The Capital Markets enterprise 2021: Innovative solutions for competitive advantage

Jul 13, 2021 by Nathan Snyder

Jul 13, 2021 by Nathan Snyder

Faced with costs of equity that exceed their return, regulations that narrow margins, and competition from flexible, diversified companies, financial institutions must look for options of digital innovation in order to maintain financial viability and market advantage.

Even the largest banks and capital markets firms should look for innovative solutions to maintaining an edge and delivering more value at speed – the days of size and scale giving continued market domination and longevity are over.

This situation has been building since the financial crisis of 2008/2009 and the regulatory response, which narrowed margins and provided a new structural challenge to running a successful financial institution. In order to increase returns, there were two main options: Cut costs or pursue new revenue streams through digital innovation.

Some banks cut their way out of the crisis, scaling back or dropping unprofitable operations. Others took the second route and modernized, adopting new digital technologies to compete effectively and increase market share.

Those who embraced digital ways of working gained the agility needed to understand clients’ priorities and respond rapidly to market opportunities. This approach also provided the ability to rationalize and optimize existing business processes and reduce operating costs: Continuous integration, deployment pipelines and other innovations have reduced the human cost of maintaining the technology stack. As a result, leaders in digitalization have shown greater assets as a ratio of operating costs.

Meanwhile, those who took the decision to cut are left with complex technology stacks that are becoming an obstacle to agility, flexibility, and time to market. Attempting to add new functionality presents an ever-escalating set of costs from the need to introduce new processes and systems on top of systems that are no longer fit for purpose.

Once deemed ‘too big to fail’, these financial institutions can no longer rely on the regulatory moat that previously helped maintain their market position. With reduced capacity to address new opportunities, siloed technology estates, and increasing costs, this group is now perceived in the marketplace as ‘too slow to compete’. As a result, they are looking for ways to turn from inertia to innovation and recapture their edge against the digital-focused competition.

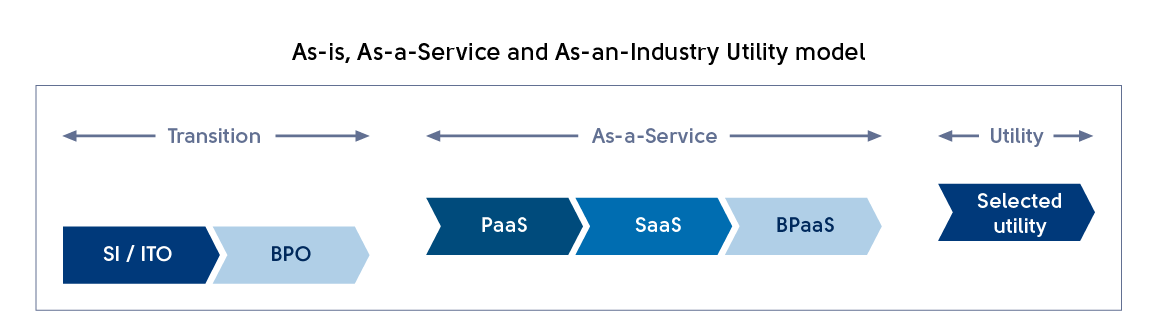

As the demand for more agility within financial institutions grows, so too does the community of digital-solution providers that can help address the challenge with innovative solutions. New regulations (such as the EU’s Open Banking initiative) have sparked the growth of small specialist companies that fill niches in the technology stack, and many larger organizations are offering Business Process-as-a-Service and Utility models.

So, how do you take advantage? The first step is to ascertain what is differentiating in your organization and what is not. Then, focus on what is differentiating and – wherever possible – consume non-differentiating functions as a service.

For example, have key elements of the trading workflow that once represented a competitive advantage – particularly around the middle and back-office – become standardized due to new regulations? If so, they’re a candidate for provisioning under an As-a-Service or Utility model.

As of 2020, more than 1,000 firms have been impacted by the new Uncleared Margin Rules (UMR), resulting in something that was once a proprietary calculation (providing competitive advantage) now becoming something where standardization provides mutual benefits.i

When conducting a review of your activities, it’s important to ask whether a particular function delivers a competitive advantage. Focus on optimizing core profit generators, reducing time to market, and supporting digital innovation for better client-outcomes.

For this approach to work, you need to take an innovative attitude both on the differentiating side and on the non-differentiating side of the business: For non-differentiating functions, the ecosystem of partners is continually evolving and should be under constant surveillance of the CTO. As for the differentiating side, CTOs need to create an environment that supports the rapid development of revenue-generating processes and technologies.

On the journey from bespoke architectures to As-a-Service and Utility models, it is imperative to remember the business drivers. CTOs are expected to partner with business colleagues to bring innovative solutions that address business opportunities.

For most firms, stakeholders’ key imperatives include the ability to deliver value more rapidly – essentially doing more for less, at greater speed. The imperatives also include the need to innovate and transform the business to support future growth, improve profitability, and optimize costs (by aligning them with the underlying business structure).

This approach requires the leveraging of commodity platforms to remove the burden of supporting non-differentiating technology stacks. Taking this course allows CTOs to focus on where technology can add significant business value and lead the changes necessary to compete effectively.

To achieve these objectives, CTOs need to partner with both business stakeholders and external clients, as well as with the emerging ecosystem of digital service providers that optimized technology organizations are now capable of leveraging for agility and better returns.

Pulling this all together and adopting a flexible approach to partnering with As-a-Service providers — while focusing on core differentiators — can allow you to deploy innovative technology solutions that reflect desired business outcomes of future growth and profitability.

iUntil recently, the pricing of OTC derivatives was a proprietary function, with the different valuation methodologies used by financial institutions offering a differentiating service. Under new Uncleared Margin Rules (UMR) however, counterparties need to either trade the derivative through clearing (where possible) or declare their valuation to the marketplace. In the event that they have a different valuation to the other counterparties, they are encouraged to reach an agreement, or both hold punitive collateral.