In brief

- EarlyResolution was developed by mortgage servicers to address industry challenges.

- The platform allows servicers to react quickly to internal and external events, including disasters, through configuration.

- EarlyResolution offers streamlined workflows, faster decisioning, online borrower access, and an engaging customer experience.

Every software application has an origin story; many developed to meet a deficiency in the marketplace.

EarlyResolution was built by a consortium of top mortgage servicers several years ago to solve two major challenges in the industry; providing consistent treatment across portfolios and allowing servicers to manage their business rules without required code changes. The ability for servicers to quickly react to internal and external events via configuration has helped EarlyResolution clients navigate the 2008 housing crisis, the COVID-19 pandemic and many natural disasters.

During disasters, time is of the essence

The disturbing effects of storms, floods, heatwaves, severe cold, droughts and wildfires are ever-present across TV news and social media channels. Loan servicers need to react quickly when these disasters occur. Assistance options must be offered within days and pushed out to customers via all available channels.

The traditional reaction to a natural disaster in the loan servicing industry is to create special swat teams, often utilizing inexperienced resources who require extensive training to manage these crises.

EarlyResolution allows servicers to quickly identify customers who may be impacted and streamline their experience to get them the help they need as soon as possible. Suppose a wildfire breaks out in a region of Australia. Within a few days, EarlyResolution clients can deploy special business rules that route customers to a payment holiday assistance plan in minutes instead of waiting to talk to the servicer’s specialty team.

It’s a more modern, realistic and immediate way of using existing business rules and highlights the flexibility and sheer scalability of the EarlyResolution platform.

EarlyResolution, the practical solution

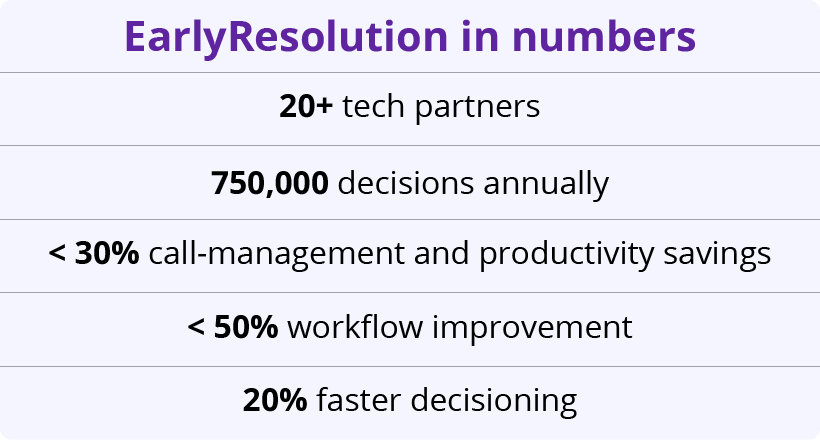

EarlyResolution delivers a single source of truth across all management and digital channels, guaranteeing a consistent service for borrowers in whichever way they interact with you. Our solution generates:

- Streamlined workflows: Automation generates < 25% increase in economies

- Faster decisioning: 20% quicker decision process with fewer errors

- Online borrower access: Secure, transparent, self-service account management

- Engaging customer experience: Simpler processes (e.g., single platform for sharing documentation)

Our loan servicing solutions have the in-depth scalability, security and flexibility the industry demands. We also strengthen access to the fintech ecosystem by rapidly integrating applications from authenticated third-party providers.

If you’d like to learn more about how the EarlyResolution application could help you to improve your regulatory change management, visit our EarlyResolution page. Or maybe you’d prefer to chat through your loan default management pain points, in which case, email Hunter Stair.