In brief

- While the post-2020 global energy commodity price index rose significantly, the 2022 global weighted average levelized cost of electricity (LCOE) fell for all renewables. In 2010, while onshore wind energy was 95% more expensive (than that produced by the cheapest fuel), it became 52% cheaper in 2022

- AI-powered analytics allow real-time market monitoring, empowering traders to increase margins and tackle volatility. The data extends beyond price monitoring to include weather and vessel tracking data. McKinsey estimates that advanced analytics can reduce costs in day-ahead and intraday markets by 30%

- Blockchain and smart contracts paved the way for renewable energy trading marketplaces like SunContract. These marketplaces allow customers to trade without intermediaries — blockchain avoids using third parties to verify certificates and authenticate/execute transactions. With decentralized markets, smaller producers need efficient trading systems to exchange energy, creating a demand for trading-as-a-service solutions tailored for renewable power purchase agreements and risk management

The rise of renewables, sped up by the volatility of fossil fuel markets after the pandemic and the full-scale invasion of Ukraine, created a shift in power markets. Globally, the renewable energy production capacity year-on-year increase was 50% higher in 2023 than that in 2022. This shift is turning coal and nuclear power into the losers and solar and wind into the winners.

Morgan Stanley went as far as to predict that renewable resources are to completely replace coal in the U.S. power grid by 2033. Solar power is, by far, the king and queen of renewables. Its share in total global energy production rose from a mere 0.8% in 2010 to 12.8% in 2022 and is expected to reach 22.2% by 2027, outpacing hydropower:

This shift in power capacity composition creates incentives for renewable energy trading as investors seek to diversify their portfolios and minimize risks. Here’s everything to know about trading renewable energy, from market overview and benefits and challenges to trends, opportunities and risks.

Defining renewable energy trading

Energy trading, as you may already know, refers to the exchange of energy commodities in financial markets. The said energy commodities include crude oil, natural gas and electricity.

Renewable energy trading, in turn, is the trade of electricity produced using renewable means and other renewable energy commodities like biofuel. Renewable energy includes solar, hydro-, wind and geothermal power, as well as bioenergy (biofuels) and marine energy.

Renewables are a sustainable means of electricity generation that doesn’t produce greenhouse gas emissions as fossil fuels do. That’s why governments around the world incentivize renewable energy production and hence the rise of renewable energy production volumes and the price decrease.

Renewable energy sources differ from fossil fuels in two key ways:

- Variable operating costs are extremely low as there’s no fuel consumed for energy production. The only costs worth taking into account concern maintenance.

- The most common renewable sources, solar and wind, can’t provide stable energy production as the output depends on the weather. That complicates forecasting output in the long run and ensuring it’s enough to satisfy the demand.

Power trading and renewable trading, while significantly overlapping, aren’t the same. Power trading encompasses all types of electricity, whether it is produced in a coal power plant, nuclear plant or solar farm. Renewable trading, in turn, includes buying and selling commodities like biofuel.

Renewable energy trading market: Brief overview

Global renewable energy production capacity reached 3,372 GW by the end of 2022, showing a 9.6% year-on-year increase. Solar and wind accounted for 90% of new renewable capacity. Asia is in the lead by renewable capacity and accounts for 48% of global production capacity, with Europe as the runner-up:

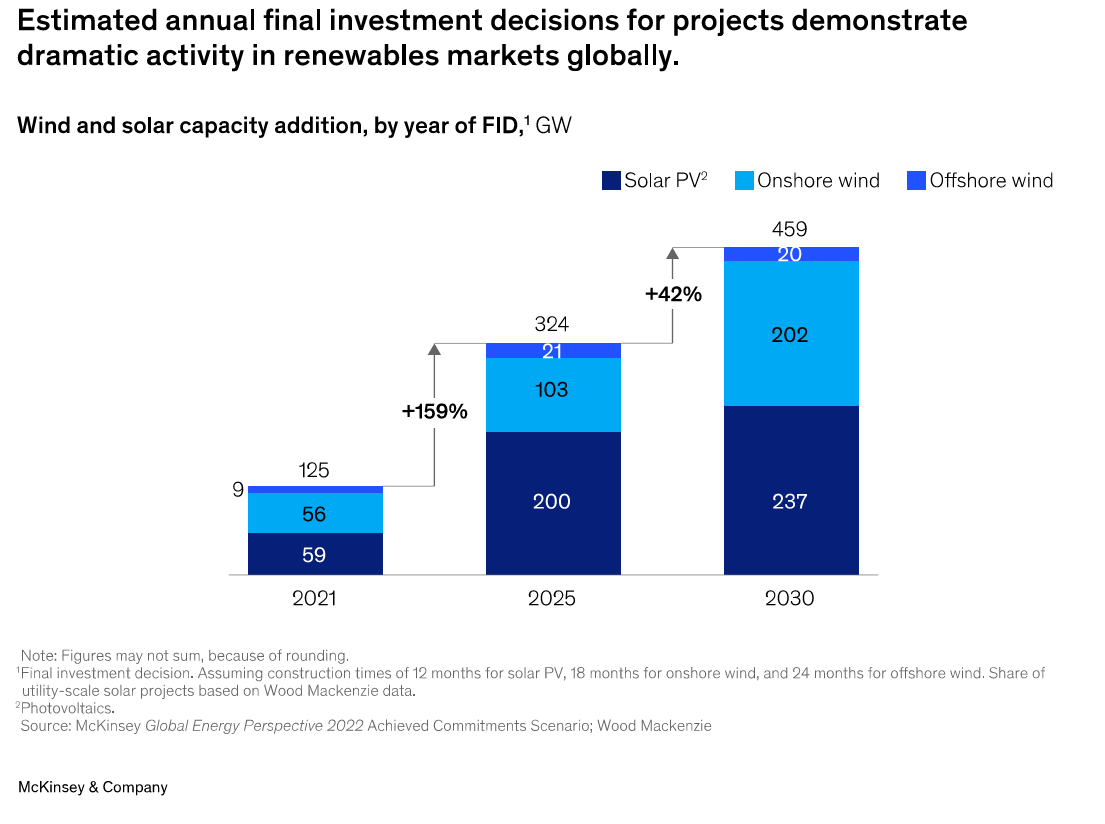

Global energy production volumes coming from solar and wind are projected to triple by 2030. Such fast growth is explained by the regulations already put in place to incentivize renewable energy production.

For example, the European Union plans to increase its renewable capacity to 45% by 2030, according to the REPowerEU energy transition plan. In the United States, the Inflation Reduction Act of 2022 heavily incentivizes renewable energy development, as well.

While the expansion of the renewable energy sector is a sure bet, historically, the market has been quite volatile. Several factors are to blame for this volatility, from frequently shifting regulations to significant fluctuations in raw material costs.

For instance, the rising demand for wind energy and pandemic-induced supply chain disruptions led to a 2-3x increase in steel, copper and aluminum prices. These materials are key to wind turbine production.

How the renewable energy trading market is organized

As the energy trading market overall, the renewable energy trading market consists of two types of markets, based on the buyer type.

Compliance wholesale markets cater to buyers who are required to purchase renewable energy to comply with regulations.

For example, in the United States, electric service providers have to maintain a minimum amount of renewable energy in the supply, as proven by a renewable energy certificate (REC). They can purchase excess electricity produced by individual consumers (e.g., from solar panels on a residential house) or commercial producers.

Voluntary energy markets allow buyers to acquire renewable energy supply beyond what is mandatory. They may choose to do so because renewable energy can be cheaper than that produced using fossil fuels.

While the global energy commodity price index was showing a significant increase post-2020, the global weighted average levelized cost of electricity fell for all renewable types in 2022. For example, while onshore wind energy was 95% more expensive than that produced by the cheapest fuel in 2010, it became 52% cheaper in 2022.

Trading renewable energy in 6 benefits and 3 challenges

Renewable energy trading comes with six benefits:

- Lower costs. As mentioned above, renewable energy costs are falling below those of the cheapest fuel-fired electricity production. Purchasing renewable energy to meet sustainability goals can be more affordable than kicking off renewable or carbon offset projects in-house or purchasing carbon credits.

- Favorable regulatory landscape. From the European Union and China to the United States, governments view renewable energy as the solution to attaining the 1.5-degree climate goal. This leads to a variety of favorable regulations, from tax incentives to government-backed investments.

- Reduction in carbon emissions. On a global scale, renewable energy production is considered vital for keeping global warming under 1.5 degrees. On the microeconomic level, purchasing renewable energy helps businesses comply with carbon emission restrictions without purchasing carbon offsets.

- Energy source diversification. Relying on a single energy source can be detrimental to energy security if the energy prices for the said source shoot up. Consider the increase in natural gas prices following the full-scale invasion of Ukraine.

- Greenified investment portfolios. Investing in renewable energy on a macroeconomic level creates jobs and promotes renewable projects’ development. On the microeconomic level, renewable energy investments improve investors’ ESG scores, which can be crucial for their reputation.

- New revenue streams. Enterprises that decide to venture into renewable energy projects can sell the excess of the produced electricity to generate an additional revenue stream. For example, solar panels can be installed on buildings’ rooftops.

However, renewable energy trading is not without challenges:

- Output variability. As renewable energy output volumes may depend on weather conditions (wind, solar power) or water levels (hydroelectricity), the output may be too low to satisfy demand. While it’s possible to predict the output in the short term, weather forecast reliability falls drastically several days into the future.

- Regulation complexity. Regulations vary drastically across the globe, leading to disparate certification systems and mandatory market rulebooks. As a result, trading renewable energy across the border can prove difficult to execute.

- Lack of standardization. RECs aren’t standardized worldwide, making certificate verification and comparison a laborious undertaking. This contributes to the complexity of cross-border renewable energy trading.

5 renewable energy trading trends to watch

Here are the five green energy trading trends to keep an eye on.

Solar and wind growth continues to outpace other renewables

According to the International Energy Agency, solar is in the lead in net renewable electricity capacity additions. PV-utility and PV-distributed technologies accounted for roughly two-thirds of additions in 2022. Wind, dominated by the onshore segment, takes up another quarter of new additions – however, wind expansion encounters persisting challenges like rising turbine production costs.

Blockchain is powering record storing

As a distributed ledger is immutable by definition, it sparked the interest of providers looking to securely store, prove and transfer RECs. For example, the French energy leader, Engie, is using blockchain for trading RECs, as well as for peer-to-peer energy trading.

Decentralizing REC issuance and tracking can also reduce operational costs and power greater traceability and transparency.

Renewables are at the center of the EU’s response to the energy crisis

As the European Union is working towards reducing its reliance on natural gas from Russia after the invasion of Ukraine in 2022, it’s placing the bet on renewables. Its inventives accelerated the development of renewable projects as solar PV energy became increasingly more cost-efficient and attracted policy support in markets like Germany, Italy and the Netherlands.

China remains in the lead in renewable capacity installations

When it comes to both onshore wind and solar PV capacity additions, China outpaced the rest of the world in 2022. The country accounted for half of global renewable capacity additions, as well. It’s projected to continue championing renewable development in 2023 and 2024.

Peer-to-peer trading enters the chat

Blockchain and smart contracts paved the way for renewable energy trading marketplaces like SunContract. Such marketplaces allow customers to engage in renewable energy commodities trading without intermediaries as the blockchain eliminates the need for a third party to verify the certificate, authenticate and execute the transaction.

The risks of diversifying into renewable energy

Those who decide to venture into renewable trading have to keep the following two risks in mind:

- Evolving policies. While the overall trend points to governments striving to incentivize the development of green energy projects, concrete incentives and regulations are prone to changing rapidly and substantially. This can lead to quick shifts in supply and demand, prompted by stricter ESG requirements, emission restrictions or evolving carbon pricing mechanisms.

- Market volatility. Evolving regulations, as well as output intermittence for certain renewable sources, make the market more prone to price volatility. Supply chain disruptions and inflationary pressure can also contribute to volatility as raw materials required for clean energy projects may soar in price due to the increase in demand.

Mitigating these risks requires both geographic and asset diversification. According to McKinsey, the latter can eliminate 50% to 80% of risk.

4 renewable trading opportunities to take advantage of

As for the opportunities of renewable trading, here are the four most significant ones.

Trading-as-a-service products

As energy trading markets become more decentralized, smaller energy producers need trading systems to efficiently exchange produced energy. This creates demand for trading-as-a-service solutions tailored to renewable power purchase agreements and risk management.

Advanced analytics

AI-powered data analytics allow for real-time market monitoring that empowers traders to maintain or increase their margins and successfully navigate volatility risks. The data in question can span far beyond basic price monitoring and include weather and vessel tracking data.

McKinsey estimates advanced analytics can reduce costs in day-ahead and intraday markets by 30%.

Emerging economies

While China, the European Union and the United States take the lead in new capacity additions, some developing nations have their success stories.

For instance, Brazil generates most of its electricity using hydropower and is currently diversifying into wind power. Other countries to watch include India and Morocco. Emerging economies are also projected to drive 70% of global biofuel demand in the upcoming five years.

Sources beyond solar and wind

Renewable energy markets involve a variety of assets. While solar and wind projects show the fastest growth, emerging assets like geothermal and renewable natural gas are poised to enhance investment portfolios in 2024.

Ready to embrace renewable energy?

Leveraging the opportunity that clean energy trading presents requires a comprehensive technology solution. Such a solution has to power risk management, output monitoring, straight-through processing and real-time execution.

At Zoreza Global, we have 14+ years of experience in developing technology solutions for energy and utilities organizations and 200+ successfully delivered projects on our track record. Our 500+ engineers leverage their deep domain expertise to deliver energy trading solutions that automate workflows and power demand-driven responses at scale.

Reach out to us to discuss how Zoreza Global can help you power a more sustainable future.