In brief

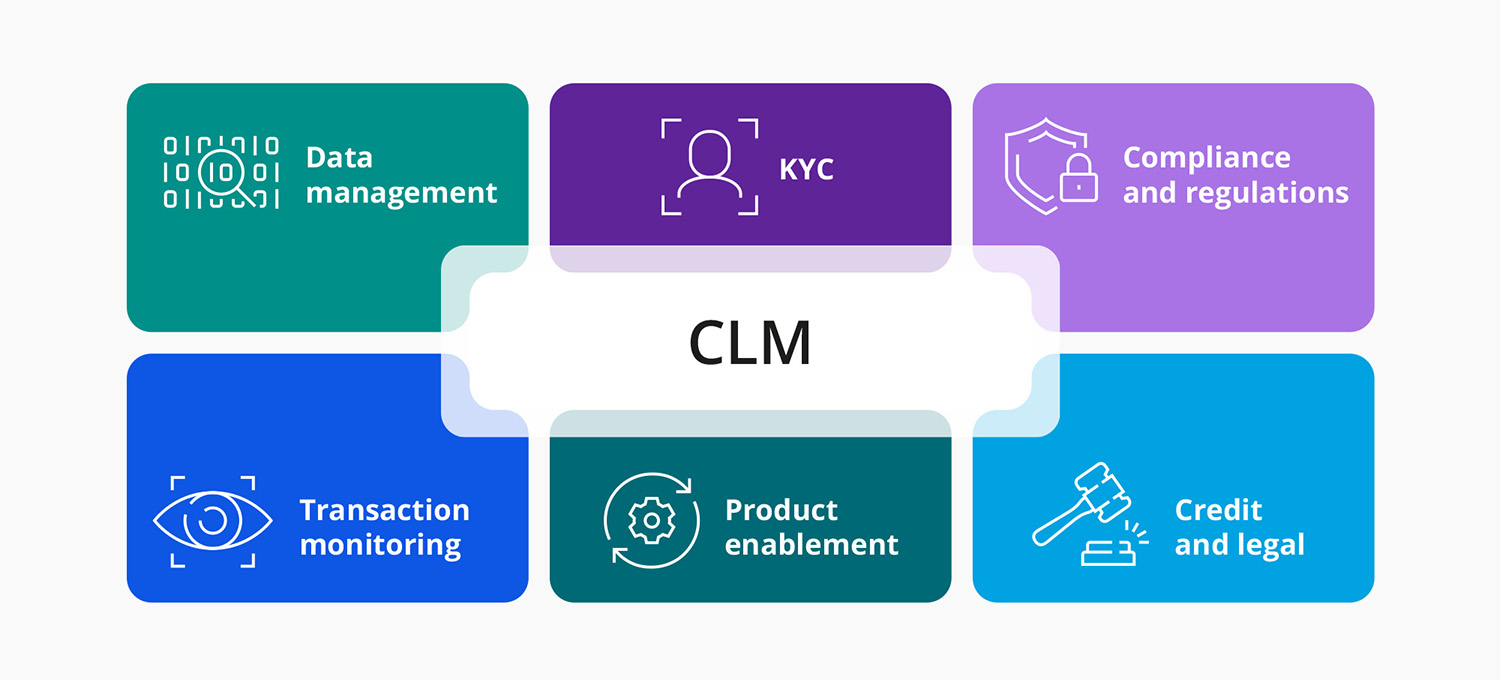

- Increasing the regulatory focus on effective customer intelligence has driven banks to deploy a disparate mix of know your customer (KYC) systems and technologies to monitor customer and transaction risk. Client lifecycle management (CLM) best practices help rationalize workstreams, providing greater insight, business value and customer satisfaction

- Integrating advanced analytics and AI into CLM systems allows for predictive modeling and personalized client experiences at scale. The use of ML algorithms in CLM significantly increases cross-selling success rates by identifying client needs before even the customers recognize them

- Mainframe hybrid cloud architecture is not just a technical choice for banks. It’s a strategic imperative, balancing the need for security, reliability and scalability with the agility and innovation demanded by an efficient and effective CLM strategy

Just 21% of U.S. retail customers were advised by their banks in 2022-2023 even though many were struggling financially. Interestingly, 47% of the lucky few who did receive practical advice opened a new account with their advisors — forward-looking banks that recognize the added value in client lifecycle management (CLM).

CLM is paramount in ensuring contemporary banking success. It coordinates the entire client journey, from onboarding and ongoing relationship management to potential offboarding. CLM enables streamlined customer interactions, enhanced satisfaction and cultivates long-term relationships. Effective CLM helps build, maintain and polish every facet of a client relationship until it shines, and CLM best practices see to it that each gleaming engagement is perfectly set for lasting profitability.

CLM improves real-world situations

CLM best practices enhance the quality of customer experiences while also optimizing regulatory compliance and operational efficiency. A CLM overhaul offers a rare opportunity to optimize your value proposition internally and enhance the customer journey. From prospecting to onboarding and transaction monitoring, CLM involves many complex processes that can put banks and their client relationships at risk if they are not carefully executed and monitored from the outset.

Robust CLM best practices leverage data-driven insights, enabling banks to personalize their services, anticipate client needs and deliver tailored solutions. While AI, machine learning and emerging technologies intelligently automate repetitive tasks and simplify CLM procedures, hyper-personalization humanizes the tech experience.

For example, you can use AI to help predict client requirements and personalize contact points, involving managers in significant decisions and coating efficiency with credible engagement and personality. A CLM approach enables banks to streamline and orchestrate the client journey, improving compliancy, minimizing risk and driving sustainable growth.

CLM challenges:

- Creating connected experiences like that “one bank” feeling

- Delivering efficient self-service capabilities through integrated channels

- Balancing the need to meet customer expectations for efficiency and security with maintaining an effective and robust internal regulatory framework

- Managing the appropriate storage, access and sharing of customer, KYC, AML, regulatory and product data

- Building low-touch or straight-through processes

- Designing a high-level systems operating model and requirements from customer portals/CRMs, through CLM applications, to downstream systems

- Aligning in-house legacy systems, vendor applications and new technology with the desired business flows

CLM best practices:

- Modernize the infrastructure. Structural challenges keep many banks from using data-driven analytics to engage customers, grow relationships and measure CLM effectiveness. A mainframe hybrid cloud approach addresses this issue

- Invest in technologies that use data like FinTechs (73% of the executives in a recent survey said they struggle to turn data into valuable insights)

- Nurture customer trust and regulatory compliance with robust and continuous due diligence frameworks. Deployment helps identify and diminish risks ahead of time

- Implement RegTech solutions that can reduce KYC and onboarding times by up to 70% (around 75% of banks surveyed admitted that they’d lost customers because of account opening delays)

- Deploy APIs that drive reciprocal ecosystems that smoothly assimilate third-party services to refine the CLM process

- Uproot departmental silos and enhance the customer journey. Integrate IT, compliance, front office and operations to improve collaboration, risk management and client satisfaction

- Align the channel mix with customer preferences. Around 80% of the value created by the world’s most successful growth companies comes from unlocking new revenue from existing customers

- Secure data integrity. Impactful CLM relies on current and accurate data. Invest in resilient data platforms that maintain data integrity throughout the cycle

- Implement advanced cybersecurity measures and educate customers about security best practices. One global bank reported that voice biometrics has prevented more than 1,000 account takeovers and saved 40+ seconds a call on average

- Execute CLM best practices in line with individual corporate strategies. Organizing a pilot program avoids wholesale rollout risks

Increased focus on KYC

Know your customer (KYC) protocols accurately establish identity and assess potential banking risks. The increasing regulatory focus on effective customer intelligence has driven banks to deploy a diverse mix of KYC systems and technologies to monitor customer and transaction risk.

While a large bank is unlikely to achieve the same level of customer understanding as a small community bank, the availability of new tools that help rationalize KYC workstreams and provide heightened insight is a promising development.

These tools gather due diligence and transactional data, providing invaluable intelligence to help reduce fraudulent activities and allow banks to tailor services to individual client needs and risk profiles. Continuous staff training and the integration of CLM principles are crucial, ensuring that employees embrace technological updates and breakthroughs.

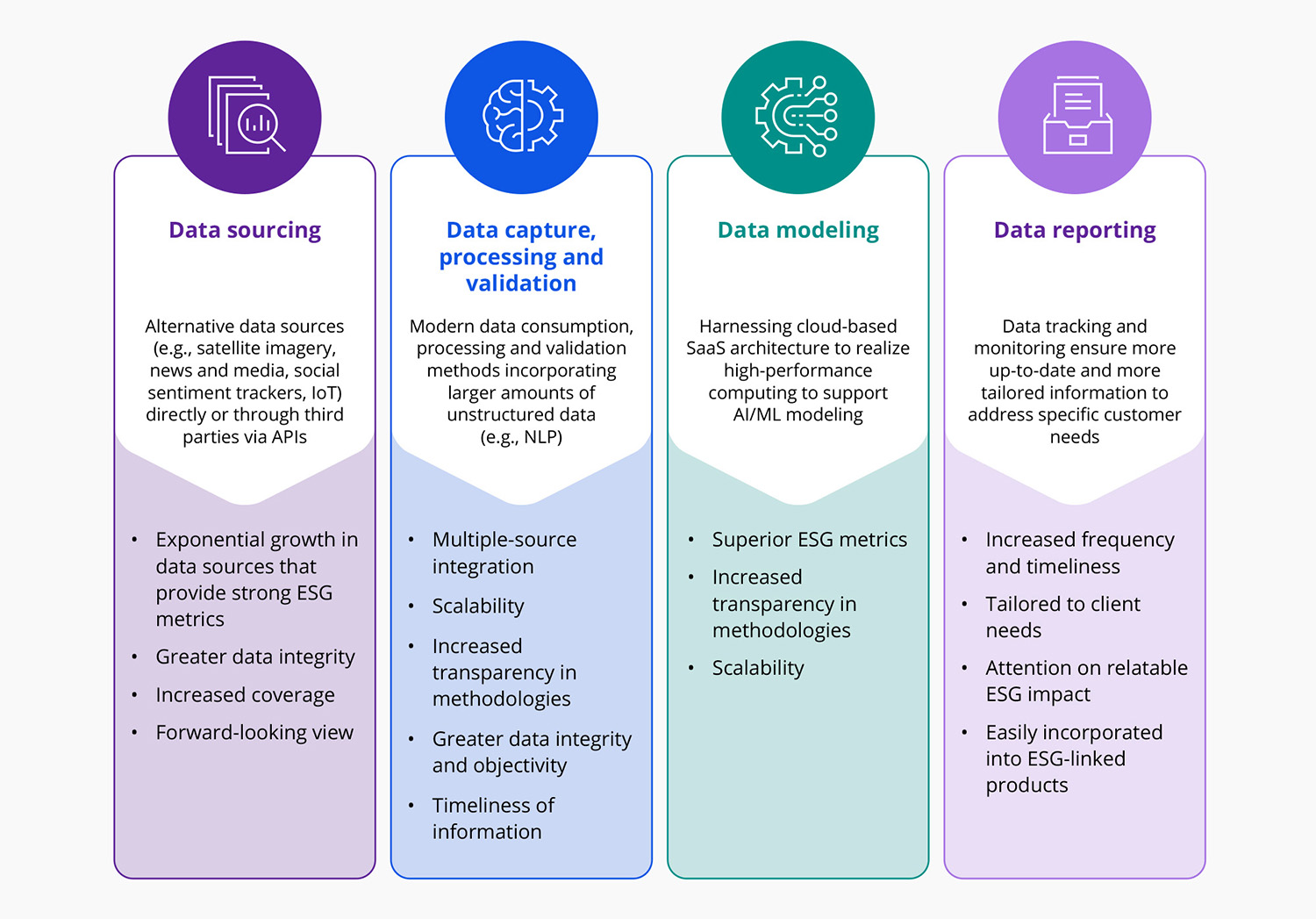

Creative methods for capturing customer data

Staying ahead in a crowded marketplace requires innovation and adaptability. One emerging trend is the integration of budgeting and goal-setting features into mobile and desktop apps. While customers recognize the added benefits of convenience and control over their finances, banks are leveraging this data to get a complete picture of the value of each customer and identify potential high-net-worth individuals.

Improve CLM with a mainframe hybrid cloud approach

A mainframe hybrid cloud approach guarantees exceptional handling of sensitive data with peerless security to guard customer information and cultivate trust. Combining mainframe reliability with cloud adaptability, banks can tailor services to suit disparate customer requirements and fulfill their social responsibilities.

Adopting a mainframe hybrid cloud strategy strengthens a bank’s governance capabilities by providing a safe and resilient platform for managing data and transactions with integrity. It also leverages immense mainframe processing power, advanced data analytics and cloud-based agility to empower real-time monitoring and reporting. In step with financial rules, this provides actors with clear insights into banking operations and commercial well-being.

CLM and Hogan — the best of both worlds

As a processor and system of record, Zoreza Global’s Hogan core banking platform has become the driving force behind many of the world’s most influential banks.

By combining mainframe compute power with new and emerging technologies, Hogan clients can achieve the scalability and flexibility required to adapt to changing CLM demands without compromising performance, operational resilience or innovation.

Impactful CLM relies on current and accurate data. Hogan’s proven and resilient platform is perfect for managing data integrity throughout the cycle.

How technology improves ESG data quality

The Hogan mainframe hybrid cloud setup

The Hogan-powered, mainframe hybrid cloud concept is a popular choice for banks. Adoption allows them to keep their core systems of record — which run well on mainframes — but opens them up to greater possibilities.

Sensitive data is secured in a fully customizable private cloud infrastructure, and less-sensitive assets are shifted to one or more highly flexible, low-entry-cost public clouds. However, banks cannot achieve this holistic solution without accurately aligning core and new systems and developing an exceptional customer experience (CX) framework. The CX must encompass streamlined processes, personalized interactions and seamless digital integration across all touchpoints.

Looking ahead

Operational resilience

Recognizing the ever-increasing risk of cyberattacks, the Digital Operational Resilience Act (DORA) will focus on strengthening digital resilience for banks, starting January 17, 2025.

The new EU regulation will require banks to adopt a multi-cloud strategy, favoring a more customer-focused, mainframe hybrid cloud approach powered by a proven provider like Hogan. A recent research report noted: “Across all three countries we surveyed, most companies planning or preparing for DORA already are making multi-cloud a part of their plans.”

GenAI in customer lifecycle management

GenAI’s algorithms learn from multiple datasets and generate new operational and marketing content, personalizing customer communications, replicating possible financial alternatives and upscaling client contact.

Benefits:

- Hyper-personalization: GenAI analyzes individual risk profiles and transaction histories to develop a bespoke advisory service and enrich customer relationships

- Super-efficient documentation: Automating legal and compliance documents saves time and money (e.g., individual contract agreements for convoluted financial products shorten the negotiation-finalization process considerably)

- Optimal impact: The technology delivers personalized marketing campaigns, increasing the impact of targeted initiatives

Challenges:

- Control: Achieving the level of quality demanded by our industry can be tough. For instance, GenAI might suggest financial options out of step with customer preferences or risk tolerance

- Ethics: Using client data to train AI models can cause complications. There might also be concerns about transparency and explainability

- Compliance: Uncompromising banking regulations (particularly for data protection and privacy) can be significant obstacles

Why Hogan clients should adopt CLM best practices (in short)

The CLM strategies that carry the most weight are customer-focused, tech-driven and fully compliant. Implementing best practices will enable banks to sharpen their competitive edge and provide exceptional customer service, inspiring trust and staunch loyalty.

Adopting CLM best practices in tandem with a Hogan-powered, mainframe hybrid cloud strategy is a confident step toward a more engaging, sustainable and resilient business model. It will create a host of new opportunities for growth, innovation and differentiation.

What’s on your mind?

To learn more about how implementing CLM best practices and enabling a Hogan-powered, mainframe hybrid cloud strategy can help manage risk, promote innovation and increase profitability, contact our experts.