AI turns the art of insurance fraud detection into an exact science

Dec 16, 2021 by Glen Marr and Wade Wickre

Dec 16, 2021 by Glen Marr and Wade Wickre

An exact data science that is.

Why? To take advantage of the proliferation of data and new data channels. And because heavy dependency on the art of manual fraud detection calls for a level of experience, problem solving and general human intelligence which is both wasteful and outrageously expensive in a modern, AI-driven world.

Fraud scenarios are getting more costly and complex as well, particularly within the digitized world. The vast majority (84%) of insurance organizations surveyed by the Coalition Against Insurance Fraud (CAIF) reported that fraud cases under investigation involved two or more industries. Closer to home, 26 billion scam calls were logged in 2019 (44% of all robocalls). Also, CAIF estimate that insurance fraudsters steal more than $80 billion a year from American consumers alone.

You’d think insurers would be right behind any initiative that guarantees operational efficiency and effectiveness in how claims fraud is tackled. However, the stark reality is that instead of investing heavily, firms are expecting bigger and better results from the same or fewer resources.

Not so long ago, as the initial response, a fraud investigator would lean his or her bike against a lamppost and knock on doors to investigate suspect cases. Nowadays, such an ancient and labor-intensive approach is rightly seen as both inefficient and ineffective. Doing something about it takes real financial and cultural commitment though.

The insurance industry is still coming to terms with Industry 4.0; the technological age. If they’re going to make credible headway, insurers should be identifying new and emerging technologies they can adopt to curb fraudulent activity and finding fresh ways to fund increased digitalization.

After a slow start, the use of AI is starting to gain traction as recognition of the benefits — efficiency, cost reduction, better customer service and journey, etc. — grows. The adoption of digital claims management is growing too, for much the same reasons.

Further, it means that existing counter-fraud teams who tend to work 9 to 5, Monday to Friday in manual and overwhelmingly reactive operations, are more likely to shy away from (rather than welcome) digital claims management. A situation that calls for a rethink and change of strategy to one that complements rather than conflicts with industry changes.

Looking on the bright side, the CAIF study showed that 56% of insurers were already using AI in one form or another to detect fraud. In addition, over 30% of insurance executives expected the pandemic to drive an increase in the use of AI. That said, harnessing the necessary quality data was seen as a major challenge.

For many fraud teams, the understanding of what AI does at an operational level and how to apply it to fraud management is still patchy. Indeed, we still have people who regard the advent of AI and machine learning (ML) as a threat rather than an enabler for the progression and augmentation of claims resources and counter-fraud teams.

What could block AI adoption? Anything from a lack of buy-in from investigators, no clear strategy or business objective, and limited domain expertise for the project could easily derail the benefits of AI adoption. If you choose not to sync the updating of your fraud technology with your other operational systems, you can’t expect to move with the times and track vital fraud trends.

In a recent survey, three quarters of respondents said the two biggest challenges to combatting insurance fraud were limited resources and data integration problems. Understandably, insurance businesses don’t want to be stuck in a cycle of continual investment in claims-fraud resources, but their commercial survival instinct leaves them no other option.

Two-thirds of the people interviewed for a Deloitte AI Institute™ and Chamber Technology Engagement Center report cited algorithmic bias, a lack of human involvement in decision loops and rogue or unanticipated behavior as particular threats. A further 56% said the lack of explainability of algorithms was a major concern. And another two-thirds of those surveyed wanted their government to reduce the impact of job losses due to AI.

The fact is, AI won’t be replacing fraud professionals anytime soon. However, fraud professionals who use AI will replace those who don’t.

“AI is a data technology solution that systematically screens for questionable claims using predictive-analytics logic driven by advanced data-modelling techniques and statistical algorithms.”

Zoreza Global is challenging the insurance industry to rethink how fraud is remedied. By using AI to enhance the response to countering fraud risks and contribute to operational efficiency, firms can achieve more from the same resources or fewer. You can provide the c-suite with greater confidence that fraud strategies are based on modern and forward-thinking tactics.

Besides catching more fraudsters, AI’s major business goals are to settle legitimate claims quickly, improve data quality, and remove human bias from identifying suspicious claims and potential fraud (without eliminating the humans who need to assess the data and verify facts). So relax, it’s not some kind of alien monster waiting to enslave humankind. If it’s any comfort, AI is not new.

AI has been a work in progress since the 1950s, and relies on people, processes and technology to make it happen. Surprisingly, although AI routinely outperforms static business rules, it works better in some areas than others.

The average manual detection rate for fraudulent claims is significantly lower than the industry would like. For insurers with particularly low detection rates, that poor performance is reflected in their bottom line.

Actually, detection rates across different policy types and loss scenarios vary considerably, underlining a narrow focus, lack of consistency and an escalation of preventable losses. The absence of quality industry data prevents insurers from benchmarking their own counter-fraud performance. Consequently, manual detection statistics and fraud-level perceptions remain on opposite sides of a very high fence.

Low detection rates reveal multiple weaknesses in counter-fraud models. Faults include low-level c-suite understanding of their exposure to fraud and the effectiveness of existing counter-fraud measures. Often this exposes disparate and disconnected legacy technology, and a serious lack of alignment with counter-fraud business strategies caused by:

Zoreza Global provides a range of insurance fraud services to meet different client needs, including FCI; a credible and powerful AI-driven solution made available through a partnership with IBM.

FCI is an end-to-end, claims-fraud offering built around integrated AI, which consists of layers of analytics working together to identify high-fraud-risk claims. The analytics layers enable more accurate and targeted claims fraud detection, reducing false positives; a common, negative feature of some other insurance fraud technology offerings.

The AI is transparent — white-box analytics enable clients to understand and control what’s generating the high-risk claims.

Our solution combines automated detection of high-risk claims (using client and third-party data), with automated triage, investigation tools and dashboards, to report on the performance of the FCI-enabled, counter-fraud claims strategy. In turn, it provides a roadmap to increased claims-fraud savings, combining the many disparate features of an insurer’s response to claims fraud in a single solution. This is a real enabler for operational efficiency in an environment where insurers repeatedly cut back resources. It also eliminates the cost of businesses having to acquire and maintain disconnected and separate technology and tools.

Because not all clients want a single technology offering, Zoreza Global provides high-level expertise in many different forms — our experts have supported the insurance industry’s fight to tackle fraud for decades.

Our roster of services includes things like identifying fraud in data sets, and consultancy for reviewing and assessing existing responses to fraud, identifying both shortfalls and opportunities, and helping with the design of target operating models. We back this up with regular reviews and assessments of counter-fraud strategies, highlighting challenges while sharing global market insight and advancements in technology.

Artificial intelligence allows you to mix and match measurements into product lines and types of claims, as well as discovering new areas where fraud could be occurring.

An exceptional contributor to the cause, AI can help you achieve much more than with manual processes. That includes current technologies and new methods of keeping up with business-model revisions and the changing ways insurers operate.

The Zoreza Global-IBM partnership offers the market’s most extensive range of features. The range is supported by the award-winning Watson environment for training dynamic new AI and machine learning models for fraud detection.

Working closely with IBM, Zoreza Global has been researching strategic workstreams and here are four areas we’re currently investigating:

AI sparks many fresh lines of questioning like: Why do you need ethical use of data and AI principles for fighting fraud? Why do you have to move on from a one-size-fits-all model and adjust new models to specific business situations? Why does it matter who owns the IP drawn from your data? Why do you need to govern the analytics to show they’re explainable, accurate and fair? Why do you have to present easily understood analytical insights to your fraud investigators? And, structurally, why do you capture investigation outcomes to fuel machine learning?

CAIF’s recent report also gave us some insights into how to convert fraudster behavior into learnings which could improve analytic responses. It looked at things like phishing (sending multiple emails, phone calls/robocalls or data, etc.), setting up websites to look like legitimate businesses selling products so they can harvest payments, download personal information and so on.

Modern insurance fraud mitigation is agile, global and evolving traditional methods of detection and remediation that fall short. A traditional, static business rules and indicators approach to fraud is easily breached. Neither opportunist nor organized fraudsters take long to figure out the rules and, once deciphered, simply work around them to steal from the insurers.

Fraudsters can be brand loyal, finding comfort in exploiting weaknesses in specific insurer counter-fraud defenses. A prime example of this is the significant impact of organized fraud committed by ghost brokers in the UK. These criminals commit widespread fraud to obtain online motor insurance cover for “customers”, who are a mixture of conspirators and victims. Ghost brokers repeatedly target specific insurers where, previously, they’ve been successful and undetected.

On the other hand, AI and machine learning use data to create new rules and develop processes to mine data for the best results. Then they run the data back through analytics as new information becomes available during the claims process, to make the program more robust and avoid false positives. This provides extra business value — a potent factor in the continuing fight to demonstrate a profitable ROI for the application of AI and machine learning technologies.

Zoreza Global data scientists don’t just work in insurance, they cover other industries too. This affords them a wider perspective when addressing challenges, bringing more varied experience for the ultimate benefit of clients.

McKinsey estimates that organizations can save between $1.3 trillion and $2 trillion a year by using AI in supply chain and manufacturing alone.

UPS uses an AI-powered GPS tool to identify the optimal routes for its fleet. The application helps drivers make deliveries on time and in the most efficient manner. Optimizing delivery routes enhances everything from saving time and money, to cutting emissions and minimizing the wear and tear on UPS vehicles. The company reckons that AI cuts the overall delivery distance travelled by 100 million miles.

Lineage Logistics keeps food cold for grocery stores and restaurants. An AI algorithm predicts when orders will enter and leave the warehouse, allowing staff to prioritize and arrange pallets accordingly. This has increased efficiency by 20% and, for a company that moves between 20 billion and 30 billion pounds of food a year, that’s a big deal.

Rolls Royce uses AI to safely transport cargo. With the advent of autonomous shipping, sensors can track engine performance while monitoring security and cargo pick-up and delivery. Using AI to increase awareness of what potential dangers are around a vessel, means the end of losing ships to collision damage or extreme weather, ensuring that goods cross the oceans more rapidly and easily.

Technology is only as good as the talent, controls and data quality that drive, manage and monitor its deployment. Once your program is up and running, you still need to review and amend accordingly because business models change faster than counter-fraud programs, leaving you exposed to all manner of risks. Also, converging industries — supermarkets, auto manufacturers and technology companies offering financial services, or health providers entering consumer markets — create fresh opportunities for fraud.

Despite all the ifs and buts, just having a dedicated counter-fraud program brings benefits anyway. Reducing your reliance on labor-intensive manual activity to identify fraud, automatically makes your processes more efficient, effective and transparent. Organizations investing in dedicated fraud prevention reportedly spend 42% less on response and 17% less on putting things right than companies that fight shy of investment.

Source: PwC’s 2020 Global Economic Crime and Fraud Survey

Canvassing opinion, clarifying goals and acting on results will increase your influence and stakeholder positivity. In addition, early identification and progression of suspect claims for further investigation while settling justifiable claims as rapidly as possible, are valuable contributors to a healthier ROI, greater profitability and happier customers.

With Zoreza Global’s solution, FCI, the key features of the claims-fraud process — all the way from detection, through accuracy and investigation, to case management — are consolidated into one automated solution rather than spread across separate, disconnected platforms and tools.

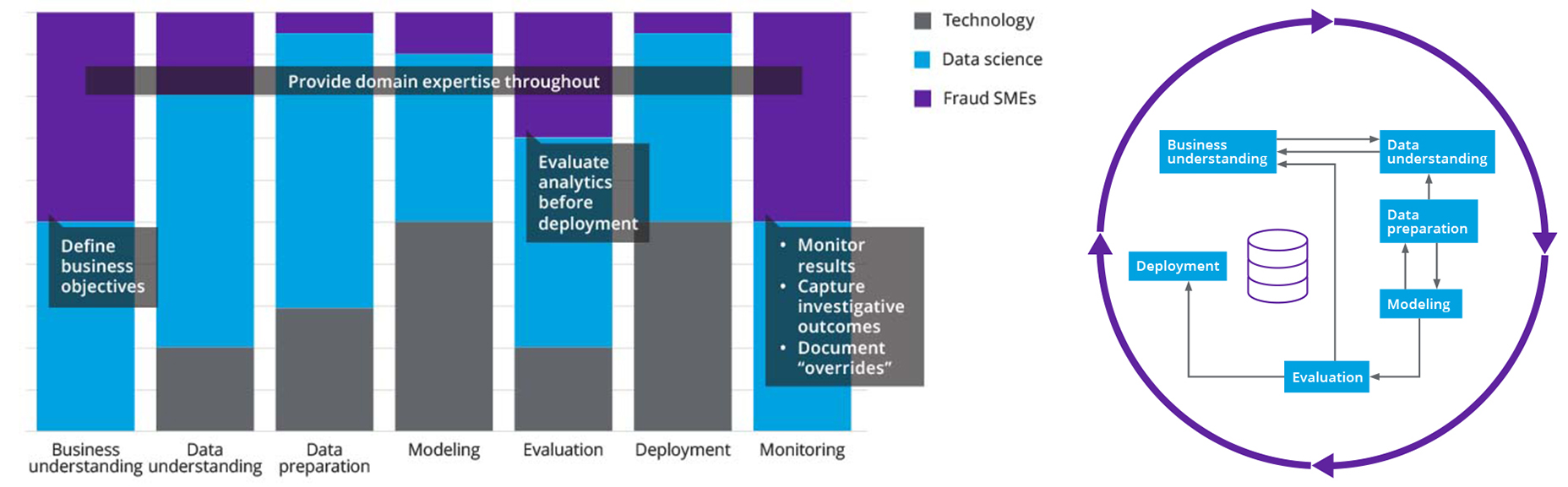

The strong mix of technology, data science and insurance fraud expertise combined with the Zoreza Global and IBM partnership, creates a true global footprint. Along the same lines, our collective experience and insight across multiple industries gives us a unique perspective on fraud detection and prevention. This leads to:

Our technology is exceptional. We also have a massive advantage in what we bring to the table. Zoreza Global team members have worked extensively within insurers, in cross-industry roles and as external vendors, which enables us to interact and partner with clients from a truly informed position. We use the same, industry leading, insurance-fraud-domain SMEs for consistency and to capitalize on their remarkable insights, knowledge and experience. The same holds true for our data science resources.

We understand the insurance policy and claims environments completely — all the challenges, opportunities and objectives. No other insurance-fraud-technology vendor can match our offering in this respect.

Recognized by insurance and business trade publications, conferences, and seminars as a byword for real-world industry knowledge, expertise and experience, Zoreza Global works with AI fact not legacy fiction.

In addition, our data science resources not only cover other industries, but each global region too; the two standout regions being the UK and North America.

The United States uses established Special Investigation Unit models, generally. SIUs are centralized fraud teams that handle potentially fraudulent claims via their own field-based fraud investigators. To some degree, mandated legislation governs how SIUs go about their work, reporting suspected fraud to the authorities.

The UK leads the way in extending fraud mitigation to include online detection and prevention. This holistic counter-fraud model embraces quotation requests, clients wanting to buy cover, changes made to in-force policies, policy renewals and claims themselves. It’s a much better use of resources than just concentrating on claims fraud, particularly when a large percentage of the risks could be mitigated by adding more robust controls to the beginning of the insurance policy lifecycle.

If you’d like to find out more about how AI and machine learning can provide comprehensive anti-fraud protection, visit our FCI page, our contact us page or consult one of our domain experts glen.marr2@dxc.com or wade.wickre@ibm.com. Together, we’ll map out your AI route to optimal insurance fraud detection and remediation.