In brief

- Discover how Zoreza Global’s customer engagement solution, Boomerang, can be integrated with existing banking systems to aid customer engagement and retention

- Increase market reach and profitability by establishing trust and loyalty while fostering lasting customer relationships and commercial growth. Achieve better business outcomes with Boomerang

- Boomerang’s functionalities range from customer service with social media monitoring to customer analysis tools for targeted campaigns

Do customers trust your bank?

How do you know? Do you take their comments and queries seriously enough to create consistent, exceptional and personalized customer experiences? And what about the increasingly tech-savvy consumers? How far is your bank along the path to digital transformation, or are you still at the omnichannel planning stage?

How can you expect customers to take you seriously if you’re not establishing or constantly reinforcing trust? Attraction and retention are slippery characters and deserve their places at the heart of your business strategy. But you’ve got to work at it. Of course, it helps to have an expert partner to guide you and share the load. A partner like Boomerang.

Keep them coming back for more

Boomerang is a dynamic B2B/B2C customer engagement (CX) solution and customer service tool for financial services organizations. It’s modular, scalable, highly configurable and manages the entire customer life cycle, strengthening relationships and helping you know your customers better to improve decision-making.

Engagement: Boomerang connects customer information, dialogue, cases and service engagement. It lays the foundation for follow-up, consumer growth and marketing activities. Customers can register for self-service.

Service: This highly automated module provides a self-service omnichannel solution that efficiently distributes work and streamlines processing while monitoring/moderating your social media feeds. Boomerang increases control, reduces waiting times and enhances customer satisfaction.

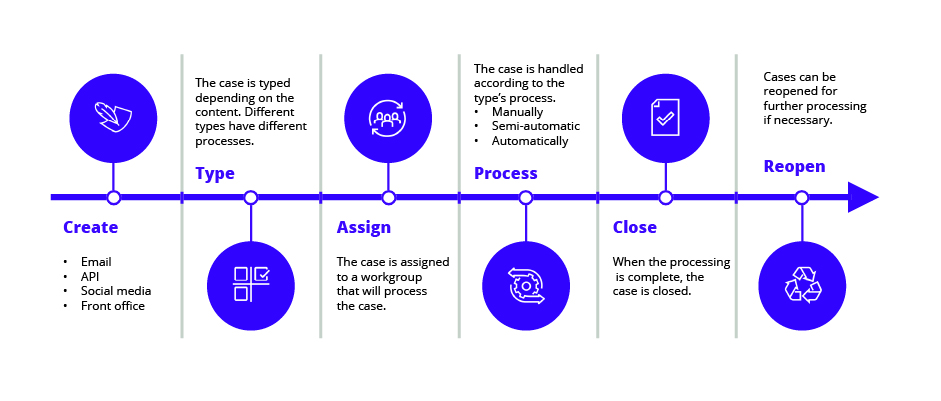

Customer service case lifecycle

E-commerce: Boomerang manages e-commerce, integrating stakeholder payment, delivery and reporting. “Contracts” enables subscriptions, installments and service agreements. Our product registry distributes consistent information across all channels.

Analysis: The analytics module helps create a data-driven business. Analyze, use, track and learn, setting up automated reports for continuous business follow-ups, ensuring that strategies remain relevant and impactful. Create campaigns and define target groups based on accurate customer knowledge.

Customer engagement in detail

Customer view

Registered customers — private or legal entities — are managed here. Search for specific customers, create new customers and manage system information. Boomerang provides a unified 1080o customer view no matter who’s in contact with the customer. The solution collects and visualizes internal data and data integrated with other systems

Customer service

`The customer service module provides an omnichannel solution with a high level of self-service and automation. Boomerang ensures efficient distribution of work with streamlined processing. It also monitors and moderates your social media feeds. Increases control, reduces waiting times and improves customer satisfaction

CRM functionality

Communicate with customers via letter, email, telephone, SMS, etc. Boomerang offers support for communicating with the customer via various channels. Standardized response templates ensure that communication with the customer is uniform. Add notes, labels and attachments. All shown in the customer view

Login/authorization

Together with its API, the Boomerang login/authentication model streamlines workloads by offering a self-service customer portal/app, targeted information and marketing. Several functions are linked to the customer's login, including password reset, blocking unwanted customers and more

GDPR/PII

Boomerang supports automatic and schedules data thinning, anonymizing and monitoring for B2B/B2C and personal data, according to GDPR guidelines. Data thinning reminders are emailed to customers around 30 days before storage. Thinning rules can be reconfigured to suit each business

Integration

Boomerang is designed to easily exchange information and interact with other systems (ready-made integrations include registry lookup, electronic ID verification and credit check). Consolidating agents' work in Boomerang avoids having to log into multiple systems

KPI, scorecard and rating

Customer data is shown as KPIs, scorecards and grades. The collected data increases customer lifetime value (CLV), enabling targeted campaigns (based on customer information)

Audit trail

The journal logs all important events, including when and who performed them. Boomerang's history function, "Audit trail," curates all reads and updates performed

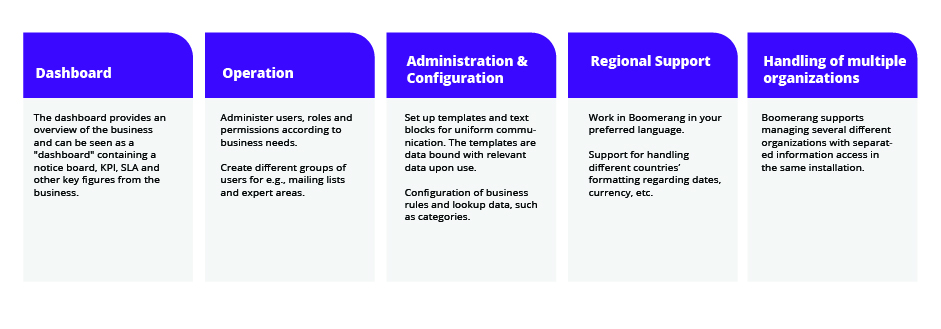

Supporting features and administration

The dashboard is loaded with information that provides an overview of the current situation. Administration and configuration options ease adaptation to different businesses and needs. Boomerang allows you to manage several businesses in the same solution and separate cases for business users.

Resolve challenges

To say banks are faced with significant challenges is a massive understatement when it comes to competition and customer engagement. But if you can really get under the skin of your problems, you’re traveling the major highway to a premier engagement strategy.

Extending your market reach is a complex but essential element in fighting churn — attracting and retaining profitable customers and valuable team members. And the challenge gets even more complex as customers’ financial needs and preferences fluctuate.

Make it personal

Also, you’re competing against companies in other industries for an optimal share of your customers’ disposable income. And positive differentiation demands deep customer knowledge to help build increasingly personalized (and relevant) products and services.

As we found earlier, trust and loyalty go hand-in-hand, but instilling and nurturing those crucial characteristics goes beyond competitive pricing and convenience. Developing enduring customer relationships is one of the central pillars of successful customer engagement.

Although these challenges are diverse and persistent, with the right game plan, they’re also beatable. Our game-changing solution leverages existing legacy banking systems to provide a 1080-degree view (three 360-degree views — transactions, customer dialog and contracts, accounts and services) covering the entire customer journey. Boomerang delivers real-time insights to help remove barriers to meaningful customer engagement.

Grow with Boomerang

In an increasingly customer-centric banking world, Boomerang is a crucial ally in the battle for productive customer life cycle management. Its unique features enable banks to build trust and develop lasting customer relationships while accelerating digital transformation and delivering personalized omnichannel experiences. Boomerang is the key to business growth.

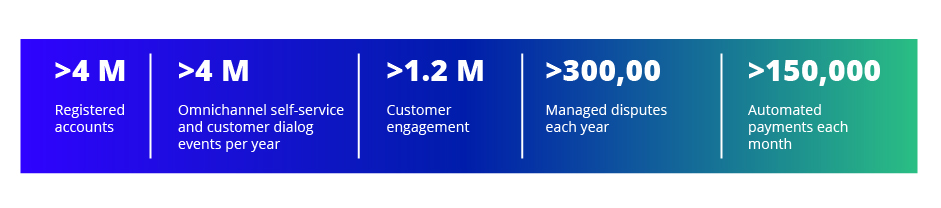

Boomerang in numbers

Checklist

Growth: Cherry-pick and add modules and features as you go. Adjust capacity to suit business needs.

Integration: Designed to easily exchange information and interact with other systems (e.g., contact centers).

Configurability: Use standard solution or configure for specific needs. Configure business rules and look up data.

Security: Permissions, encryption and monitoring ensure continuous and secure operation without data leaks and disruptions.

Support: Built into Boomerang delivery. Choose daytime or 24/7 support.

Customization: Pay-per-feature. Only pay for what you use.

Get in touch

So, if you’d like to learn more about how Zoreza Global and Boomerang can help you navigate the consumer relationship maze and turn your customer engagement program around, visit our website or contact us.