In brief

- FDIC 370 requires covered institutions to have the data and ability to calculate deposit insurance coverage for each account. It aims to clarify account classification and support FDIC deposit exposure calculation during institutional distress

- The recent increase in interest rates and inflation has negatively impacted banks, eroding regulatory capital and leaving them underfunded. The failure of Silicon Valley Bank alone cost the FDIC Deposit Insurance Fund an estimated $20 billion

- Compliance with FDIC 370 presents an opportunity for banks to enhance their enterprise data capability and improve areas such as product information, customer information, and account strategy

The Federal Deposit Insurance Corporation (FDIC) realized during the 2008 financial crisis that it did not have sufficient resources or information to calculate the potential deposit insurance liability of defaulting banks. FDIC 370 (12 CFR, Part 370) was introduced to oblige each covered institution with two million or more deposit accounts to have the data and ability to calculate the amount of deposit insurance coverage available for each deposit account. This regulation is due to come into force on April 1, 2024.

Understanding FDIC 370

FDIC 370 will serve multiple purposes. The first is to clarify the classification of accounts as well as the FDIC-insured portions of those accounts. The second is to support the FDIC deposit exposure calculation in the event of institutional distress. The new regulation requires 10 measures around account category, transactional features, retained interest, overfunding, contingent interest and customer information.

This regulation could not be more timely. Recent inflation and tightening of monetary policy through increased interest rates has been detrimental to banks. Banks invest heavily in government treasury and municipal bonds with regulatory capital, and these are traditionally granted low or “risk-free” status. As interest rates went up, lower-yield bond prices fell, eroding billions in regulatory capital and leaving banks underfunded. Once a bank is perceived as being distressed, a run on deposits compounds the capital shortage and leaves the bank vulnerable. This has created a large exposure to the FDIC. The recent failure of Silicon Valley Bank is estimated to have cost the FDIC Deposit Insurance Fund approximately $20 billion.

Turning compliance into competitive advantage

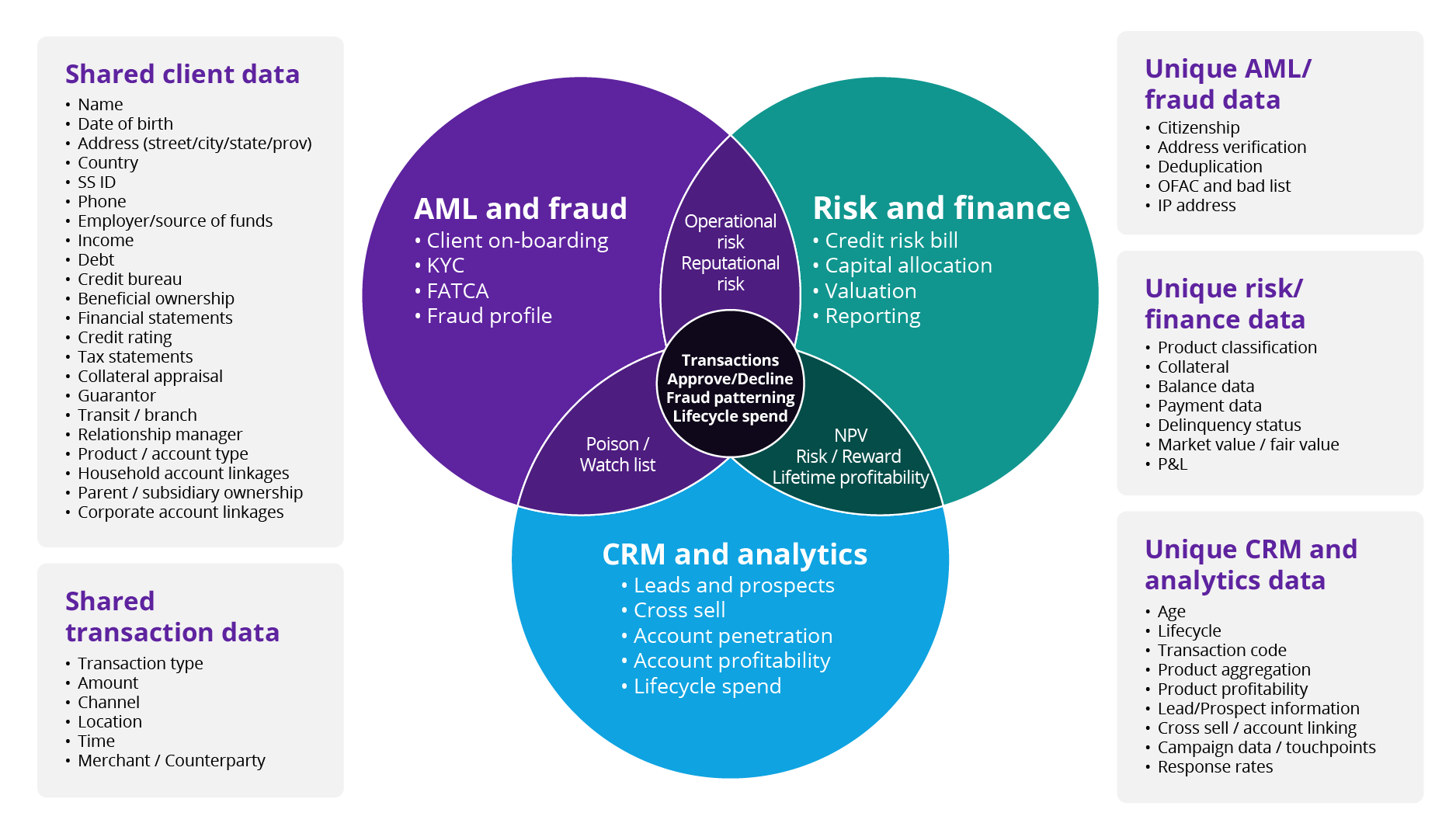

Going beyond compliance, FDIC 370 information opens up several opportunities to enhance enterprise data capability. Enhancements to CIF, cross-sell / penetration, risk, finance, financial crime and CRM can be supported.

If we look at the individual components of FDIC 370, we see the potential to revisit and improve product information, customer information, account ownership, household aggregation, balance and insurance information. This will yield business benefits through the ability to support core banking modernization and new channel development.

There is also an opportunity to improve account strategy and upsell to clients beyond deposits. The SVB experience showed that excessive deposits may provide a cheap source of capital but can intensify a run on the bank when account holders realize their exposure to uninsured deposits.

Zoreza Global, a DXC Technology Company, has developed a framework for banks to assist in going beyond CFR 370 compliance to improve enterprise data capability, turning compliance spend into a competitive advantage. If you’d like to know more, reach out to our experts.