In brief

- An upgraded T24 system streamlines operations, managing most regulatory requirements and giving banks a competitive edge. Being a Global Certified Temenos Partner, Zoreza Global is the ideal provider to implement it

- Upgrading the Temenos Transact core banking system involves a stream of complex challenges. Get to know some of the key challenges that your financial institution could face during your next upgrade

- Zoreza Global’s automation framework enables future upgrades, minimizing the effort and time spent on the process itself. This value-add service is on-request as setup and execution vary with each project

It’s one of these:

Zoreza Global is a leading member of a very select group of Temenos Transact certified upgrade partners.

We signed the global strategic agreement for an expanded partnership with Temenos in 2020, certification being achieved in record time thanks to our wealth of banking and capital markets experience and deep understanding of the upgrade process.

We aimed to accelerate digital transformation strategies for our large bank customers experiencing renewed and aggressive competition in the marketplace and being pressured into reconsidering their IT and business positions.

Changing times

To compete effectively, T24 banks must optimize the efficiency of their systems and processes and place less emphasis on local customization. Changing customer preferences and the explosion of available banking channels have compromised the effectiveness of legacy IT infrastructures by increasing the complex nature of digital commerce.

Upgrading the core banking system enables banks to claw back lost ground and assume a leading market position. While enhancing security, streamlining operations, improving compliance, cutting costs and repairing functional cracks, a Temenos upgrade program implements advanced features to cut the rollout time for improved products and services.

Key upgrade challenges

As a Temenos-Certified Global Partner for Managed Upgrades, Zoreza Global delivers smooth upgrades with maximum speed and minimum disruption. Even so, a Transact core banking system upgrade generates a wealth of complex challenges. Here's a helicopter view:

Customization and configuration. Most Transact implementations have a lot of customizations to cater to the clients’ own business needs. These customizations must be analyzed, reengineered or rejigged to work with a newly upgraded system architecture and features.

Integration. The upgrade has to tie in with several other systems (e.g., payment gateways, risk management tools and reporting systems). Confirming post-upgrade integration is an essential step in the process. Altered APIs, data structures and communication protocols can cause problems and must be meticulously tested and updated.

Testing complexity. Upgrade validation requires extensive testing, including unit, integration, regression and user acceptance testing. It must consider all kinds of situations — various banking operations, user roles and data input — to guarantee stability.

Data quality and consistency. The upgrade might result in change of data structures or have different data characteristics, compromising quality and introducing inconsistency. Naturally, existing data must still be accurate and functional post-upgrade, so this is a number one priority.

Performance and scalability. Increased transaction volumes and user loading are prime concerns. Architectural changes or increased demand can lead to lower performance or scalability considerations. Load testing and post-upgrade performance optimization are essential program ingredients.

Compliance and regulatory reporting. A Temenos Transact upgrade can affect the regulatory frameworks that control ops and reporting. Being confident the revised system provides equally accurate and compliant reports is a must.

Training and change management. Sharing tips and tricks of the augmented system is a core capability. Comprehensive training programs encompass changes in user interfaces, workflows, features and more. Advanced change management skills are fundamental for efficient and effective transition and quelling staff concerns.

Downtime. Business continuity is one of the major upgrade concerns, so downtime must be kept to an absolute minimum. Rolling upgrades, failover mechanisms and backup systems all help achieve the objective without a lot of fuss.

Cost management. Software licenses, hardware upgrades, consultancy services, training and potential business interruptions all have on-costs that must be carefully controlled as part of the process.

Vendor coordination. Liaising with Temenos and third parties to establish appropriate support makes all the difference to a successful upgrade outcome.

Security. Maintaining tight security measures to ensure data is secured during the upgrade process is a principal concern.

Time-tested Temenos methodology

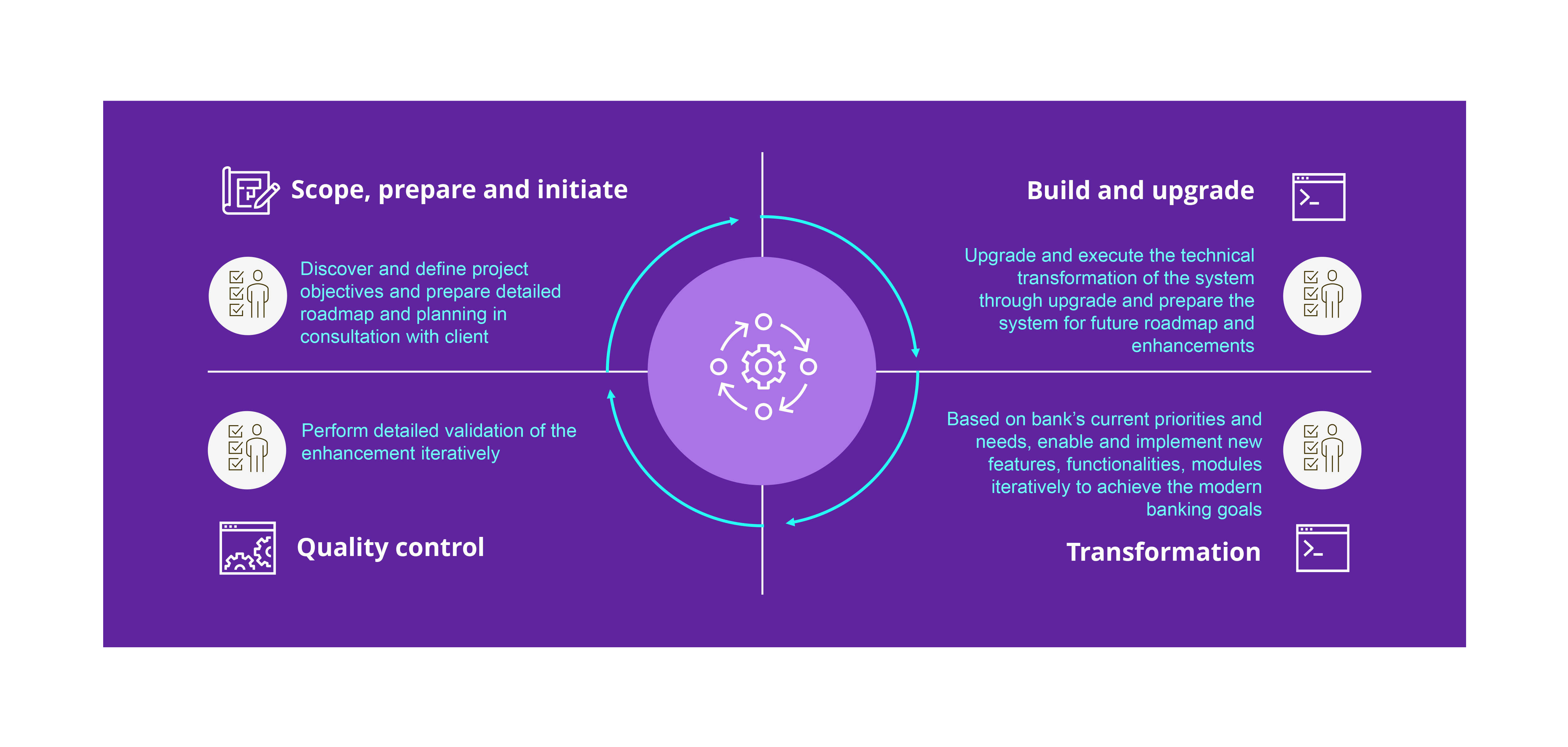

Being a certified upgrade partner, Zoreza Global follows the TIM approach enriched with value-added processes. The approach consists of four distinct phases:

Value adds:

Tooling

The upgrade tools developed by Zoreza Global. Each tool is purpose-built to ensure a quality upgrade.

Upgrade analyzer

Scoping tool which helps extract and create a detailed overview of the Transact setup/configuration, local developments, impact on release upgrade, etc. Helps to deliver accurate scoping and estimation.

Data comparison

Transact-specific comparison tool to compare data between source and target systems. Helps to validate the data integrity post-upgrade process.

GL comparison

Exclusively developed to provide insight into financial reporting lines in Transact and identify transactional-level differences between pre- and post-upgrade.

Object explorer

Provides a detailed catalog of the components implemented in a Transact environment including parameterization with dependency information. Helps identify used/unused components for cleanup/decommissioning or for decomposing the core.

Trusted partners

Banks can take advantage of many new Temenos features and frameworks by implementing them as part of the upgrade. Framework deployment provides banks with new modes of API-driven integration and the use of microservices. This ensures systems are more scalable and flexible.

Zoreza Global works with clients to build an upgrade strategy and tailor the roadmap to provide incremental business capability in line with business priorities. Together, we address technology obsolescence and rearchitect the landscape to future-proof the application. This progressive digital roadmap is designed to minimize the impact on BAU operations and allow for the upskilling of existing IT support and operations teams.

Case study: A leading Japanese bank’s T24 transformation

Background

A premier Japanese banking institution sought to revamp its T24 system in order to stay abreast of evolving business demands. The objective was twofold: Leverage the latest features of T24 and ensure the highest quality platform support, particularly in incident and defect management. At the outset, Zoreza Global was presented with numerous unresolved incidents and unstreamlined processes.

Challenges faced by the Bank:

- Streamlining operations to effectively manage incidents and defects

- Enhancing the T24 system's functionality to align with modern banking needs

- Meeting stringent regulatory guidelines and adopting current SWIFT standards

- Launching innovative banking products to stay competitive

Our solution

Zoreza Global's dedicated business as usual (BAU) team stepped in to bolster the existing T24 (R17) installation, including its FCM and analytics applications. Here’s how we added value:

- Provided comprehensive incident and defect management, ensuring 24x7 on-call support and timely system enhancements

- Instituted best practices in software management with:

- Version control via GitHub, complemented by binaries in

- Artifactory Streamlined documentation processes through Confluence

- Efficient defect tracking using Jira

- Optimal test management through TestRail

We prioritized transparency, furnishing the bank with weekly updates that encapsulated system health, incident statistics and task progress. Regular stakeholder sync-ups ensured everyone was aligned and informed.

In 2022, a specialized Zoreza Global team commenced a pivotal upgrade, transitioning the system to its most recent version, R22. This wasn't just a simple upgrade — it encompassed foundational changes such as migrating the database from Oracle to MS SQL and transitioning the application server from WebLogic to JBoss, all while ensuring seamless functioning in a clustered virtual server environment.

Additionally, we incorporated:

- System enhancements to satisfy regulatory mandates and address core bank needs

- A state-of-the-art TPH module to support the latest SWIFT standards, specifically MX messages

- The roll-out of avant-garde trade finance products

- Comprehensive upgrades for the FCM application and server

- Deployment of the RFR feature

Outcomes

Thanks to Zoreza Global’s BAU team, the T24 system saw a marked stabilization in terms of defects and incident resolution. The broader transformation project is dynamically progressing, bringing about organizational enhancements in its wake.

Client testimonial

The Bank's collaboration with Zoreza Global has borne fruit, resulting in a strengthened relationship. They've expressed gratitude for our managed services, noting them as a significant upgrade from their previous partner. The Bank looks forward to our continued partnership.

Why Zoreza Global?

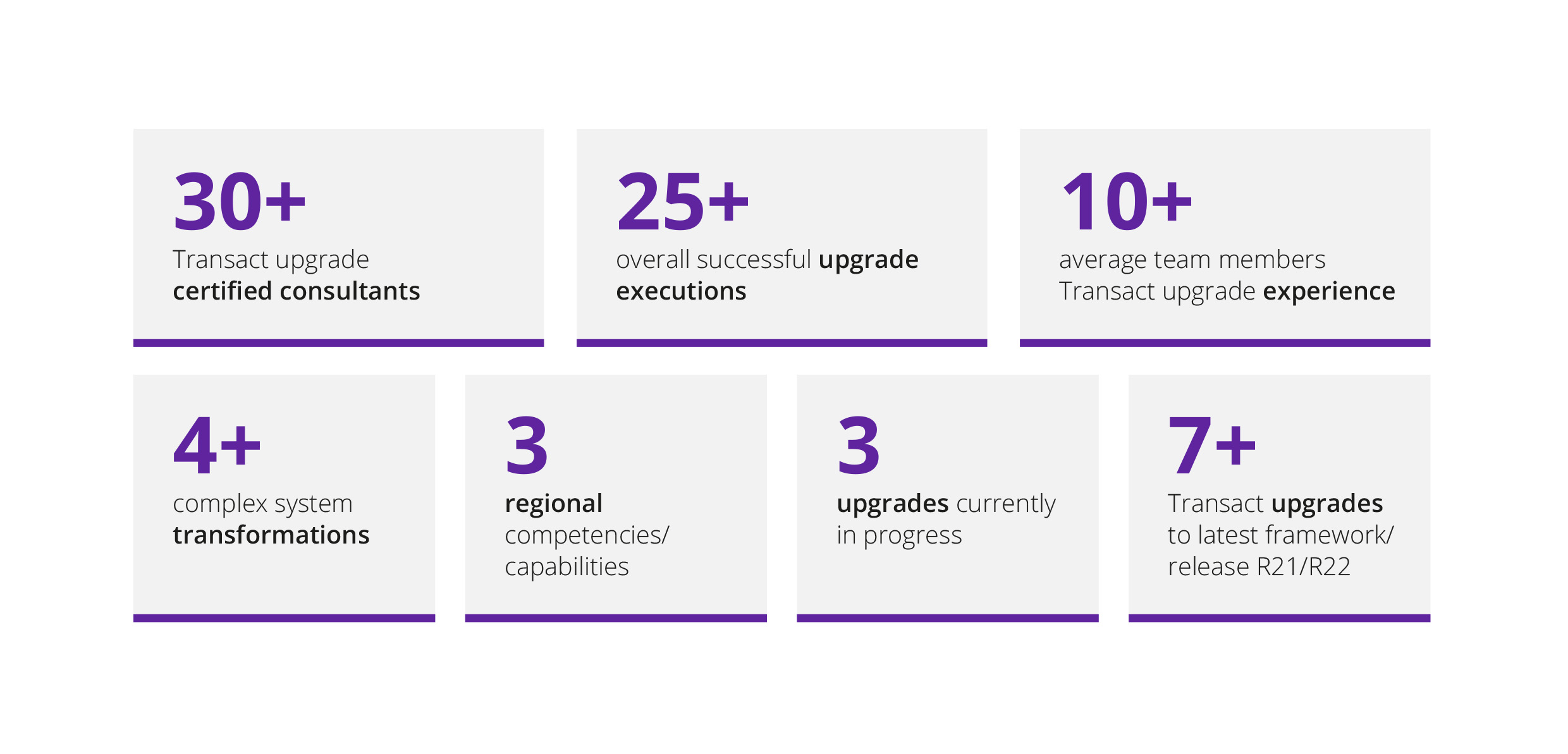

Zoreza Global ‘s Transact upgrade experience is second to none. Our dedicated and dynamic team has developed a unique insight into the upgrade process by performing complex transformations and upgrade projects, maximizing performance with minimal downtime.

Here’s a quick overview of our team’s expertise:

Free scoping exercise

An upgrade can take anything from a few months to a couple of years to complete. Understandably, prospects need an idea of the cost and timescales involved. So, we undertake a free scoping exercise to get to grips with client and system requirements.

Clients complete a questionnaire, providing a detailed description of their current- and desired end-state architecture. Then, Zoreza Global prepares a client-specific upgrade analyzer tool designed and executed in the client’s environment to provide the required transformation data and insights.

Want to know more?

To learn more about what upgrading the world’s #1 core banking system could do for your organization, visit our website. Or, if you’d like to arrange a T24 demonstration, health check or upgrade, contact us.