LXA — a single, no-code solution to transform your insurance claims process

Feb 17, 2023 by Sofia Levytska

Feb 17, 2023 by Sofia Levytska

The Zoreza Global analytics platform (LXA) uses data analytics as a mechanism for driving automation. It can be used for any insurance process where a chain of decisions needs to be made.

Our two previous articles in this short series described how LXA streamlines insurance claim handling processes, how to train predictive models to recognize fraud, plus the analytics and back-end technology. Now, we’d like to share details of the flexible and customizable front-end UI and how users work with the platform. A Dataiku layer holds all the underlying data and existing information.

The LXA front-end application was developed using Appian’s low-code platform. It provides an easy-to-use interface (UI), enabling different end users to seamlessly advance processes, including attaching documents, reports, screenshots and media.

The UI allows permission-controllable access for many different user types with wide-ranging responsibilities. Importantly, it also provides auditable transparency.

To illustrate some of the UI’s lifecycle capabilities, we’re taking the management of fraudulent insurance claims as our example. The process often suffers from operational inefficiencies and inconsistencies, reliance on manual activities and hand-offs, together with the use of disconnected platforms and records.

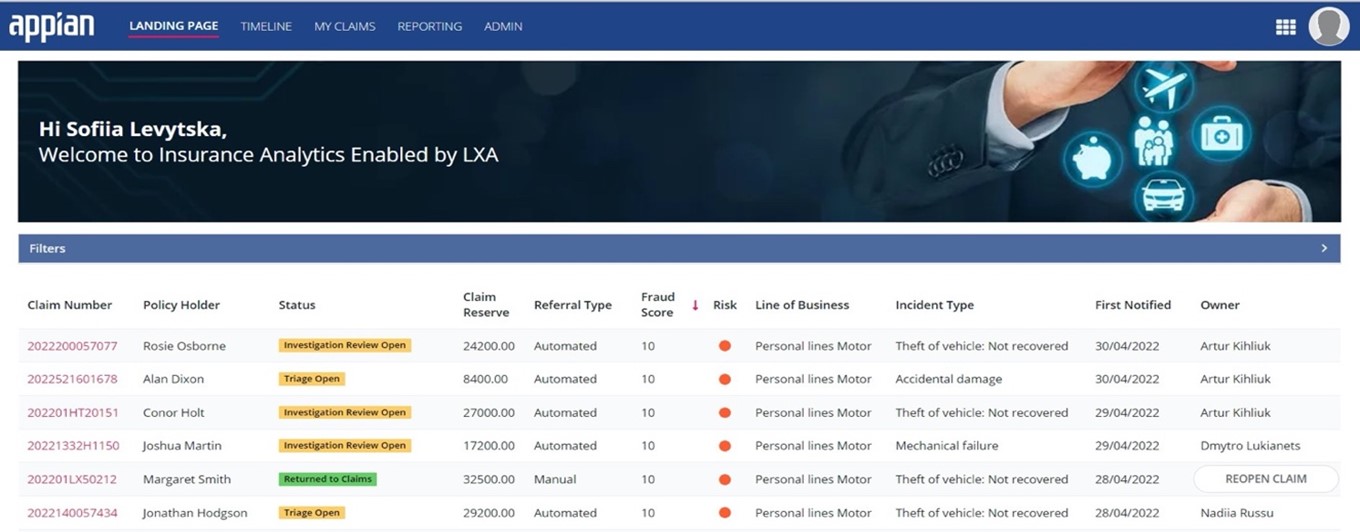

The landing page

The platform landing page features a list of all claims received from the back-end application. The front- and back-end work with real-time data drawn from the same single database. At each step, end users see the referred claims list, as well as who’s working on a claim and its current process status.

The initial status for every new claim on the landing page is automatically shown as ‘Triage Incomplete’. The triage user clicks on the ‘Open Claim’ button, forwarding the claim to their ‘My Claim List’, where the case status changes to ‘Triage Open’.

Triage

The triage user proceeds to open the claim in ‘My Claim List’.

Here, the side tabs reveal important claim information, enabling triage users to review and make an informed decision on their next steps.

Facts under the ‘Claim Details’ tab include the incident type, the weather at the time and when the user first created the claim. The policyholder’s details are there, too — name, date of birth, occupation, driving license, contact information and related policy particulars. Also, the user can see the policy’s primary information drawn from the single database.

All of which is readily accessible in one UI location, avoiding switching between claims and policy systems.

The triage user decides on the next steps

Having reviewed the claim and available information, the triage user chooses their next action from the ‘Available Actions’ tab. They can add a note for each activity to make it clear to the recipient why they chose that particular action.

The triage user might refer the case to a special investigator or supervisor, for example. By submitting the referral, they automatically transfer it to the appropriate user’s ‘Work Basket’.

Adding attachments to individual cases

Documents are an integral feature of insurance fraud investigations. An end user (e.g., the special investigator) can attach a document, report, email screenshot, photographs and other media to each claim. Or, they can provide a link to an asset stored on an external system like SharePoint or similar.

Ongoing case management

A user can easily create notes on updates, activities undertaken and so on for each case.

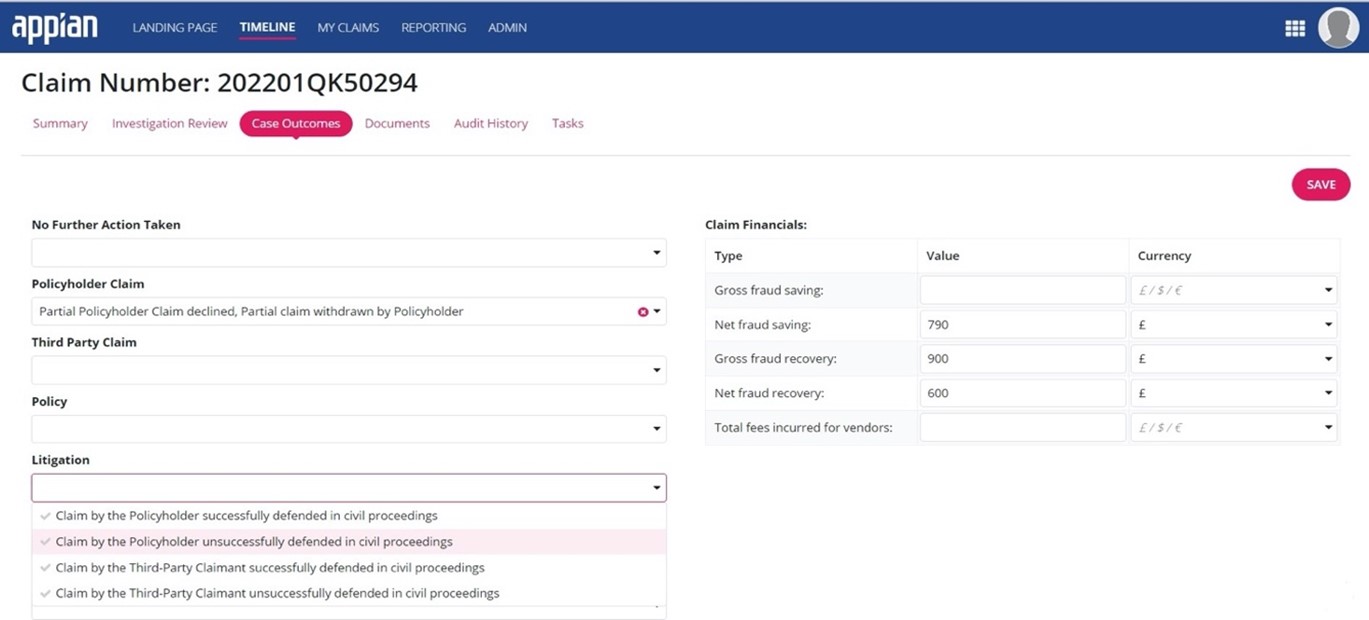

Concluding a case

The ‘Investigation Review’ and ‘Case Outcomes’ tabs enable the user to capture essential information about the investigation — known financials, including costs and savings, and details of any external vendors. Again, these sections are simple for the user to complete.

Reporting

Permissions dictate which users have access to on-demand reporting.

This example is for the special investigator.

If you’d like to learn more about LXA’s initial deployment and what the platform could do for your own processes, visit luxoft.com/industries/insurance or contact us. We’ll provide a deeper, more personalized dive into the LXA automation engine and our flexible UI.