In brief

- Faced with costs of equity that exceed their return, regulations that narrow margins and competition from flexible, diversified companies, financial institutions must look to digital innovation to maintain financial viability and market advantage

- What do your clients need? Not what they pay you to do, but what do they actually need? Outside of the mandated KYC data collection and press comment, how much do you really know about their businesses and what drives them to come to you or your competitors for solutions?

- Perhaps the easiest way to assess differentiation maturity is to ask yourself, “Do clients notice when the work gets done right or only when it goes wrong?”. If the answer is the latter, then that work and those business processes could, and should, be done by an external service provider

A perfect storm of challenges

Year on year, capital markets firms have seen revenues stagnate and margins narrow to a fraction of what they once were. On the sell side, the capital requirements for many staple products are now so severe that the cost of carrying inventory is prohibitive.

Despite years of cost-cutting, firms have realized that their convoluted business and organizational models are far too expensive. As well as being extremely costly to run, maintain and change, fragmented heritage estates cause multiple processing bottlenecks that compromise operational stability and business continuity.

Too big to change?

In addition, supervisory bodies are focused on operational resilience, leading to uncomfortable levels of regulatory scrutiny that pump up the pressure to make wholesale changes.

Firms that choose to cut costs rather than modernize are left with complex, outdated technology stacks that choke agility, flexibility and time to market. And attempting to create new functionality by adding new processes and systems on top of existing systems that are no longer fit for purpose just fans the flames of overheating balance sheets.

Once deemed “too big to fail,” these financial institutions can no longer rely on the regulatory divide that helped maintain their market position. With increasing costs, siloed technology estates and reduced capacity to grasp new opportunities, this group is now regarded as “too slow to compete.” As a result, they’re looking for ways to jump-start innovation and steal a march on digitally focused competitors.

Less is more

Logically, firms should reduce the range of products they actively support and focus on areas where they can compete profitably. But anxious managers struggle to turn away any kind of business. They chase the dollar even though questionable clients will likely cost them money in terms of low-margin and high-touch service (thanks to a lack of automation and continued reliance on expensive manual processes).

Perhaps the toughest and most immediate decision they need to make is around prioritizing long-term investment. The need for radical simplification of the processes and platforms that underpin complex and siloed organizations is a given. As is the tooling required to boost agility and transform the client experience.

Develop a positive attitude toward innovative solutions

When reviewing investment potential, it’s important to consider the competitive advantage each function provides. Focus on optimizing core profit generators, reducing time to market and supporting digital innovation for better client outcomes.

To ensure this approach bears fruit, keep an open mind on differentiation. The partner ecosystem is continually evolving for non-differentiating functions and should be under constant CTO surveillance. For the differentiating side of the business, CTOs need to create an environment that supports the rapid development of revenue-generating processes and technologies.

Deliver added business value faster

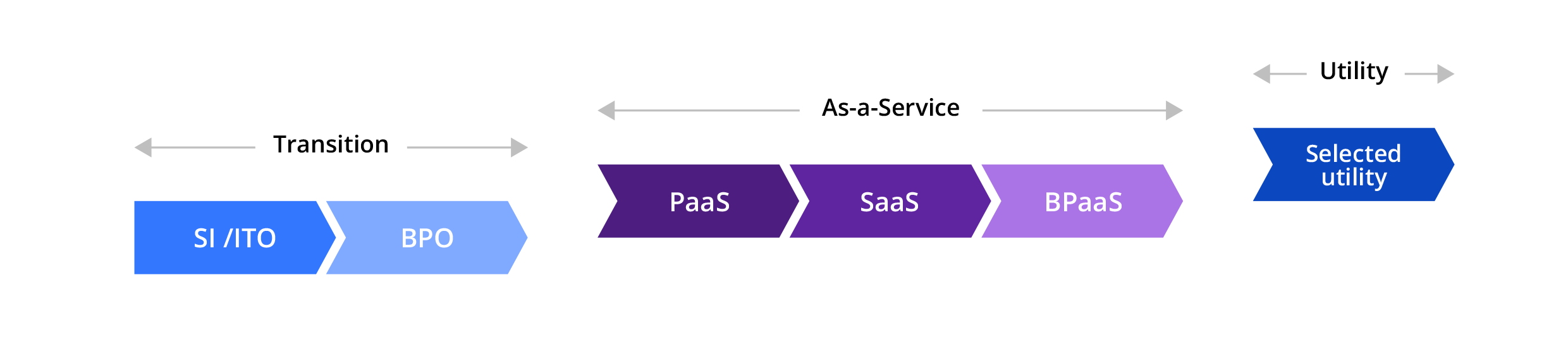

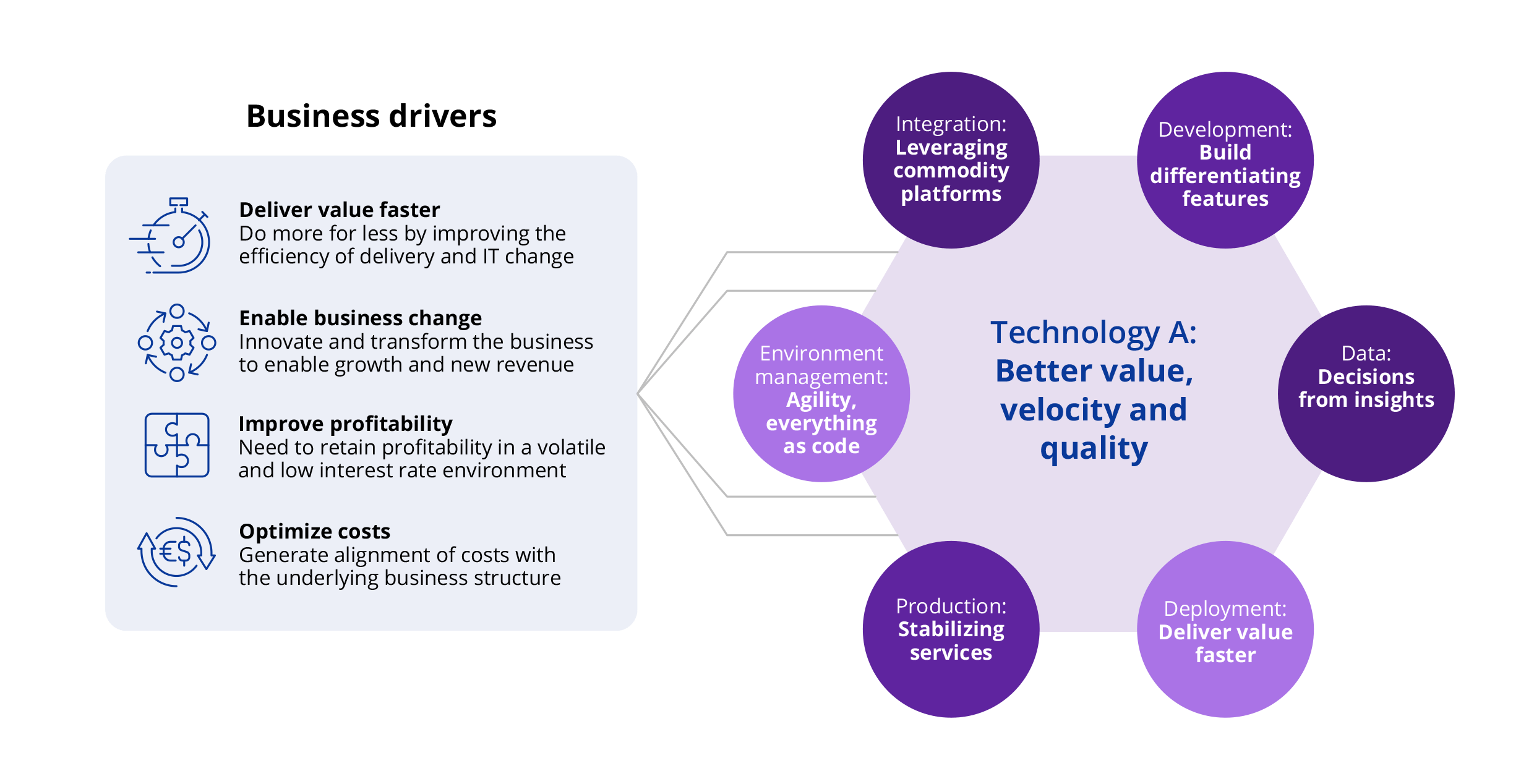

Business drivers are central to the shift from bespoke architectures to as-a-Service and utility models.

Accordingly, CTOs must partner with business colleagues to develop innovative solutions that maximize business opportunities:

For most traders, that means doing more for less at greater speed.

In other words, transforming the business to support future growth, enhancing profitability and optimizing costs by aligning them with the underlying business structure. Or, in practical terms, leveraging commodity platforms and removing the burden of supporting non-differentiating technology stacks.

That way, CTOs can focus on areas where the technology can add significant business value and start in on the changes necessary to compete effectively.

Modern. Agile. Streamlined.

Streamlining clunky workflows and processes and introducing flexible, modern technologies enable firms to understand client behavior and preferences better. It allows them to react rapidly, developing products and solutions that meet client needs more precisely. But making the required changes can be frustratingly slow.

At the risk of stating the obvious, digital transformation is impossible without a clear strategy backed by sustained, significant investment. However, strategic investment is routinely diverted toward short-term initiatives to address shifting market conditions and regulatory obligations.

We all think we’re special in some way

What’s less obvious is the extent to which the quantum of investment required is compounded by a belief that, in capital markets, each firm’s requirements are unique and need a bespoke strategy, operating model and associated technology solutions.

However, the truth is that banks, brokerages and asset managers trade similar products for similar clients and counterparties in the same core geographies. And, while few might admit it, little differentiates one firm from another, especially once a trade is executed.

All too often, firms allow their perceived uniqueness to dictate business processes. Then, this confusion is amplified by underlying technology dependencies, organizational inertia and an outdated “If it ain’t broke, don’t fix it” mentality.

Unsurprisingly, the industry is awash with underfunded, under-resourced change programs, and, understandably, the success record of these initiatives is poor.

It’s a jumble out there

Modernization isn’t simply a question of consolidating an assortment of outlier systems and re-platforming the essential core. Granted, consolidation can’t be shelved. But a tangle of systems, feeds and interfaces isn’t going to straighten itself out. And the longer it’s left, the greater the cost of unraveling it all.

The first big decision firms must make is to determine what’s core (and should stay that way) and what’s non-core and ripe for consumption as-a-Service.

There’s a better, more cost-effective way

The concept of outsourcing is not new to the industry. Cast your mind back to the days when clearing derivatives was done in-house rather than through clearing-house utilities. Or, when all trading was OTC and voice-based rather than executed as standardized products via electronic platforms.

Think how much it would have cost to create platforms as firm-specific services. Compare that to today’s pay-per-use subscription fees and the lack of management headaches that such mission-critical platforms cause.

Let’s be clear, no one’s advocating retracing steps. Traditional outsourcing is a short-term fix for the pressing need to cut costs. And because the management of people and work culture/methods is unique to each enterprise, each firm has to do all the thinking, accept the risk and bear the cost of building, maintaining and running systems.

So, what do your clients need?

We’ve looked at the mid- and back-office side of the equation, but what about clients? What do they need? Not what services do they pay you for, but what do they actually need? Outside of the mandated KYC data collection and press comment, how much do you really know about your clients’ business problems and why they come to you for solutions? Are you always able to respond to their issues in a timely, informed and efficient manner?

Undoubtedly, frontline staff will have a view, but it will be shaped by exchanges with one or two contacts for each client. How much of their insight is based on subjective opinion rather than objective fact? How much of it is captured and encoded in a form that the rest of your firm can leverage automatically? How many of your sales opportunities are a response to client requests, as opposed to the proactive pitching of relevant and practical ideas? Or, having executed their initial request, advising them on their next steps?

Data fuels your business

Your firm’s ability to understand and guide clients is the key to retention. In a world where alpha is harder and harder to find, offering clients solutions they need (before they know it themselves) is your best chance of maximizing client relationship value.

This understanding begins with data. Data is the fuel that drives business; it always has been. But the capital markets industry is now awash with data either created internally or sourced externally. The scale of the tasks involved in managing that data — sourcing, validation, normalization, storage, orchestration, distribution and removal — is already vast and will only increase, especially with the advent of new data sources and the acceleration of open APIs acting as virtual geysers of real-time information. The fact is, many firms are already drowning in data.

Think differently

Data provision and management lies firmly in the as-a-Service or as-an-Industry camps. But interaction with that data — how your firm makes it relevant and turns it into client insights, plus the tooling and processes needed to make those insights accessible to an expanded front office — can differentiate your firm. Consequently, data insight should lie at the heart of your business strategy.

Place your bets

Over the next decade, survival for many buy- and sell-side enterprises hinges on making strategic bets in two main areas. These bets also form the basis of what it takes for firms and the wider industry to thrive. Everything else is either a distraction or a function of those bets.

It starts with being clear on what differentiates your company; everything else is a waste of time and resources. Clarity around your firm’s reason for being and how (and where) you can realistically compete allows you to make the right decisions, including where to simplify the rest of your business. Being clear upfront on which parts of your business are central to the way you compete enables you to decide which processes must be kept in-house (and why) and which could or should be outsourced.

It’s a battle for survival

The first bet is all about survival. It’s about being brave and clear-headed enough to decide what not to do and stick to it in spite of the inevitable naysayers. The second bet concerns the opposite point of view — deciding what to do — and is enabled by efficiencies generated by the first. Survival hinges on answering two fundamental questions: “What will affect my clients and business most?” and “How do I equip my workforce to serve those clients best?”

Answers to these questions are not easy but essential if the second bet is to pay off. Focus your full managerial attention on customer interaction and the technology that best augments your customer-facing business machine. Then, allocate the majority of your investment funds to equipping the machine at pace and scale with leading-edge tooling and insights.

How can Zoreza Global help?

We’re proud to have earned universal recognition as the premier provider of software engineering teams and services for banking and capital markets. Through more than 200 engagements in the capital markets space alone, we have become the preferred choice for large-scale, time-sensitive and highly complex projects.

Zoreza Global has evolved from a trusted provider of outsourcing and consulting services to a trusted partner that clients can rely on when they need to modernize systems or deploy new and innovative technologies.

Practitioners at heart with an appetite for complexity, we work with other tech specialists to offer an ecosystem of innovative solutions, technologies and talent.

Zoreza Global’s core strengths are founded on three “Ps”

1. People: Our experts have deep domain expertise, strong engineering capabilities and an enviable track record in successful operational efficiency programs and application-implementation projects. Zoreza Global helps clients determine the best approach for adopting innovative solutions that drive new business and increase profitability

2. Projects: Over the years, we have become a byword for successfully delivering large-scale, complex capital markets projects. This is a result of our ability to rapidly deploy engineering teams with an optimal mix of experience and seniority at any given cost point

3. Partners: This collaborative environment embraces trading and risk, treasury management, the middle and back offices, client relationship management and data analytics, supported by unrivaled bespoke engineering and technology advisory and delivery teams. We’re the leading integrator of a wide range of proven and innovative capital markets applications, including offerings from market leaders like Murex, Calypso, Finastra and Fenergo

Delivering mission-critical projects

Our extensive capital markets experience has given Zoreza Global a deep understanding of what makes the industry tick. This translates into knowledge of functional requirements and how to apply them across a wide range of market-oriented use cases. Also, it has enabled us to develop an acute awareness of the sensitivities of operating as a regulated entity.

Our appetite for complexity means clients regularly turn to Zoreza Global for help with their most demanding technology projects and regulatory requirements. We specialize in highly complex mission-critical projects for targeted application deployments or broader digital transformation initiatives.

The design and make-up of Zoreza Global’s delivery teams allow them to flex and scale in line with client needs over the engagement lifecycle, ensuring resources are closely mapped to needs throughout.

Let’s talk

If you’d like to discover more about Zoreza Global’s approach to leveraging AI, ML, automation and emerging technologies to grow capital markets business and make firms more profitable, visit our website or contact us.