or function rather than by choosing ad-hoc applications. This will allow you to create an iterative approach with appropriate support that can be repeated across the enterprise, building skills and learning from experience. Once the migrated assets join forces in their business domains, value sparks will begin to fly.

The idea is, joint teams can calculate the amount of modernization required to maximize the business benefits and then develop cloud-enabled business use cases based on the advantages of automation, predictive analytics, exceptional CX and so on.

Think long-term

However, if you only look at cloud migration as a short-term fix, obstacles will likely outweigh the opportunities. Applying your familiar on-premises controls to on-cloud working can cause disruption and security gaps. A robust governance and security strategy must be conceived and implemented consistently across public and private clouds. In addition, applying DevOps and site reliability engineering (SRE) best practices reduces vulnerability, maximizing automated benefits and operational efficiency.

Security as code (SaC) is fast becoming a must-have for cloud security. SaC embeds security into DevOps workflows, detailing code and infrastructure changes, and locating and inserting new checks and balances without slowing BAU or inflating costs. It automates app and infrastructure code testing, checking security, resiliency and regulatory requirements with standards instantiated as code instead of text. Unsuitable code is automatically canceled, while faulty code is amended, affirmed and made compliant. Infrastructure as code (IaC) takes a similar approach, adding security to DevOps velocity.

Without this robust framework, each app could end up costing more to migrate than its predecessor because by simply transferring existing process and operational issues to the cloud, you’re escalating the bank’s technical debt.

Greater agility cuts reaction time

On the brighter side, adopting a mainframe hybrid cloud approach to complement a passion for hyper-personalization brings essential services like providing customers a 360-degree view across their deposit, saving and investment accounts within reach. And the resulting speed, flexibility and simplification are vital characteristics in extreme markets.

Why? Because the more time it takes to process the flood of data from multiple sources, the longer it exposes the bank to unnecessary risk. Hogan mainframe hybrid cloud enablement conceals complexity and allows banks to react faster to market threats and opportunities.

Shield your sensitive data

Hogan has been serving the banking sector for more than 4 decades. Over 40 banks and card processors use Hogan as their primary core banking modernization application. Today that means processing over $5 trillion in deposits, which makes it one of the largest core banking systems in the world.

Needless to say, the mainframe hybrid cloud model powering Hogan applications is a popular choice for banks. Adoption of this approach allows organizations to secure sensitive data in fully customizable private cloud infrastructure and move less-sensitive assets to one or more highly versatile, low-cost public cloud resources.

Cloud migration has risen to the top of banking boardroom agendas as decision-makers become more convinced of its IT and business benefits.

Make your bank more resilient

Zoreza Global is a trusted provider of change, modernization and operational services for banking and capital markets. By partnering with market-leading tech companies, Zoreza Global expands its ecosystem of innovative services, technologies and talent, enhancing customer relationship management and empowering clients to achieve better business outcomes.

We regard cloud migration and progressive, mainframe-based, core-application modernization as two sides of the same transformational coin. Zoreza Global develops and invests in talented people who keep the on-premises infrastructure operationally resilient, maintaining the core and innovating around it. Our experts possess the right skills and experience in Hogan core banking applications to control and modernize this vital part of client architecture.

Want to know more?

To learn more about how Hogan mainframe hybrid cloud enablement works in practice, visit our Hogan hybrid cloud solution page. However, if you’d like to delve deeper and discover what Zoreza Global’s cloud innovation and unrivaled domain knowledge can do for your bank, contact us.